Concept explainers

Spreadsheet and Statement of

1.

Prepare a statement of cash flows using spreadsheet method.

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare a statement of cash flows using spreadsheet method.

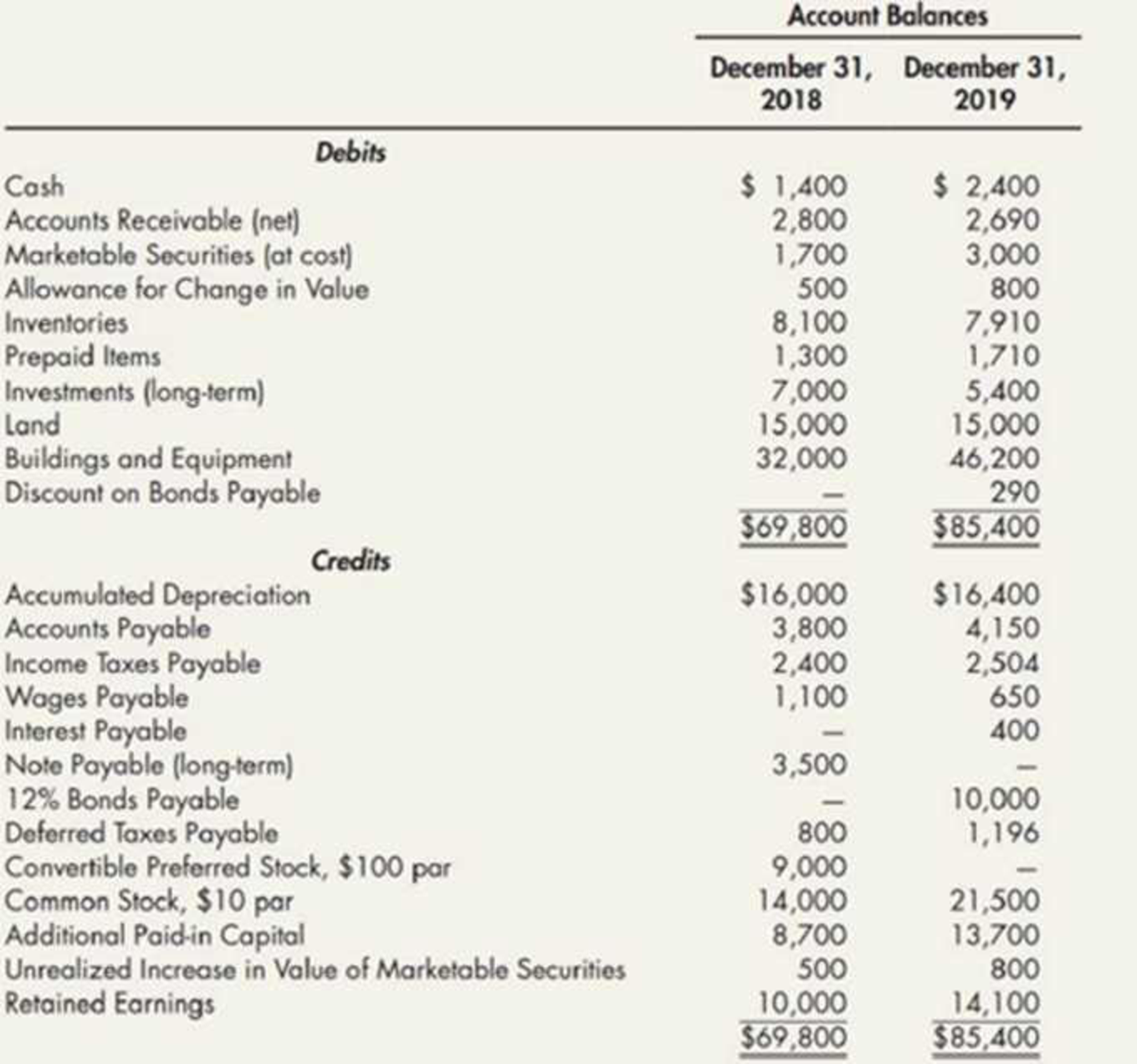

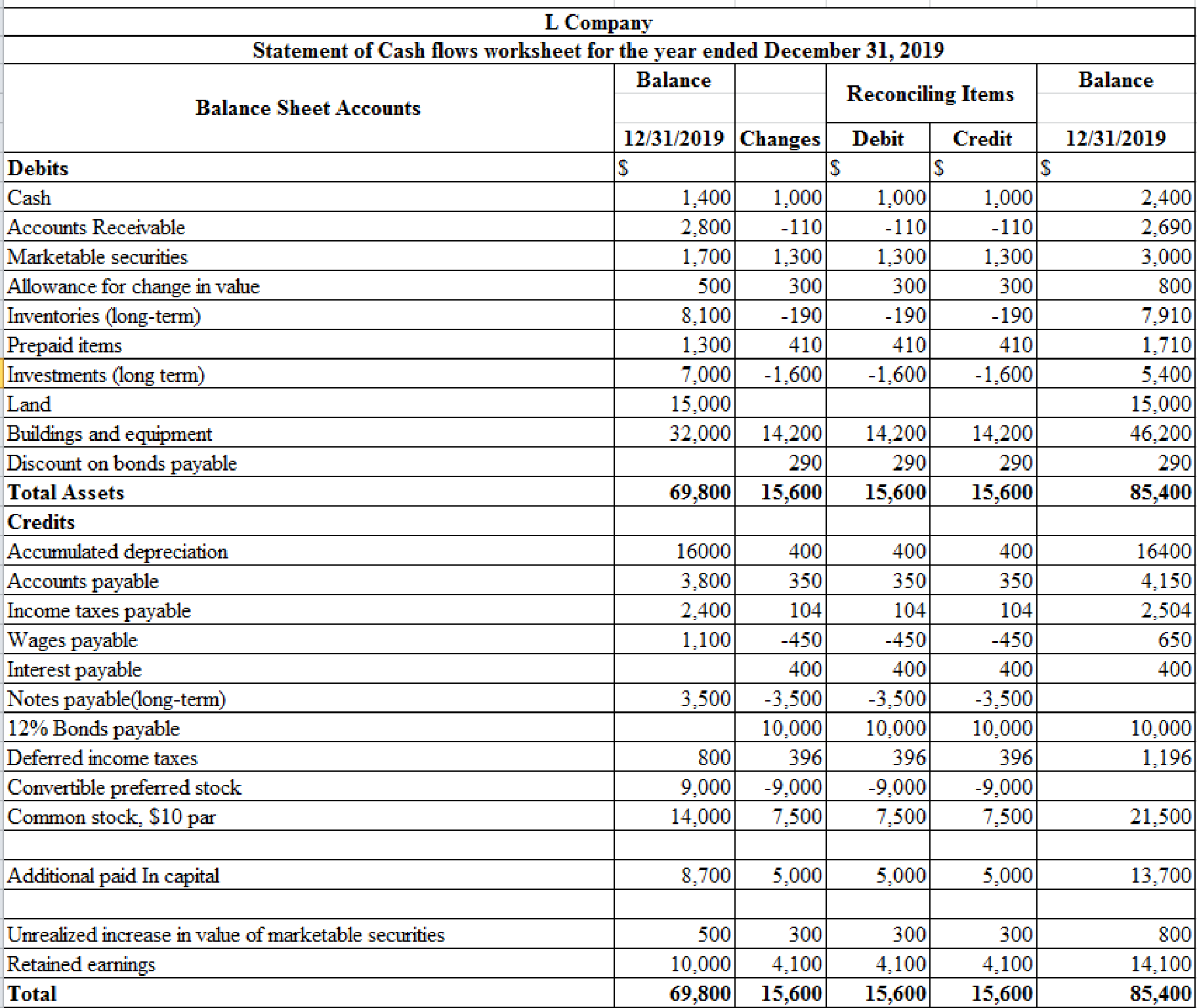

Table (1)

Table (1)

Notes:

a. Depreciation for the year ended is $2,100

b. Calculate accounts receivable.

c. Calculate the marketable securities.

d. Calculate the decrease in inventories.

e. Calculate the prepaid items.

f. Calculate the increase in accounts payable.

g. Calculate the income taxes payable.

h. Calculate the wages payable.

j. Interest payable for the year ended is $400.

k. Calculate the retained earnings.

l-1. Calculate the issuance of common stock to preferred stock.

1-2. Conversion of preferred stock to common stock is $9,000.

m. Calculate the proceeds from sale of long-term investments

n-1. Calculate the Issuance of common stock to pay long-term note.

n-2. Long- term notes payable is $3,500.

o. Calculate the sale of building and equipment.

- Cost of the equipment is $2,000.

- Loss on sale of equipment is $200.

- Proceeds from sale of equipment is $100.

p. Calculate the payment for purchase of equipment.

q. Calculate the proceeds from issuance of bonds.

r. Calculate the increase in deferred tax.

s. Calculate the bond discount amortization.

t. Calculate the allowance for change in value.

u. Calculate net increase in cash.

2.

Prepare the statement of cash flows of L Company for the year ended December 31, 2016.

Explanation of Solution

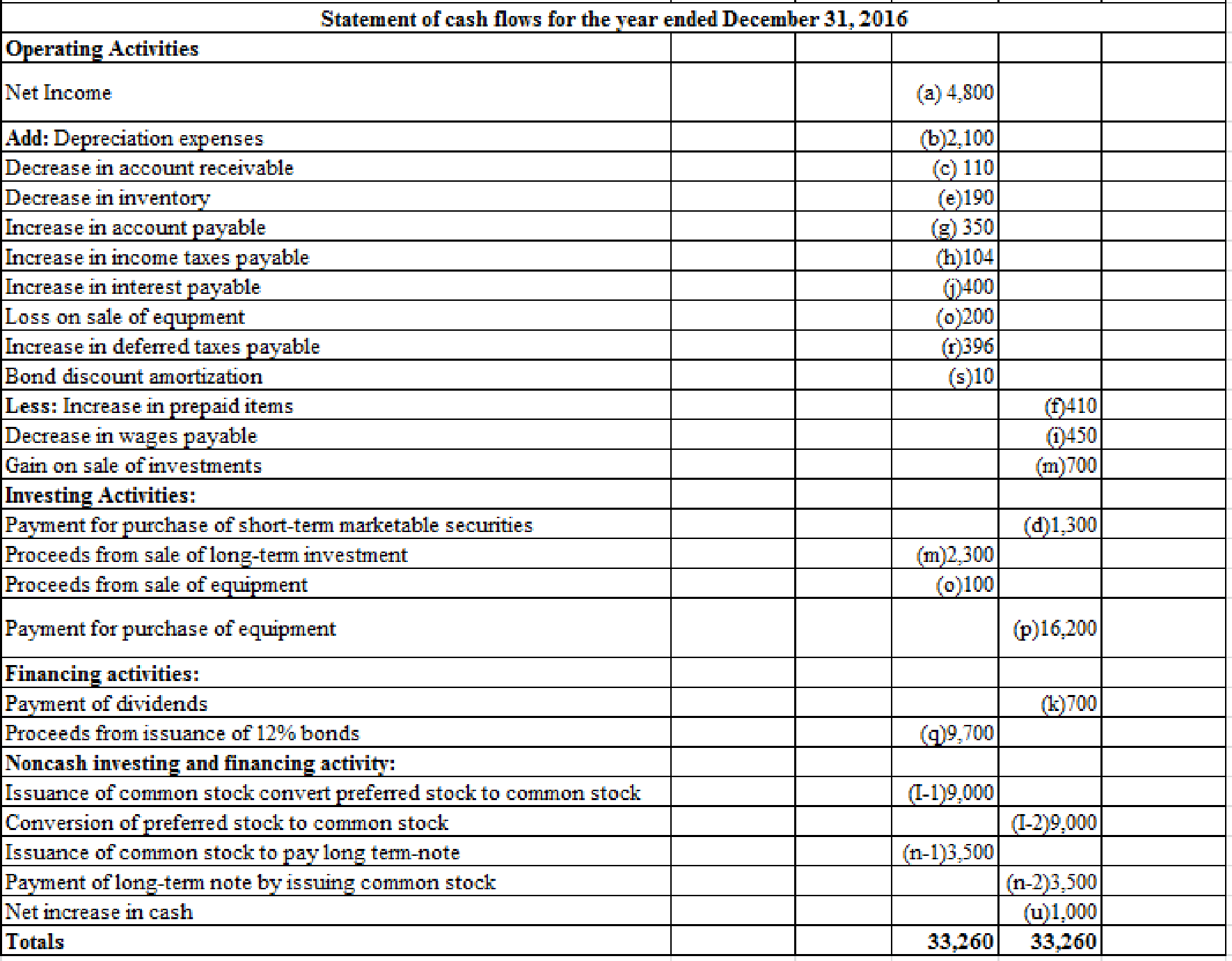

Prepare the statement of cash flows of L Company for the year ended December 31, 2016.

| L Company | ||

| Statement of cash flows for the year 2016 | ||

| Particulars | Amount($) | Amount($) |

| Operating Activities: | ||

| Net income | 4,800 | |

| Adjustment for non-cash income items: | ||

| Add: Depreciation expenses | 2,100 | |

| Bound discount amortization | 10 | |

| Loss on sale of equipment | 200 | |

| Increase in deferred taxes payable | 396 | |

| Less: Gain on sale of equipment | (700) | |

| Adjustments for cash flow effects from working capital items: | ||

| Decrease in accounts receivable | 110 | |

| Decrease in inventories | 190 | |

| Increase in prepaid items | (410) | |

| Increase in accounts payable | 350 | |

| Decrease in wages payable | (450) | |

| Increase in income taxes payable | 104 | |

| Increase in interest payable | 400 | |

| Net cash provided by operating activities | 7,100 | |

| Investing Activities: | ||

| Payment for purchase of short-term marketable securities | (1,300) | |

| Proceeds from sale of long-term investments | 2,300 | |

| Proceeds from sale of equipment | 100 | |

| Payment for purchase of equipment | (16,200) | |

| Net cash used for investing activities | (15,100) | |

| Financing Activities: | ||

| Proceeds from issuance of 12% bonds | 9,700 | |

| Payment of dividends | (700) | |

| Net cash provided by financing activities | 9,000 | |

| Net increase in cash( schedule 1) | 1,000 | |

| Cash on January 1, 2016 | 1,400 | |

| Cash on December 31,2016 | 2,400 | |

| Schedule 1: Investing and Financial Activities Not Affecting Cash | ||

| Financing Activities: | ||

| Conversion of preferred stock to common stock | (9,000) | |

| Issuance of common stock to convert preferred stock | 9,000 | |

| Payment of long-term note by issuing common stock | (3,500) | |

| Issuance of common stock to pay long- term note | 3,500 | |

Table (2)

3.

Determine the difference in cash flow from operation to sales ratio and profit margin ratio of L Company for the year 2016.

Explanation of Solution

Cash flow to sales ratio: The cash flow to sales ratio reveals the ability of a business to generate cash flow in proportion to its sales volume. It is calculated by dividing operating cash flows by net sales.

Formula for Formula for to sales ratio:

Profit margin ratio: The profit margin ratio, also called the return on sales ratio or gross profit ratio, is a profitability ratio that measures the amount of net income earned with each dollar of sales generated by comparing the net income and net sales of a company.

Formula for Formula for to profit margin ratio

The primary reason for the difference is depreciation expenses ($2,100), which was deducted to determine the net income, which did not involve an operating cash outflow.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Accounting: Reporting And Analysis

- Carichem Company produces sanitation products after processing specialized chemicals. The following relates to its activities: 1 Kilogram of chemicals purchased for $4000 and with an additional $2000 is processed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, a gram of Crystal can be sold for $2 and the Cleaning agent can be sold for $8 per litre. At an additional cost of $800, Carichem can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $4 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $600 and made into 200 packs of Softener that can be sold for $4 per pack. Required: 1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method 2. Should Carichem have processed each of the products further? What effect does the allocation method have on this decision?arrow_forwardGeneral accountingarrow_forwardKindly help me with accounting questionsarrow_forward

- Don't use ai given answer accounting questionsarrow_forwardPlease provide correct solution this financial accounting questionarrow_forwardAllocate the two support departments’ costs to the two operating departments using the following methods: a. Direct method b. Step-down method (allocate HR first) c. Step-down method (allocate IS first) d. The Algebraic method.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College