Concept explainers

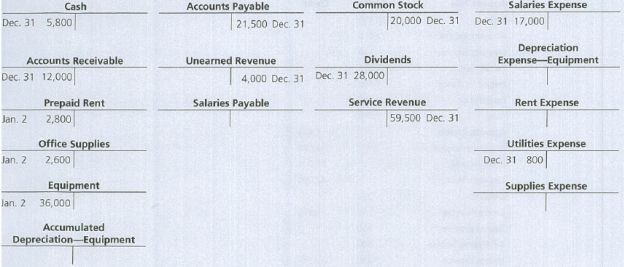

One year ago, Tyler Stasney founded Swift Classified Ads. Stasney remembers that you took an accounting course while in college and comes to you for advice. He wishes to know how much net income his business earned during the past year in order to decide whether to keep the company going. His accounting records consist of the T-accounts from his ledger, which were prepared by an accountant who moved to another city. The ledger at December 31 follows. The accounts have not been adjusted.

Stasney indicates that at year-end, customers owe the business $1,600 for accrued service revenue. These revenues have not been recorded. During the year, Swift Classified Ads collected $4,000 service revenue in advance from customers, but the business earned only $900 of that amount. Rent expense for the year was $2,400, and the business used up $1,700 of the supplies. Swift determines that

Help Swift Classified Ads compute its net income for the year. Advise Stasney whether to continue operating Swift Classified Ads.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Horngren's Financial & Managerial Accounting (5th Edition)

- For each of the transactions above, indicate the amount of the adjusting entry on the elements of the balance sheet and income statement.Note: Enter negative amounts with a minus sign.arrow_forwardNeed help with this question solution general accountingarrow_forwardDon't use ai given answer accounting questionsarrow_forward

- I want to correct answer general accounting questionarrow_forwardKindly help me with accounting questionsarrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 Cash Flow -$ 30,000 12,200 14,900 16,800 4 5 13,900 -10,400 The company uses an interest rate of 8 percent on all of its projects. a. Calculate the MIRR of the project using the discounting approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. Calculate the MIRR of the project using the reinvestment approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c. Calculate the MIRR of the project using the combination approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Discounting approach MIRR b. Reinvestment approach MIRR c. Combination approach MIRR % % %arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub