Concept explainers

Direct materials and direct labor

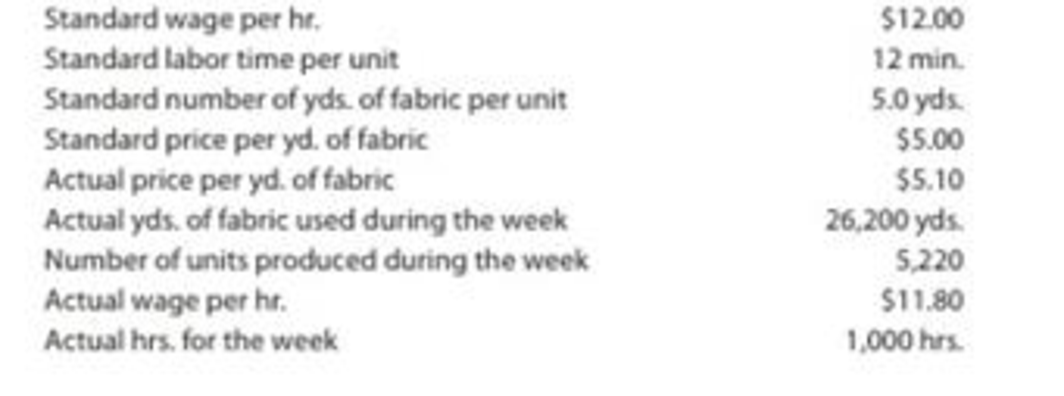

Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows:

Instructions

Determine (A) the

(A)

Ascertain the standard cost per unit for direct materials, and direct labor.

Explanation of Solution

Direct material variances:

The difference between the actual material cost per unit and the standard material cost per unit for the direct material purchased is known as direct material cost variance. The direct material variance can be classified as follows:

- v Direct materials price variance.

- v Direct materials quantity variance.

Direct labor variances:

The difference between the actual labor cost in the production and the standard labor cost for actual production is known as direct labor cost variance. The direct labor variance can be classified as follows:

- v Labor rate variance.

- v Labor time variance.

Determine the standard cost per unit for direct materials, and direct labor.

| Particulars | Standard materials and labor cost per unit |

| Direct materials (1) | $25.00 |

| Direct labor (2) | $2.40 |

| $27.40 |

Table (1)

Working Note (1):

Working Note (2):

The standard cost per unit for direct materials, and direct labor is $27.40.

(B)

Ascertain the direct materials price variance.

Explanation of Solution

Determine the direct materials price variance.

Hence, the direct materials price variance is $2,620, and it is an unfavorable variance, since the actual price is more than the standard price.

Working note (3):

Ascertain the direct materials quantity variance.

Working note (4):

Hence, the quantity variance is $500, and it is an unfavorable variance. Since the actual quantity is more than the standard quantity.

(C)

Ascertain the direct labor rate variance, direct labor time variance, and total direct labor cost variance.

Explanation of Solution

Determine the direct labor rate variance.

The direct labor rate variance is $(200) and it is a favorable variance, since the actual rate per hour is lesser than the standard rate per hour.

Determine the direct labor time variance.

Determine the total direct labor cost time variance.

The direct labor cost variance is $(728) and it is a favorable variance, since the direct labor rate variance is lesser than the direct labor time variance.

Working note (5):

Working note (6):

Want to see more full solutions like this?

Chapter 23 Solutions

Financial And Managerial Accounting

- Maplewood Textiles reported $1,100,000 in net sales and $720,000 in cost of goods sold. If operating expenses totaled $250,000, what is the company's gross profit and operating income?arrow_forwardNonearrow_forwardHarbor Freight Equipment issued $800,000 in bonds with a 7% annual interest rate for a term of 6 years. The company makes semiannual interest payments. What will be the total interest expense over the bond's life?arrow_forward

- Cogs for silver creek manufacturing?arrow_forwardneed help this questionsarrow_forwardSummit Beverages purchased a delivery truck for $90,000. The company estimates a 5-year useful life with a residual value of $10,000. Using the double-declining balance depreciation method, what is the depreciation expense for the first year?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College