Concept explainers

JLR Enterprises provides consulting services throughout California and uses a

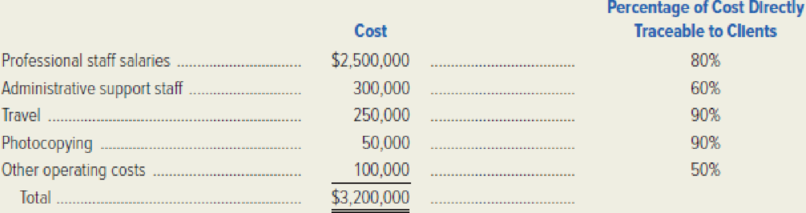

JLR’s director of cost management, Brent Dean, anticipates the following costs for the upcoming year:

The firm’s partners desire to make a $640,000 profit for the firm and plan to add a percentage markup on total cost to achieve that figure.

On March 10, JLR completed work on a project for Martin Manufacturing. The following costs were incurred: professional staff salaries, $41,000; administrative support staff, $2,600; travel, $4,500; photocopying, $500; and other operating costs, $1,400.

Required:

- 1. Determine JLR’s total traceable costs for the upcoming year and the firm’s total anticipated overhead.

- 2. Calculate the predetermined overhead rate. The rate is based on total costs traceable to client jobs.

- 3. What percentage of cost will JLR add to each job to achieve its profit target?

- 4. Determine the total cost of the Martin Manufacturing project. How much would Martin be billed for services performed?

- 5. Notice that only 50 percent of JLR’s other operating cost is directly traceable to specific client projects. Cite several costs that would be included in this category and difficult to trace to clients.

- 6. Notice that 80 percent of the professional staff cost is directly traceable to specific client projects. Cite several reasons that would explain why this figure isn’t 100 percent.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Chapter 18 Homework i Saved 15 Exercise 18-14 (Algo) Contribution margin income statement LO C2 1 points eBook Hint Sunn Company manufactures a single product that sells for $190 per unit and whose variable costs are $133 per unit. The company's annual fixed costs are $628,000. The sales manager predicts that next year's annual sales of the company's product will be 39,800 units at a price of $198 per unit. Variable costs are predicted to increase to $138 per unit, but fixed costs will remain at $628,000. What amount of income can the company expect to earn under these predicted changes? Prepare a contribution margin income statement for the next year. SUNN COMPANY Contribution Margin Income Statement Units $ per unit 39,800 $ 198 Ask Sales Variable costs 39,800 Print Contribution margin 39,800 Fixed costs Income References Mc Graw Hill $ 7,880,400 138 5,492,400 2,388,000 628,000 $ 1,760,000 Help Save & Exit Submit Check my workarrow_forwardI want to correct answer general accountingarrow_forwardHi expert please give me answer general accounting questionarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning