Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 37E

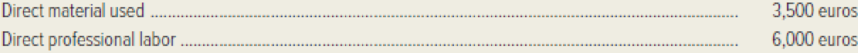

Design Arts Associates is an interior decorating firm in Berlin. The following costs were incurred in the firm’s contract to redecorate the mayor’s offices.

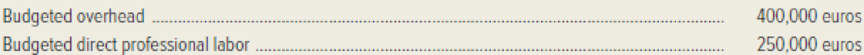

The firm’s budget for the year included the following estimates:

Required: Calculate the total cost of the firm’s contract to redecorate the mayor’s offices. (Remember to express your answer in terms of euros.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Tropico Services is a landscaping firm located in Nadi. The following costs were incurred in the firm’s contract to beautify the local hotels: Direct material $4 800 Professional labour $13 000 The firm’s budget for the year included the following estimates: Budgeted overhead $900 000 Budgeted professional labour $600 000

F) Which method would you recommend for estimating client fees? Explain your answer.

Peters Realtors, a real estate consulting firm, specializes in advising companies on potential new plant sites. The company uses a job order costing system with a predetermined overhead allocation rate,

computed as a percentage of direct labor costs. At the beginning of 2024, managing partner Jane Peters prepared the following budget for the year:

(Click the icon to view the prepared budget.)

(Click the icon to view additional information.)

Read the requirements.

Requirement 1. Compute Peters Realtors' (a) hourly direct labor cost rate and (b) predetermined overhead allocation rate.

Begin with (a) hourly direct labor cost rate.

Direct labor

cost rate

per hour

Data table

Direct labor hours (professionals)

Direct labor costs (professionals)

Office rent

Support staff salaries

Utilities

Print

$

Done

12,750 hours

2,550,000

380,000

1,397,500

390,000

X

The Barberton Municipal division of Road Maintenance is charged with road repair in the city of Barberton and the surrounding area. Cindy Kramer, road maintenance director, must submit a staffing plan for the next year based on a set schedule for repairs and on the city budget. Kramer estimates that the labor hours required for the next four quarters are 6,000,

12,000, 20,000, and 10,000, respectively. Each of the 11 workers on the workforce can contribute 500 hours per quarter. Payroll costs are $6,000 in wages per worker for regular time worked up to 500 hours, with an overtime pay rate of $17 for each overtime hour. Overtime is limited to 20 percent of the regular-time capacity in any quarter. Although unused overtime capacity has no cost, unused regular time is paid at $12 per hour. The cost of hiring a worker is $3,600, and the cost of laying off a worker is $1,400. Subcontracting is not permitted. (Hint: When calculating the number of workers, make sure to round up to…

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 3 - List and explain four purposes of product costing.Ch. 3 - Explain the difference between job-order and...Ch. 3 - How is the concept of product costing applied in...Ch. 3 - What are the purposes of the following documents:...Ch. 3 - Why is manufacturing overhead applied to products...Ch. 3 - Explain the benefits of using a predetermined...Ch. 3 - Describe one advantage and one disadvantage of...Ch. 3 - Describe an important cost-benefit issue involving...Ch. 3 - Explain the difference between actual and normal...Ch. 3 - When a single, volume-based cost driver (or...

Ch. 3 - Prob. 11RQCh. 3 - Describe the process of two-stage cost allocation...Ch. 3 - Define each of the following terms, and explain...Ch. 3 - Describe how job-order costing concepts are used...Ch. 3 - What is meant by the term cost driver? What is a...Ch. 3 - Describe the flow of costs through a...Ch. 3 - Give an example of how a hospital, such as the...Ch. 3 - Why are some manufacturing firms switching from...Ch. 3 - What is the cause of over applied or under applied...Ch. 3 - Briefly describe two ways of closing out over...Ch. 3 - Describe how a large retailer such as Lowes would...Ch. 3 - Prob. 22RQCh. 3 - For each of the following companies, indicate...Ch. 3 - The controller for Tender Bird Poultry, Inc....Ch. 3 - Finley Educational Products started and finished...Ch. 3 - Bodin Company manufactures finger splints for kids...Ch. 3 - McAllister, Inc. employs a normal costing system....Ch. 3 - Garrett Toy Company incurred the following costs...Ch. 3 - Crunchem Cereal Company incurred the following...Ch. 3 - Prob. 31ECh. 3 - Selected data concerning the past years operations...Ch. 3 - Sweet Tooth Confectionary incurred 157,000 of...Ch. 3 - The following information pertains to Trenton...Ch. 3 - The following data pertain to the Oneida...Ch. 3 - Refer to the data for the preceding exercise for...Ch. 3 - Design Arts Associates is an interior decorating...Ch. 3 - Suppose you are the controller for a company that...Ch. 3 - Laramie Leatherworks, which manufactures saddles...Ch. 3 - Refer to Exhibit 312, which portrays the three...Ch. 3 - Refer to the illustration of overhead application...Ch. 3 - The following data refer to Twisto Pretzel Company...Ch. 3 - Burlington Clock Works manufactures fine,...Ch. 3 - Perfecto Pizza Company produces microwavable...Ch. 3 - Stellar Sound, Inc. which uses a job-order costing...Ch. 3 - Finlon Upholstery, Inc. uses a job-order costing...Ch. 3 - JLR Enterprises provides consulting services...Ch. 3 - Garcia, Inc. uses a job-order costing system for...Ch. 3 - MarineCo, Inc. manufactures outboard motors and an...Ch. 3 - The following data refers to Huron Corporation for...Ch. 3 - Refer to the schedule of cost of goods...Ch. 3 - Marco Polo Map Companys cost of goods sold for...Ch. 3 - Midnight Sun Apparel Company uses normal costing,...Ch. 3 - Marc Jackson has recently been hired as a cost...Ch. 3 - Troy Electronics Company calculates its...Ch. 3 - Tiana Shar, the controller for Bondi Furniture...Ch. 3 - Scholastic Brass Corporation manufactures brass...Ch. 3 - Refer to the preceding problem regarding...Ch. 3 - Prob. 59PCh. 3 - TeleTech Corporation manufactures two different...Ch. 3 - CompuFurn, Inc. manufactures furniture for...Ch. 3 - FiberCom, Inc., a manufacturer of fiber optic...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Westfield branch of Security Home Bank submitted the following cost data for last year: Teller wages Assistant branch manager salary Branch manager salary Total Virtually all other costs of the branch-rent, depreciation, utilities, and so on-are organization-sustaining costs that cannot be meaningfully assigned to individual customer transactions such as depositing checks. In addition to the cost data above, the employees of the Westfield branch were interviewed concerning how their time was distributed last year across the activities included in the activity-based costing study. The results of those interviews appear below: Teller wages Assistant branch manager salary Branch manager salary $ 144,000 74,000 90,000 $ 308,000 Activity Opening accounts Processing deposits and withdrawals Processing other customer transactions Distribution of Resource Consumption Across Activities Processing Deposits and Withdrawals 75% 15% 0% Opening Accounts 4% 15% 4% Activity Cost Pool Opening…arrow_forwardHicks Contracting collects and analyzes cost data in order to track the cost of installing decks on new home construction jobs. The following are some of the costs that they incur. Classify these costs as fixed or variable costs and as product or period costs. Lumber used to construct decks ($12.00 per square foot) Carpenter labor used to construct decks ($10 per hour) Construction supervisor salary ($45,000 per year) Depreciation on tools and equipment ($6,000 per year) Selling and administrative expenses ($35,000 per year) Rent on corporate office space ($34,000 per year) Nails, glue, and other materials required to construct deck (varies per job)arrow_forwardThe director of public works needs to distribute the indirect cost allocation of $1.2 million to the three branches around the city. She will use the information from last year to determine the rates for this year. a. Determine this year’s indirect cost rates for each branch. b. Use the rates from last year and records for this year to distribute the allocation for this year. How much of the $1.2 million is actually distributed?arrow_forward

- Simms Realtors, a real state consulting firm, specializes in advising companies on potential new plant sites. The company uses a job order costing system with a predetermined indirect cost allocation rate, computed as a percentage of direct labor costs. At the beginning of 2011, managing partner Debra Simms prepared the following budget for the year: Direct labor hours (professional) 14,000 hours Direct labor costs (professional) $2,150,000 Office rent 260,000 Support staff sallaries 850,000 Utilities 350,000 Maynard Manufacturing, Inc. is inviting several consultants to bid for work. Debra Simms estimated that this Job will require about 260 direct labor hours. Compute Simms' Relators' indirect cost allocation rate.arrow_forwardQuestion 5, Part 2. Please answer in the same format as the question :)arrow_forwardRegis Place is a health-care facility that has been allocating its overhead costs to patients based on number of patient days. The facility’s overhead costs total $2,172,240 per year and the facility (which operates monthly at capacity) has a total of 60 beds available. (Assume a 360-day year.) The facility’s accountant is considering a new overhead allocation method using the following information: Rooms are cleaned daily; laundry for rooms is done, on average, every other day. d. Assume a patient stayed at Regis Place for six days. The patient was in a single room and required six hours of nursing care and 30 hours of physical therapy. 1. What overhead cost would be assigned to this patient under the current method of overhead allocation? $______ 2. What overhead cost would be assigned to this patient under the ABC method of overhead allocation? Rooms $ Laundry $ Nursing care $ Physical therapy $ General services $ Total $arrow_forward

- Don Johnson is the management accountant for Cari-Blocks (CB), which manufacturesspecialty blocks. CB uses two direct cost categories: direct materials and directmanufacturing labour. Johnson feels that manufacturing overhead is most closely related tomaterial usage. Therefore, CB allocates manufacturing overhead to production based uponpounds of materials used.At the beginning of 2021, CB budgeted annual production of 200,000 blocks and adopted thefollowing standards for each block: Direct materials 0.5 lb. @ $12/lb. $ 6.00Direct manufacturing labour 1.4 hours @ $20/hour 28.00Manufacturing overhead:Variable $6/lb. 0.5 lb. 3.00Fixed $15/lb. 0.3 lb. 4.50Standard cost per block $41.50Actual results for April 2021 were as follows:Production 24,000 blocksDirect materials purchased 12,000 lb. at $13/lb.Direct materials used 11,450 lb.Direct manufacturing labour 38,000 hours for $798000Variable manufacturing overhead $68,150Fixed manufacturing overhead $155,000 calculate: For the month of…arrow_forwardDon Johnson is the management accountant for Cari-Blocks (CB), which manufacturesspecialty blocks. CB uses two direct cost categories: direct materials and directmanufacturing labour. Johnson feels that manufacturing overhead is most closely related tomaterial usage. Therefore, CB allocates manufacturing overhead to production based uponpounds of materials used.At the beginning of 2021, CB budgeted annual production of 200,000 blocks and adopted thefollowing standards for each block:Direct materials 0.5 lb. @ $12/lb. $ 6.00Direct manufacturing labour 1.4 hours @ $20/hour 28.00Manufacturing overhead:Variable $6/lb. 0.5 lb. 3.00Fixed $15/lb. 0.3 lb. 4.50Standard cost per block $41.50Actual results for April 2021 were as follows:Production 24,000 blocksDirect materials purchased 12,000 lb. at $13/lb.Direct materials used 11,450 lb.Direct manufacturing labour 38,000 hours for $798000Variable manufacturing overhead $68,150Fixed manufacturing overhead $155,000 CALCULATE: .a. Direct…arrow_forwardSouthern Tier Heating, Inc. installs heating systems in new homes built in the southern tier counties of New York state. Jobs are priced using the time and materials method. The president of Southern Tier Heating, EIwing, is pricing a job involving the heating systems for six houses to be built by a local developer. He has made the following estimates. Material cost $ 60,000 Labor hours 400 The following predictions pertain to the company’s operations for the next year. Labor rate, including fringe benefits $ 16.00 per hour Annual labor hours 12,000 hours Annual overhead costs: Material handling and storage $ 25,000 Other overhead costs $ 108,000 Annual cost of materials used $ 250,000 Perbanas adds a markup of $ 4 per hour on its time charges, but there is no markup on material costs. Required: 1. Calculate the company's time charges and the material charges percentage. 2. Compute the price for the job 3. What would be the price of the job if Perbanas also added a markup of 10 % on…arrow_forward

- A local engineering firm is bidding on a design project for a new client. The total budgeted direct-labor costs for the firm are $600,000. The total budgeted indirect costs are $800,000. It is estimated that there are 10,000 billable hours in total. a. What is the budgeted direct-labor cost rate? b. What is the budgeted indirect-cost rate assuming direct-labor cost is the allocation base? c. What should be the engineering firm bid on the project if the direct labor hours are estimated at 300 hours?arrow_forwardWest Glass (WG), which manufactures specialty windows, recently hired Derek Smith as the management accountant . Direct materials and direct manufacturing labour are the two direct cost categories used by WG. Smith feels that manufacturing overhead is most closely related to material usage. Therefore, WG allocates manufacturing overhead to production based upon pounds of materials used. At the beginning of 2021, WG budgeted annual production of 200,000 windows and adopted the following standards for each window: Input Cost/window Direct materials 0.5 lb. @ $12/lb. $ 6.00 Direct manufacturing labour 1.4 hours @ $20/hour 28.00 Manufacturing overhead: Variable $6/lb. 0.5 lb.…arrow_forwardPlease complete all three parts (refer to picture for info).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Inspection and Quality control in Manufacturing. What is quality inspection?; Author: Educationleaves;https://www.youtube.com/watch?v=Ey4MqC7Kp7g;License: Standard youtube license