Concept explainers

Scholastic Brass Corporation manufactures brass musical instruments for use by high school students. The company uses a normal costing system, in which manufacturing

During March, the firm worked on the following two production jobs:

Job number T81, consisting of 76 trombones

Job number C40, consisting of 110 cornets

The events of March are described as follows:

- a. One thousand square feet of rolled brass sheet metal were purchased on account for $5,000.

- b. Four hundred pounds of brass tubing were purchased on account for $4,000.

- c. The following requisitions were submitted on March 5:

Requisition number 112: 250 square feet of brass sheet metal at $5 per square foot (for job number T81)

Requisition number 113: 1,000 pounds of brass tubing, at $10 per pound (for job number C40)

Requisition number 114: 10 gallons of valve lubricant, at $10 per gallon

All brass used in production is treated as direct material. Valve lubricant is an indirect material.

- d. An analysis of labor time cards revealed the following labor usage for March.

Direct labor: Job number T81, 800 hours at $20 per hour

Direct labor: Job number C40, 900 hours at $20 per hour

Indirect labor: General factory cleanup, $4,000

Indirect labor: Factory supervisory salaries, $9,000

- e.

Depreciation of the factory building and equipment during March amounted to $12,000. - f. Rent paid in cash for warehouse space used during March was $1,200.

- g. Utility costs incurred during March amounted to $2,100. The invoices for these costs were received, but the bills were not paid in March.

- h. March property taxes on the factory were paid in cash, $2,400.

- i. The insurance cost covering factory operations for the month of March was $3,100. The insurance policy had been prepaid.

- j. The costs of salaries and

fringe benefits for sales and administrative personnel paid in cash during March amounted to $8,000. - k. Depreciation on administrative office equipment and space amounted to $4,000.

- l. Other selling and administrative expenses paid in cash during March amounted to $1,000.

- m. Job number T81 was completed on March 20.

- n. Half of the trombones in job number T81 were sold on account during March for $700 each.

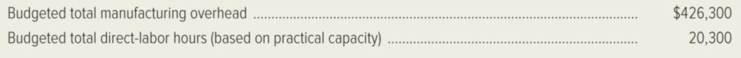

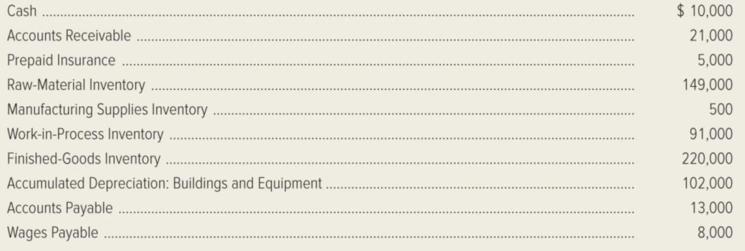

The March 1 balances in selected accounts are as follows:

Required:

- 1. Calculate the company’s predetermined overhead rate for the year.

- 2. Prepare journal entries to record the events of March.

- 3. Set up T-accounts, and

post the journal entries made in requirement (2). - 4. Calculate the over applied or under applied overhead for March. Prepare a

journal entry to close this balance into Cost of Goods Sold. - 5. Prepare a schedule of cost of goods manufactured for March.

- 6. Prepare a schedule of cost of goods sold for March.

- 7. Prepare an income statement for March.

1.

Compute the predetermined overhead rate for Corporation SB.

Explanation of Solution

Predetermined Overhead Rate: Predetermined overhead rate is a measure used to allocate the estimated manufacturing overhead cost to the products or job orders during a particular period. This is generally evaluated at the beginning of each reporting period. The evaluation takes into account the estimated manufacturing overhead cost and the estimated allocation base that includes direct labor hours, direct labor in dollars, machine hours and direct materials.

Compute the predetermined overhead rate for Corporation SB.

Thus, the predetermined overhead rate for Corporation SB is $21 per direct-labor hour.

2.

Record the events in the books of Corporation SB for the month of March.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Record the events in the books of Corporation SB for the month of March.

| Date | Account title and explanation | Debit ($) | Credit ($) |

| a) | Raw-material inventory | 5,000 | |

| Accounts payable | 5,000 | ||

| (To record the purchase of raw materials on account) | |||

| b) | Raw-material inventory | 4,000 | |

| Accounts payable | 4,000 | ||

| (To record the purchase of raw materials on account) | |||

| c) | Work-in-process inventory | 11,250 | |

| Raw-material inventory | 11,250 | ||

| (To record the raw-material inventory) | |||

| Manufacturing overhead | 100 | ||

| Wages payable | 100 | ||

| (To record the wages payable) | |||

| d) | Work-in-process inventory | 34,000 | |

| Manufacturing overhead | 13,000 | ||

| Wages payable | 47,000 | ||

| (To record the labor usage during March) | |||

| Work-in-process inventory | 35,700 | ||

| Manufacturing overhead | 35,700 | ||

| (To record the manufacturing overhead) | |||

| e) | Manufacturing overhead | 12,000 | |

| Accumulated depreciation: Building and equipment | 12,000 | ||

| (To record the depreciation expense for building and equipment) | |||

| f) | Manufacturing overhead | 1,200 | |

| Cash | 1,200 | ||

| (To record the payment of rent in cash) | |||

| g) | Manufacturing overhead | 2,100 | |

| Accounts payable | 2,100 | ||

| (To record the utilities cost incurred during March) | |||

| h) | Manufacturing overhead | 2,400 | |

| Cash | 2,400 | ||

| (To record the payment of property taxes) | |||

| i) | Manufacturing overhead | 3,100 | |

| Prepaid insurance | 3,100 | ||

| (To record the prepaid insurance) | |||

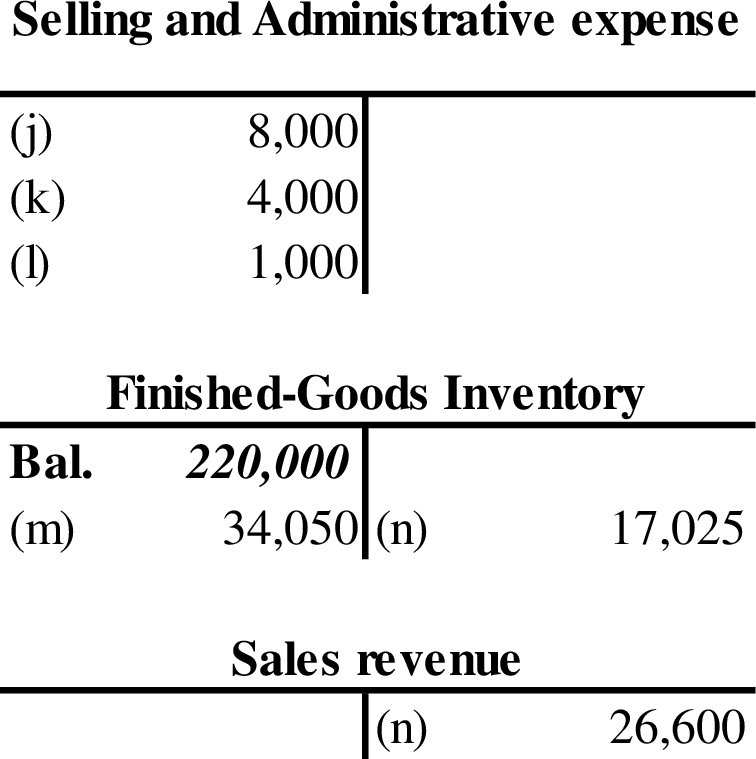

| j) | Selling and administrative expenses | 8,000 | |

| Cash | 8,000 | ||

| (To record the selling and administrative expenses) | |||

| k) | Selling and administrative expenses | 4,000 | |

| Accumulated depreciation: Buildings and equipment | 4,000 | ||

| (To record the depreciation expense for office equipment) | |||

| l) | Selling and administrative expenses | 1,000 | |

| Cash | 1,000 | ||

| (To record the payment of other selling and administrative expenses) | |||

| m) | Finished goods inventory (1) | 34,050 | |

| Work-in-process inventory | 34,050 | ||

| (To record the job completed during March 20.) | |||

| n) | Accounts receivable | 26,600 | |

| Sales revenue | 26,600 | ||

| (To record the sales revenue) | |||

| Cost of goods sold | 17,025 | ||

| Finished goods inventory | 17,025 | ||

| (To record the cost of goods sold) |

Table (1)

Working note (1):

Calculate the amount of finished goods inventory.

| Particulars | Amount ($) |

| Direct material | $1,250 |

| Direct labor | $16000 |

| Manufacturing overhead | $16,800 |

| Total cost | $34,050 |

Table (2)

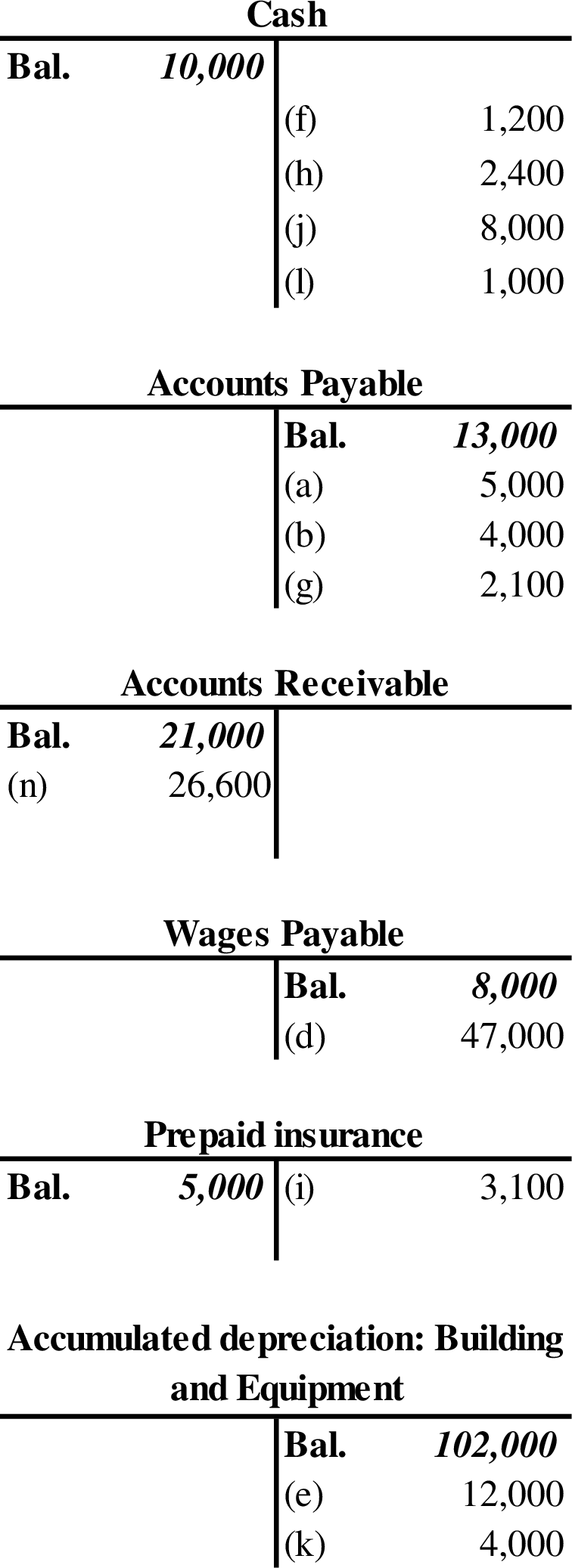

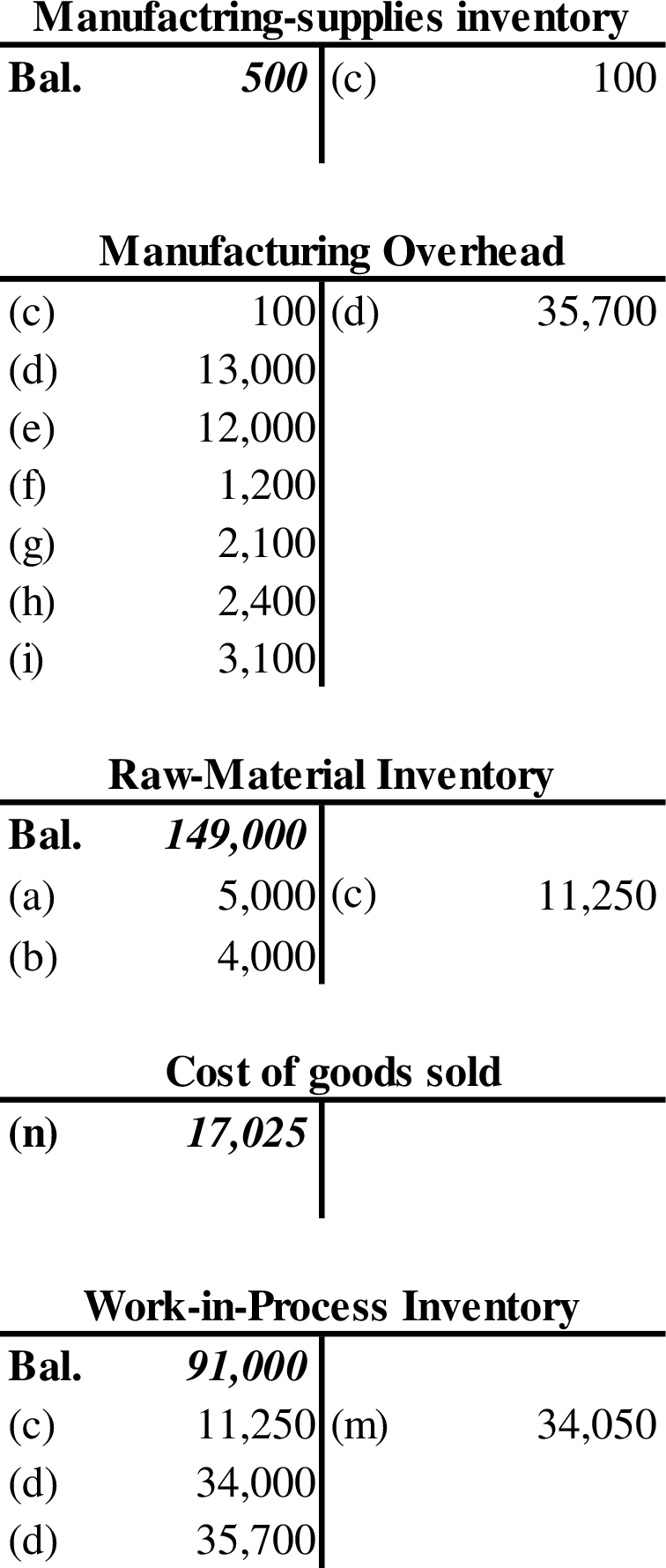

3.

Prepare the T-accounts and post the journal entries.

Explanation of Solution

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

Prepare the T-accounts and post the journal entries.

4.

Compute the overapplied or underapplied overhead for March and close the balance into cost of goods sold.

Explanation of Solution

Step 1: Calculate the amount of actual overhead.

| Particulars | Amount ($) |

| Indirect material (valve lubricant) | $100 |

| Indirect labor | $13,000 |

| Depreciation: factory building and equipment | $12,000 |

| Rent: warehouse | $1,200 |

| Utilities | $2,100 |

| Property taxes | $2,400 |

| Insurance | $3,100 |

| Total actual overhead | $33,900 |

Table (3)

Step 2: Calculate the amount of applied manufacturing overhead.

Step 3: Calculate the overapplied or underapplied overhead.

Step 4: Prepare the journal entry to close the cost of goods sold.

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Manufacturing overhead | 1,800 | ||

| Cost of goods sold | 1,800 | ||

| (To close the overapplied manufacturing overhead to cost of goods sold) |

Table (4)

5.

Prepare a schedule of cost of goods manufactured for March.

Explanation of Solution

Cost of goods manufactured: Cost of goods manufactured refers to the cost incurred for a making a product, that are available for sales at the end of the accounting period.

Prepare a schedule of cost of goods manufactured for March.

| Corporation SC | ||

| Schedule of Cost of Goods Manufactured | ||

| For the Month of March | ||

| Particulars | Amount ($) | Amount ($) |

| Direct material: | ||

| Raw-material inventory, March 1 | $149,000 | |

| Add: March purchases of raw material | $9,000 | |

| Raw material available for use | $158,000 | |

| Deduct: Raw-material inventory, March 31 | $146,750 | |

| Raw material used | $ 11,250 | |

| Direct labor | $34,000 | |

| Manufacturing overhead: | ||

| Indirect material | $100 | |

| Indirect labor | $13,000 | |

| Depreciation on factory building and equipment | $12,000 | |

| Rent: Warehouse | $1,200 | |

| Utilities | $2,100 | |

| Property taxes | $2,400 | |

| Insurance | $3,100 | |

| Total actual manufacturing overhead | $33,900 | |

| Add: overapplied overhead | $1,800 | |

| Overhead applied to work in process | $35,700 | |

| Total manufacturing costs | $80,950 | |

| Add: Work-in-process inventory, March 1 | $91,000 | |

| Subtotal | $171,950 | |

| Deduct: Work-in-process inventory, March 31 | $137,900 | |

| Cost of goods manufactured | $34,050 | |

Table (5)

Thus, the cost of goods manufactured is $34,050.

6.

Prepare the schedule of cost goods sold for March.

Explanation of Solution

Schedule of cost of goods sold: The schedule which reports all the expenses incurred by a company to sell the goods during the given period.

Prepare the schedule of cost goods sold for March.

| Corporation SC | |

| Schedule of Cost of Goods Sold | |

| For the Month of March | |

| Particulars | Amount ($) |

| Finished-goods inventory, March 1 | $220,000 |

| Add: Cost of goods manufactured | $34,050 |

| Cost of goods available for sale | $254,050 |

| Deduct: Finished-goods inventory, March 31 | $237,025 |

| Cost of goods sold | $17,025 |

| Deduct: Overapplied overhead | $1,800 |

| Cost of goods sold (adjusted for overapplied overhead) | $15,225 |

Table (6)

Thus, the cost of goods sold is $15,225.

7.

Prepare an income statement for March.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for March.

| Corporation SC | |

| Income Statement | |

| For the Month of March | |

| Particulars | Amount ($) |

| Sales revenue | $26,600 |

| Less: Cost of goods sold | $15,225 |

| Gross margin | $11,375 |

| Selling and administrative expenses | $13,000 |

| Income (loss) | ($1,625) |

Table (7)

Thus, there is a net loss for the month of March amounts to ($1,625).

Want to see more full solutions like this?

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Genral accountarrow_forward?!arrow_forwardAt the beginning of the year, Lexington Corporation had total assets of $920,000 and total liabilities of $580,000. During the year, total liabilities increased by $120,000, and stockholders' equity decreased by $80,000. What is the amount of total assets at the end of the year?arrow_forward

- Company X sets price equal to cost plus 60%. Recently, Company X charged a customer a price of $42 for an item. What was the cost of the item to Company X?arrow_forwardNeed answerarrow_forwardExplore the concept of accounting flexibility and its impact on the reliability and usefulness of financial information. While adaptability in accounting methods can allow organizations to better reflect their unique circumstances, it may also introduce the risk of selective application or manipulation. Discuss the appropriate balance between standardization and customization in accounting practices, and the safeguards that can be implemented to preserve the integrity of financial reporting.arrow_forward

- Explore the concept of accounting flexibility and its impact on the reliability and usefulness of financial information. While adaptability in accounting methods can allow organizations to better reflect their unique circumstances, it may also introduce the risk of selective application or manipulation. Discuss the appropriate balance between standardization and customization in accounting practices, and the safeguards that can be implemented to preserve the integrity of financial reporting. Correct Answerarrow_forwardWhen should modified attribution analysis replace direct assignment?arrow_forwardAccurate answerarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning