Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 27E

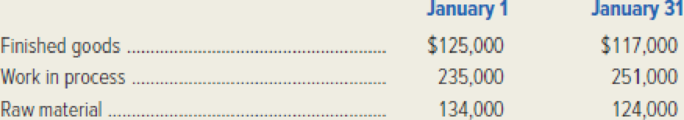

Bodin Company manufactures finger splints for kids who get tendonitis from playing video games. The firm had the following inventories at the beginning and end of the month of January.

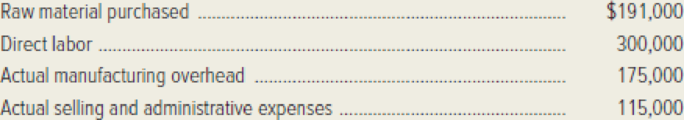

The following additional data pertain to January operations.

The company applies manufacturing

Required: Compute the following amounts.

- 1. The company’s prime cost for January.

- 2. The total

manufacturing cost for January. - 3. The cost of goods manufactured for January.

- 4. The cost of goods sold for January.

- 5. The balance in the manufacturing overhead account on January 31. Debit or credit?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following transactions were incurred by Mooney Fabricators during January, the first month of its fiscal year.

(Click the icon to view the transactions.)

Requirements

1. Record the proper journal entry for each transaction.

2. By the end of January, was manufacturing overhead overallocated or underallocated? By how much?

Date

TWIT

b. $178,000 of materials was used in production; of this amount, $146,000

Journal Entry

uyumiv

era boln

Accounts

b. Work in Process Inventory

Manufacturing Overhead

Raw Materials Inventory

Debit

More info

a. $205,000 of materials was purchased on account.

b. $178,000 of materials was used in production; of this amount, $146,000 was

used on specific jobs.

C. Manufacturing labor and salaries for the month totaled $225,000. A total of

$215,000 of manufacturing labor and salaries was traced to specific jobs, and

the remainder was indirect labor used in the factory.

d.

e.

f.

The company recorded $24,000 of depreciation on the plant and plant

equipment. The…

Blossom Limited is a company that produces machinery to customer orders, using a normal job-order cost system. It applies manufacturing overhead to production using a predetermined rate. This overhead rate is set at the beginning of each fiscal year by forecasting the year’s overhead and relating it to direct labour costs. The budget for 2022 was as follows:

Direct labour

$1,800,000

Manufacturing overhead

900,000

As at the end of the year, two jobs were incomplete. These were 1768B, with total direct labour charges of $110,000, and 1819C, with total direct labour charges of $390,000. Machine hours were 287 hours for 1768B and 647 hours for 1819C. Direct materials issued for 1768B amounted to $220,000, and for 1819C they amounted to $420,000.Total charges to the Manufacturing Overhead Control account for the year were $897,000, and direct labour charges made to all jobs amounted to $1,573,600, representing 247,200 direct labour hours.There were no beginning inventories. In…

Crane Limited is a company that produces machinery to customer orders, using a normal job-order cost system. It applies

manufacturing overhead to production using a predetermined rate. This overhead rate is set at the beginning of each fiscal year by

forecasting the year's overhead and relating it to direct labour costs. The budget for 2022 was as follows:

Direct labour

Manufacturing overhead

$1,810,000

As at the end of the year, two jobs were incomplete. These were 1768B, with total direct labour charges of $111,000, and 1819C, with

total direct labour charges of $390,800. Machine hours were 287 hours for 1768B and 647 hours for 1819C. Direct materials issued

for 1768B amounted to $229,000, and for 1819C they amounted to $420,200.

905,000

Total charges to the Manufacturing Overhead Control account for the year were $902,500, and direct labour charges made to all jobs

amounted to $1,582,600, representing 247,800 direct labour hours.

There were no beginning inventories. In addition to…

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 3 - List and explain four purposes of product costing.Ch. 3 - Explain the difference between job-order and...Ch. 3 - How is the concept of product costing applied in...Ch. 3 - What are the purposes of the following documents:...Ch. 3 - Why is manufacturing overhead applied to products...Ch. 3 - Explain the benefits of using a predetermined...Ch. 3 - Describe one advantage and one disadvantage of...Ch. 3 - Describe an important cost-benefit issue involving...Ch. 3 - Explain the difference between actual and normal...Ch. 3 - When a single, volume-based cost driver (or...

Ch. 3 - Prob. 11RQCh. 3 - Describe the process of two-stage cost allocation...Ch. 3 - Define each of the following terms, and explain...Ch. 3 - Describe how job-order costing concepts are used...Ch. 3 - What is meant by the term cost driver? What is a...Ch. 3 - Describe the flow of costs through a...Ch. 3 - Give an example of how a hospital, such as the...Ch. 3 - Why are some manufacturing firms switching from...Ch. 3 - What is the cause of over applied or under applied...Ch. 3 - Briefly describe two ways of closing out over...Ch. 3 - Describe how a large retailer such as Lowes would...Ch. 3 - Prob. 22RQCh. 3 - For each of the following companies, indicate...Ch. 3 - The controller for Tender Bird Poultry, Inc....Ch. 3 - Finley Educational Products started and finished...Ch. 3 - Bodin Company manufactures finger splints for kids...Ch. 3 - McAllister, Inc. employs a normal costing system....Ch. 3 - Garrett Toy Company incurred the following costs...Ch. 3 - Crunchem Cereal Company incurred the following...Ch. 3 - Prob. 31ECh. 3 - Selected data concerning the past years operations...Ch. 3 - Sweet Tooth Confectionary incurred 157,000 of...Ch. 3 - The following information pertains to Trenton...Ch. 3 - The following data pertain to the Oneida...Ch. 3 - Refer to the data for the preceding exercise for...Ch. 3 - Design Arts Associates is an interior decorating...Ch. 3 - Suppose you are the controller for a company that...Ch. 3 - Laramie Leatherworks, which manufactures saddles...Ch. 3 - Refer to Exhibit 312, which portrays the three...Ch. 3 - Refer to the illustration of overhead application...Ch. 3 - The following data refer to Twisto Pretzel Company...Ch. 3 - Burlington Clock Works manufactures fine,...Ch. 3 - Perfecto Pizza Company produces microwavable...Ch. 3 - Stellar Sound, Inc. which uses a job-order costing...Ch. 3 - Finlon Upholstery, Inc. uses a job-order costing...Ch. 3 - JLR Enterprises provides consulting services...Ch. 3 - Garcia, Inc. uses a job-order costing system for...Ch. 3 - MarineCo, Inc. manufactures outboard motors and an...Ch. 3 - The following data refers to Huron Corporation for...Ch. 3 - Refer to the schedule of cost of goods...Ch. 3 - Marco Polo Map Companys cost of goods sold for...Ch. 3 - Midnight Sun Apparel Company uses normal costing,...Ch. 3 - Marc Jackson has recently been hired as a cost...Ch. 3 - Troy Electronics Company calculates its...Ch. 3 - Tiana Shar, the controller for Bondi Furniture...Ch. 3 - Scholastic Brass Corporation manufactures brass...Ch. 3 - Refer to the preceding problem regarding...Ch. 3 - Prob. 59PCh. 3 - TeleTech Corporation manufactures two different...Ch. 3 - CompuFurn, Inc. manufactures furniture for...Ch. 3 - FiberCom, Inc., a manufacturer of fiber optic...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Abbey Products Company is studying the results of applying factory overhead to production. The following data have been used: estimated factory overhead, 60,000; estimated materials costs, 50,000; estimated direct labor costs, 60,000; estimated direct labor hours, 10,000; estimated machine hours, 20,000; work in process at the beginning of the month, none. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. Compute the predetermined rate, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Using each of the methods, compute the estimated total cost of each job at the end of the month. 3. Determine the under-or overapplied factory overhead, in total, at the end of the month under each of the methods. 4. Which method would you recommend? Why?arrow_forwardDunder Corp. manufactures products in two departments: Mixing and Packaging. The company allocates manufacturing overhead using a single plantwide rate with direct labor hours as the allocation base. Estimated overhead costs for the year are $881,000 and estimated direct labor hours are 392,000. In October, the company incurred 50,000 direct labor hours.(Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the predetermined overhead allocation rate. Total estimated overhead cost ? Total estimated quantity of the overhead allocation base = Predetermined Overhead Allocation Rate (Per Direct Labor Hour) = 2. Determine the amount of overhead allocated in October. Predetermined Overhead Allocation Rate ? Actual Quantity of the Allocation Base Used = Allocated Manufacturing Overhead Cost =arrow_forwardCavy Company estimates that the factory overhead for the following year will be $1,066,000. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 41,000 hours. The machine hours for the month of April for all of the jobs were 5,400. Journalize the entry to record the factory overhead applied in April. If an amount box does not require an entry, leave it blank. Work in Process Factory Overheadarrow_forward

