Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 23, Problem 21E

Income statement indicating

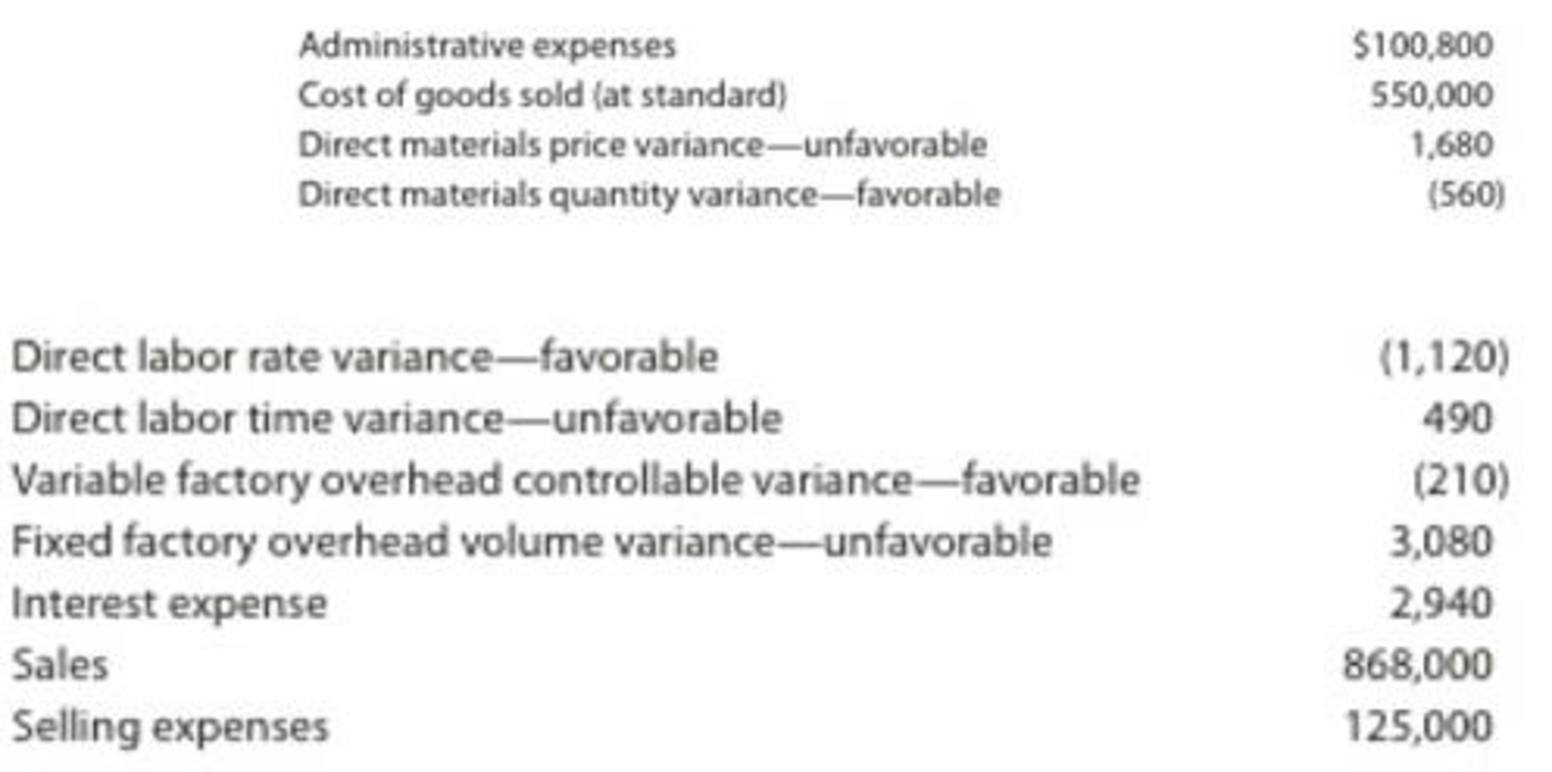

The following data were taken from the records of Griggs Company for December:

Prepare an income statement for presentation to management.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hi expert please help me answer

Provide correct answer

Hello expert please provide this answer

Chapter 23 Solutions

Financial And Managerial Accounting

Ch. 23 - What are the basic objectives in the use of...Ch. 23 - What is meant by reporting by the principle of...Ch. 23 - Prob. 3DQCh. 23 - Prob. 4DQCh. 23 - A. What are the two variances between the actual...Ch. 23 - A new assistant controller recently was heard to...Ch. 23 - Would the use of standards be appropriate in a...Ch. 23 - Prob. 8DQCh. 23 - At the end of the period, the factory overhead...Ch. 23 - If variances are recorded in the accounts at the...

Ch. 23 - Direct materials variances Bellingham Company...Ch. 23 - Direct labor variances Bellingham Company produces...Ch. 23 - Factory overhead controllable variance Bellingham...Ch. 23 - Factory overhead volume variance Bellingham...Ch. 23 - Standard cost journal entries Bellingham Company...Ch. 23 - Income statement with variances Prepare an income...Ch. 23 - Crazy Delicious Inc. produces chocolate bars. The...Ch. 23 - Atlas Furniture Company manufactures designer home...Ch. 23 - Salisbury Bottle Company manufactures plastic...Ch. 23 - The following data relate to the direct materials...Ch. 23 - De Soto Inc. produces tablet computers. The...Ch. 23 - Standard direct materials cost per unit from...Ch. 23 - H.J. Heinz Company uses standards to control its...Ch. 23 - Direct labor variances The following data relate...Ch. 23 - Glacier Bicycle Company manufactures commuter...Ch. 23 - Ada Clothes Company produced 40,000 units during...Ch. 23 - Mexicali On the Go Inc. owns and operates food...Ch. 23 - Direct materials and direct labor variances At the...Ch. 23 - Flexible overhead budget Leno Manufacturing...Ch. 23 - Flexible overhead budget Wiki Wiki Company has...Ch. 23 - Factory overhead cost variances The following data...Ch. 23 - Thomas Textiles Corporation began November with a...Ch. 23 - Prob. 17ECh. 23 - Factory overhead cost variance report Tannin...Ch. 23 - Recording standards in accounts Cioffi...Ch. 23 - Prob. 20ECh. 23 - Income statement indicating standard cost...Ch. 23 - Rockport Industries Inc. gathered the following...Ch. 23 - Dickinsen Company gathered the following data for...Ch. 23 - Rosenberry Company computed the following revenue...Ch. 23 - Lowell Manufacturing Inc. has a normal selling...Ch. 23 - Shasta Fixture Company manufactures faucets in a...Ch. 23 - Flexible budgeting and variance analysis I Love My...Ch. 23 - Direct materials, direct labor, and factory...Ch. 23 - Factory overhead cost variance report Tiger...Ch. 23 - CodeHead Software Inc. does software development....Ch. 23 - Direct materials and direct labor variance...Ch. 23 - Flexible budgeting and variance analysis Im Really...Ch. 23 - Direct materials, direct labor, and factory...Ch. 23 - Factory overhead cost variance report Feeling...Ch. 23 - Prob. 5PBCh. 23 - Prob. 1COMPCh. 23 - Advent Software uses standards to manage the cost...Ch. 23 - Admissions time variance Valley Hospital began...Ch. 23 - United States Postal Service: Mail sorting time...Ch. 23 - Direct labor time variance Maywood City Police...Ch. 23 - Ethics in action Dash Riprock is a cost analyst...Ch. 23 - Variance interpretation Vanadium Audio Inc. is a...Ch. 23 - MinnOil performs oil changes and other minor...Ch. 23 - Prob. 2CMACh. 23 - Frisco Company recently purchased 108,000 units of...Ch. 23 - JoyT Company manufactures Maxi Dolls for sale in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license