Concept explainers

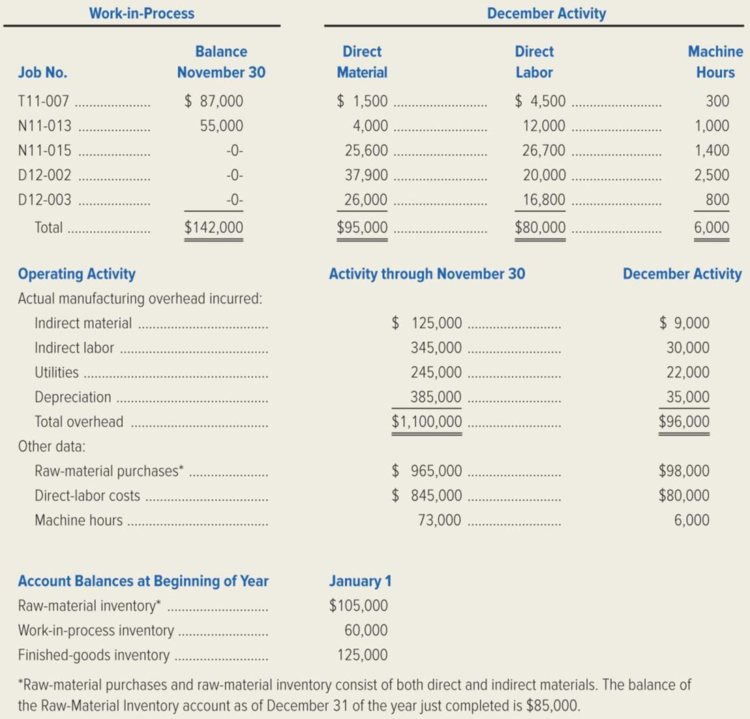

FiberCom, Inc., a manufacturer of fiber optic communications equipment, uses a

Required:

- 1. Explain why manufacturers use a predetermined overhead rate to apply manufacturing overhead to their jobs.

- 2. How much manufacturing overhead would FiberCom have applied to jobs through November 30 of the year just completed?

- 3. How much manufacturing overhead would have been applied to jobs during December of the year just completed?

- 4. Determine the amount by which manufacturing overhead is over applied or under applied as of December 31 of the year just completed.

- 5. Determine the balance in the Finished-Goods Inventory account on December 31 of the year just completed.

- 6. Prepare a Schedule of Cost of Goods Manufactured for FiberCom, Inc. for the year just completed. (Hint: In computing the cost of direct material used, remember that FiberCom includes both direct and indirect material in its Raw-Material Inventory account.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning