Concept explainers

Identifying the impact of

Austin Acoustics recorded the following transactions during October 2016:

a. Received $2,500 cash from customer for three months of service beginning October 1, 2016, and ending December 31, 2016. The company recorded a $2,500 debit to Cash and a $2,500 credit to Unearned Revenue.

b. Employees are paid $3,000 on Monday following the five-day workweek October 31, 2016, is on Friday.

c. The company pays $440 on October 1, 2016 for its six-month auto insurance policy. The company recorded a $440 debit to Prepaid Insurance and a $440 credit to Cash.

d. The company purchased office furniture for $8,300 on January 2, 2016. The company recorded a $8,300 debit to Office Furniture and a $8,300 credit to Accounts Payable. Annual

e. The company began October with $50 of office supplies on hand. On October 10, the company purchased office supplies on account of$100. The company recorded a $100 debit to Office Supplies and a $100 credit to Accounts Payable. The company used $120 of office supplies during October.

f. The company received its electric bill on October 30 for $325 but did not pay it until November 10.

g. The company paid November’s rent of $2,500 on October 30. On October 30, the company recorded an $2,500 debit to Rent Expense and an $2,500 credit to Cash.

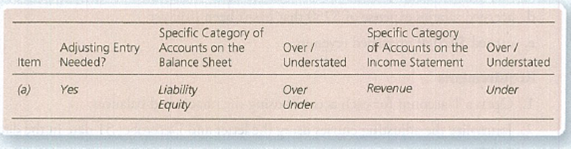

Indicate if an adjusting entry is needed for each item on October 31 for the month of October. Assuming the adjusting entry is not made, indicate which specific category or categories of accounts on the financial statements are misstated and if they are overstated or understated. Use the following table as a guide. Item a is completed as an example:

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Horngren's Financial & Managerial Accounting (5th Edition)

- What is its accounts receivable turnover for the period?arrow_forwardWhat are annual credit sales ?arrow_forwardIf beginning and ending work in process inventories are $9,100 and $18,100, respectively, and cost of goods manufactured is $183,000, what is the total manufacturing cost for the period? Need helparrow_forward

- Ans plzarrow_forwardWhat are annual credit sales ? General accountingarrow_forwardThe next dividend payment by Skippy Inc. will be $3.45. The dividends are anticipated to maintain a growth rate of 4.2% forever. If the stock currently sells for $37.95 per share, what is the required rate of return? Comprehensive Holdings just paid a dividend of $2.95 per share on its stock. The dividends are expected to grow at a constant rate of 4.8% forever. If investors require a return of 12% on the stock, what is the current price? What will be the price in 3 years? In 7 years? Citibank expects to pay a dividend of $2 per share on its common stock at the end of this year. The growth rate of the dividend is 8% for the next 2 years. After that, the dividends are expected to grow at a constant growth rate of 5% per year forever. The required rate of return on the company’s stock is 11%. What is the price of Citibank stock today? A firm pays a current dividend of $3, which is expected to grow at a rate of 4% indefinitely. If the current value of the firm’s shares is $53,…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College