Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 44P

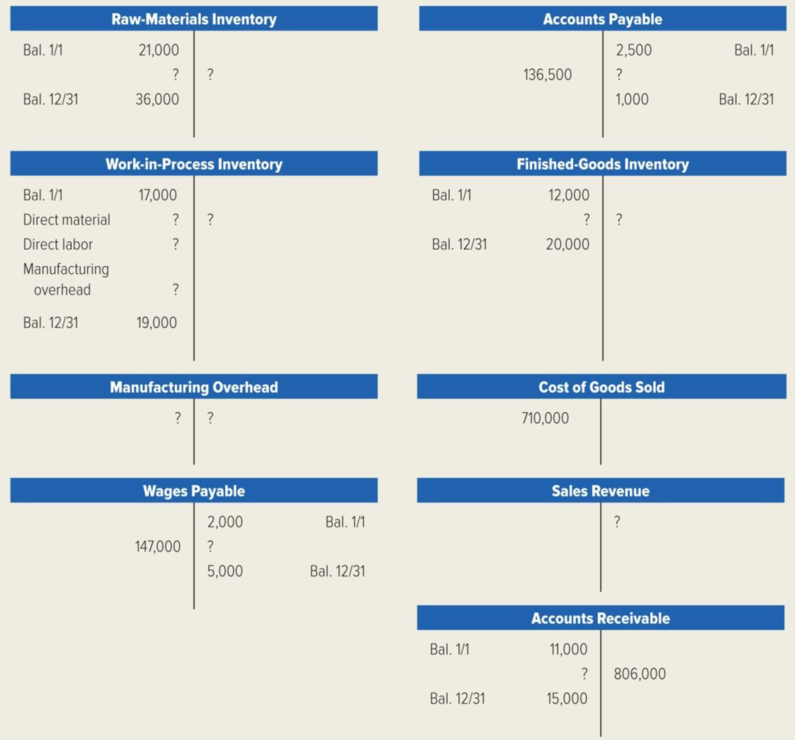

Perfecto Pizza Company produces microwavable pizzas. The following accounts appeared in Perfecto’s ledger as of December 31.

Additional information:

- a. Accounts payable is used only for direct-material purchases.

- b. Under applied

overhead of $2,500 for the year has not yet been closed into cost of goods sold.

Required: Complete the T-accounts by computing the amounts indicated by a question mark.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's assets, Liabilities, and Equity?

Need answer general Accounting

Provide correct answer of this question answer general Accounting

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 3 - List and explain four purposes of product costing.Ch. 3 - Explain the difference between job-order and...Ch. 3 - How is the concept of product costing applied in...Ch. 3 - What are the purposes of the following documents:...Ch. 3 - Why is manufacturing overhead applied to products...Ch. 3 - Explain the benefits of using a predetermined...Ch. 3 - Describe one advantage and one disadvantage of...Ch. 3 - Describe an important cost-benefit issue involving...Ch. 3 - Explain the difference between actual and normal...Ch. 3 - When a single, volume-based cost driver (or...

Ch. 3 - Prob. 11RQCh. 3 - Describe the process of two-stage cost allocation...Ch. 3 - Define each of the following terms, and explain...Ch. 3 - Describe how job-order costing concepts are used...Ch. 3 - What is meant by the term cost driver? What is a...Ch. 3 - Describe the flow of costs through a...Ch. 3 - Give an example of how a hospital, such as the...Ch. 3 - Why are some manufacturing firms switching from...Ch. 3 - What is the cause of over applied or under applied...Ch. 3 - Briefly describe two ways of closing out over...Ch. 3 - Describe how a large retailer such as Lowes would...Ch. 3 - Prob. 22RQCh. 3 - For each of the following companies, indicate...Ch. 3 - The controller for Tender Bird Poultry, Inc....Ch. 3 - Finley Educational Products started and finished...Ch. 3 - Bodin Company manufactures finger splints for kids...Ch. 3 - McAllister, Inc. employs a normal costing system....Ch. 3 - Garrett Toy Company incurred the following costs...Ch. 3 - Crunchem Cereal Company incurred the following...Ch. 3 - Prob. 31ECh. 3 - Selected data concerning the past years operations...Ch. 3 - Sweet Tooth Confectionary incurred 157,000 of...Ch. 3 - The following information pertains to Trenton...Ch. 3 - The following data pertain to the Oneida...Ch. 3 - Refer to the data for the preceding exercise for...Ch. 3 - Design Arts Associates is an interior decorating...Ch. 3 - Suppose you are the controller for a company that...Ch. 3 - Laramie Leatherworks, which manufactures saddles...Ch. 3 - Refer to Exhibit 312, which portrays the three...Ch. 3 - Refer to the illustration of overhead application...Ch. 3 - The following data refer to Twisto Pretzel Company...Ch. 3 - Burlington Clock Works manufactures fine,...Ch. 3 - Perfecto Pizza Company produces microwavable...Ch. 3 - Stellar Sound, Inc. which uses a job-order costing...Ch. 3 - Finlon Upholstery, Inc. uses a job-order costing...Ch. 3 - JLR Enterprises provides consulting services...Ch. 3 - Garcia, Inc. uses a job-order costing system for...Ch. 3 - MarineCo, Inc. manufactures outboard motors and an...Ch. 3 - The following data refers to Huron Corporation for...Ch. 3 - Refer to the schedule of cost of goods...Ch. 3 - Marco Polo Map Companys cost of goods sold for...Ch. 3 - Midnight Sun Apparel Company uses normal costing,...Ch. 3 - Marc Jackson has recently been hired as a cost...Ch. 3 - Troy Electronics Company calculates its...Ch. 3 - Tiana Shar, the controller for Bondi Furniture...Ch. 3 - Scholastic Brass Corporation manufactures brass...Ch. 3 - Refer to the preceding problem regarding...Ch. 3 - Prob. 59PCh. 3 - TeleTech Corporation manufactures two different...Ch. 3 - CompuFurn, Inc. manufactures furniture for...Ch. 3 - FiberCom, Inc., a manufacturer of fiber optic...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

INVENTORY & COST OF GOODS SOLD; Author: Accounting Stuff;https://www.youtube.com/watch?v=OB6RDzqvNbk;License: Standard Youtube License