- Cullumber Limited is a company that produces machinery to customer orders, using a normal job-order cost system. It applies manufacturing overhead to production using a predetermined rate. This overhead rate is set at the beginning of each fiscal year by forecasting the year's overhead and relating it to direct labour costs. The budget for 2022 was as follows: Direct labour $1809.000 Manufacturing overhead 904,500 As at the end of the year, two jobs were incomplete. These were 1768B, with total direct labour charges of $ 113,800, and 1819C. with total direct labour charges of $ 390,200. Machine hours were 287 hours for 1768B and 647 hours for 1819C. Direct materials issued for 1768B amounted to $ 228.000. and for 1819C they amounted to $ 420.900, Total charges to the Manufacturing Overhead Control account for the year were $ 899,000, and direct labour charges made to all jobs amounted to $ 1,577.200, representing 248,100 direct labour hours. There were no beginning inventories. In…arrow_forwardCavy Company estimates that the factory overhead for the following year will be $1,119,400. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 38,600 hours. The machine hours for the month of April for all of the jobs were 4,900. Required: Prepare the journal entry to apply factory overhead. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for spaces or journal explanations. Every line on a journal page is used for debit or credit entries. Do not add explanations or skip a line between journal entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. CHART OF ACCOUNTS Cavy Company General Ledger ASSETS 110 Cash 121 Accounts Receivable 131 Materials 133 Work in Process 135 Factory Overhead 137 Finished Goods 141 Supplies 142 Prepaid Expenses 181 Land 190 Factory Equipment 191…arrow_forwardCavy Company estimates that total factory overhead costs for the following year will be $1,046,900. The company has decided that the basis for applying factory overhead should be machine hours, which are estimated to be 36,100 hours. The machine hours for the month of April for all of the jobs were 4,500. Journalize the entry for the factory overhead applied in April. If an amount box does not require an entry, leave it blank.arrow_forward

- Cavy Company estimates that the factory overhead for the following year will be $1,824,500. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 44,500 hours. The machine hours for the month of April for all of the jobs were 5,200. Journalize the entry to record the factory overhead applied in April. If an amount box does not require an entry, leave it blank. - Select - Select - Select - - Select -arrow_forwardA manufacturing company estimates it will incur $240,000 of overhead costs in the next year. The company allocates overhead using machine hours, and estimates it will use 1,600 machine hours in the next year. During the month of June, the company used 80 machine hours on Job 1 and 70 machine hours on Job 2. 1. Compute the predetermined overhead rate to be used to apply overhead during the year. Predetermined Overhead Rate Estimated Overhead Costs Estimated Activity Base 2. Determine how much overhead should be applied to Job 1 and to Job 2 for June. OH Applied x Predetermined OH rate Machine Hours Used 80 hours 70 hours 150 hours Job 1 Job 2 Total 3. Prepare the journal entry to record overhead applied for June. General Journal Work in Process Inventory Factory Overhead Debit Credit Learning Objective P3: Describe and record the flow of overhead costs in job order costingarrow_forwardRothchild Company estimates that total factory overhead costs will be $810,000 for the year. Direct labor hours are estimated to be 90,000. For Rothchild Company, (a) determine the predetermined factory overhead rate using direct labor hours as the activity base, (b) determine the amount of factory overhead applied to Jobs 40 and 42 in August using the data on direct labor hours from Practice Exercise 19-2B, and (c) prepare the journalentry to apply factory overhead to both jobs in August according to the predetermined overhead rate.arrow_forward

- Salinger Company estimates that total factory overhead costs will be $78,000 for the year. Direct labor hours are estimated to be 13,000. a. For Salinger Company, determine the predetermined factory overhead rate using direct labor hours as the activity base. If required, round your answer to two decimal places b. During August, Salinger Company accumulated 850 hours of direct labor costs on Job 40 and 530 hours on Job 42. Determine the amount of factory overhead applied to Jobs 40 and 42 in August. c. Prepare the journal entry to apply factory overhead to both jobs in August according to the predetermined overhead rate.arrow_forwardMalik’s Bookshop applies operating overhead to printing jobs on the basis of machine hours used. Overhead costs are expected to total $360,000 for the year, and machine usage is estimated at 125,000 hours. For the year, $395,000 of overhead costs are incurred and 130,000 hours are used. Instructions (a) Compute the service overhead rate for the year.(b) What is the amount of under- or overapplied overhead at December 31?(c) Assuming the under- or overapplied overhead for the year is not allocated to inventory accounts, prepare the adjusting entry to assign the amount to cost of jobs finished.arrow_forwardCavy Company estimates that the factory overhead for the following year will be $976,800. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 44,400 hours. The machine hours for the month of April for all of the jobs were 4,900. Journalize the entry to record the factory overhead applied in April. If an amount box does not require an entry, leave it blank.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY