Concept explainers

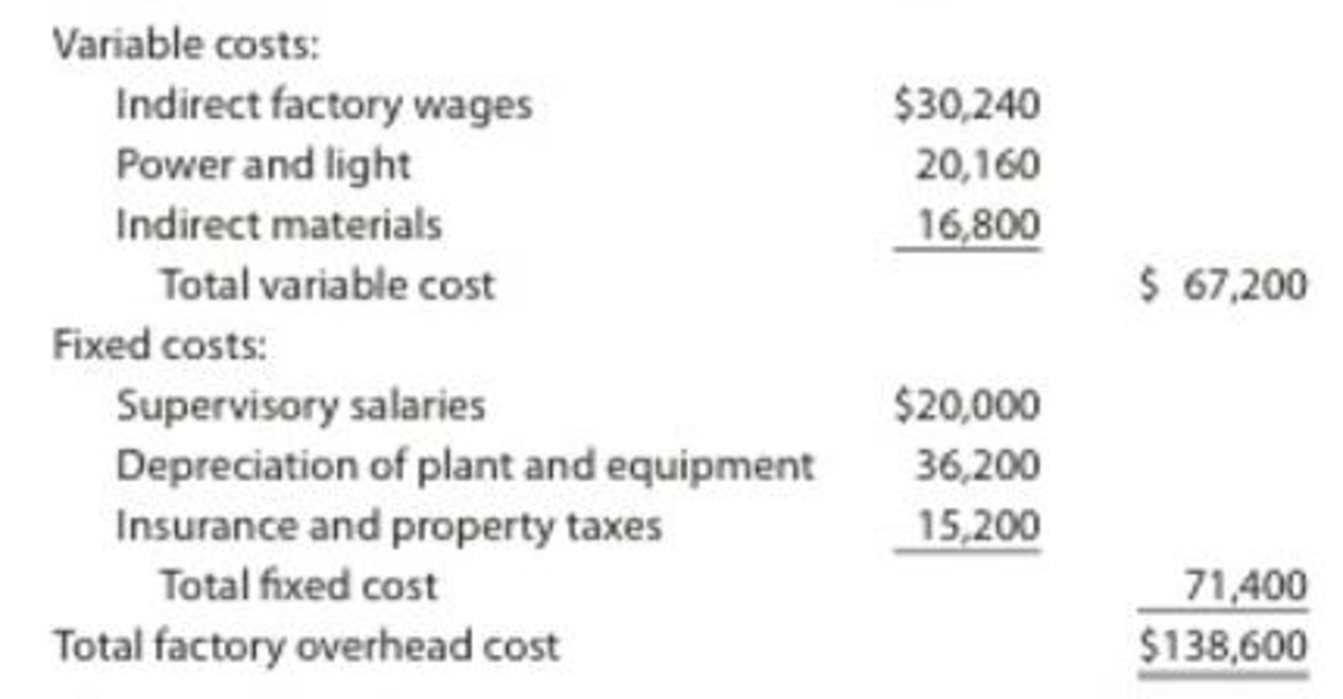

Tiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the Welding Department for May of the current year. The company expected to operate the department at 100% of normal capacity of 8,400 hours.

During May, the department operated at 8,860 hours, and the factory overhead costs incurred were indirect factory wages, $32,400; power and light, $21,000; indirect materials, $18,250; supervisory salaries, $20,000;

Instructions

Prepare a factory overhead cost variance report for May. To be useful for cost control, the budgeted amounts should be based on 8,860 hours.

Trending nowThis is a popular solution!

Chapter 23 Solutions

Financial And Managerial Accounting

- Depreciation is recorded in the books to:A. Allocate the cost of an asset over its useful lifeB. Estimate the resale value of assetsC. Track market valueD. Match expenses with liabilitiesarrow_forwardA contra-asset account has what type of balance?A. DebitB. CreditC. ZeroD. Variablei need helparrow_forwardA contra-asset account has what type of balance?A. DebitB. CreditC. ZeroD. Variablearrow_forward

- Unearned revenue is classified as:A. An expenseB. An assetC. A liabilityD. Equity need helparrow_forwardUnearned revenue is classified as:A. An expenseB. An assetC. A liabilityD. Equityarrow_forwardWhat is the impact of recording depreciation expense on the financial statements?A. Assets increase; Net income increasesB. Assets decrease; Net income decreasesC. Liabilities increase; Net income increasesD. Assets increase; Liabilities increaseneed helparrow_forward

- What is the impact of recording depreciation expense on the financial statements?A. Assets increase; Net income increasesB. Assets decrease; Net income decreasesC. Liabilities increase; Net income increasesD. Assets increase; Liabilities increasearrow_forwardWhich financial statement shows a company’s financial position at a specific point in time?A. Income StatementB. Balance SheetC. Statement of Cash FlowsD. Statement of Retained Earningsarrow_forwardWhich account is closed at the end of the accounting period? A. Accumulated Depreciation B. Salaries Payable C. Service Revenue D. Retained Earnings need carrow_forward

- Which account is closed at the end of the accounting period?A. Accumulated DepreciationB. Salaries PayableC. Service RevenueD. Retained Earningsarrow_forward12. Which account is closed at the end of the accounting period?A. Accumulated DepreciationB. Salaries PayableC. Service RevenueD. Retained Earningsneed helparrow_forward12. Which account is closed at the end of the accounting period?A. Accumulated DepreciationB. Salaries PayableC. Service RevenueD. Retained Earningsarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning