Concept explainers

Journalizing and posting adjustments to the four-column accounts and preparing an adjusted

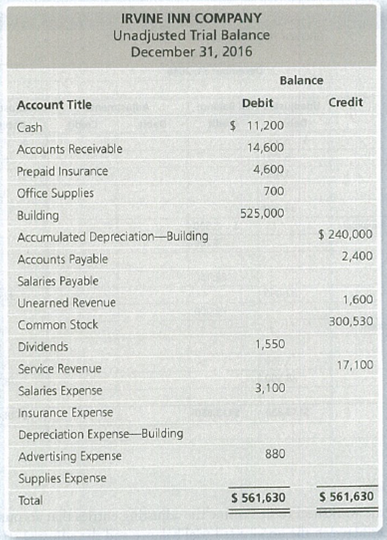

The unadjusted trial balance of Irvine Inn Company at December 31, 2016, and the data needed for the adjustments follow.

Adjustment data at December 31 follow:

a. As of December 31, Irvine Inn had $500 of Prepaid Insurance remaining.

b. At the end of the month, Irvine Inn had $400 of office supplies remaining.

c.

d. Irvine Inn pays its employees on Friday for the weekly salaries. Its employees earn $1,000 for a five-day workweek. December 31 falls on Wednesday this year.

e. On November 20, Irvine Inn contracted to perform services for a client receiving $ 1,600 in advance. Irvine In n recorded this receipt of cash as Unearned Revenue.

As of December 31, Irvine Inn has $1,100 still unearned.

Requirements

1. Journalize the

2. Using the unadjusted trial balance, open the accounts (use a four-column ledger) with the unadjusted balances.

3. Prepare the adjusted trial balance.

4. Assuming the adjusted trial balance has total debits equal to total credits, does this mean that the adjusting entries have been recorded correctly? Explain.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Horngren's Financial & Managerial Accounting (5th Edition)

- Please help with accountingarrow_forwardAccounting problem with solutionarrow_forwardHome Insert Draw Page Layout Formulas Data Review View Automate Developer Calibri (Body) 12 ✓ Α Αν Conditional Formatting ✓ ☑Insert v Σ Custom Paste B I U ✓ ✓ $ ✓ %9 0 .00 →0 Format as Table ✓ Cell Styles ▾ Delete ✓ Format ✓ C26 fx A B D E F G 1 Instruction: 2 1. Please complete the following budget plan using appropriate cell references format (the cells highlighted in grey) 3 2. Please use fill handler to complete the table. E.g. in cell C16, build one formula and generate other formulas to D16 and E16 with fill handler. 4 3. For "Cost of Goods Sold" section (before "COGS Subtotal"), build one formula in cell C19, and generate formulas until E21. Overhead (B21) is 20% (B10) of the labor cost (B20). 5 4. For "COGS Subtotal", build one formula in C22, and generate the formulas to E22. 6 5. Similar requirements for "Selling Expenses" and "Projected Earnings" section. 7 6. Please be noted, for all items under "Cost of Goods Sold", and "Selling Expenses" the cost is per ONE shoe, not per…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,