Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 5P

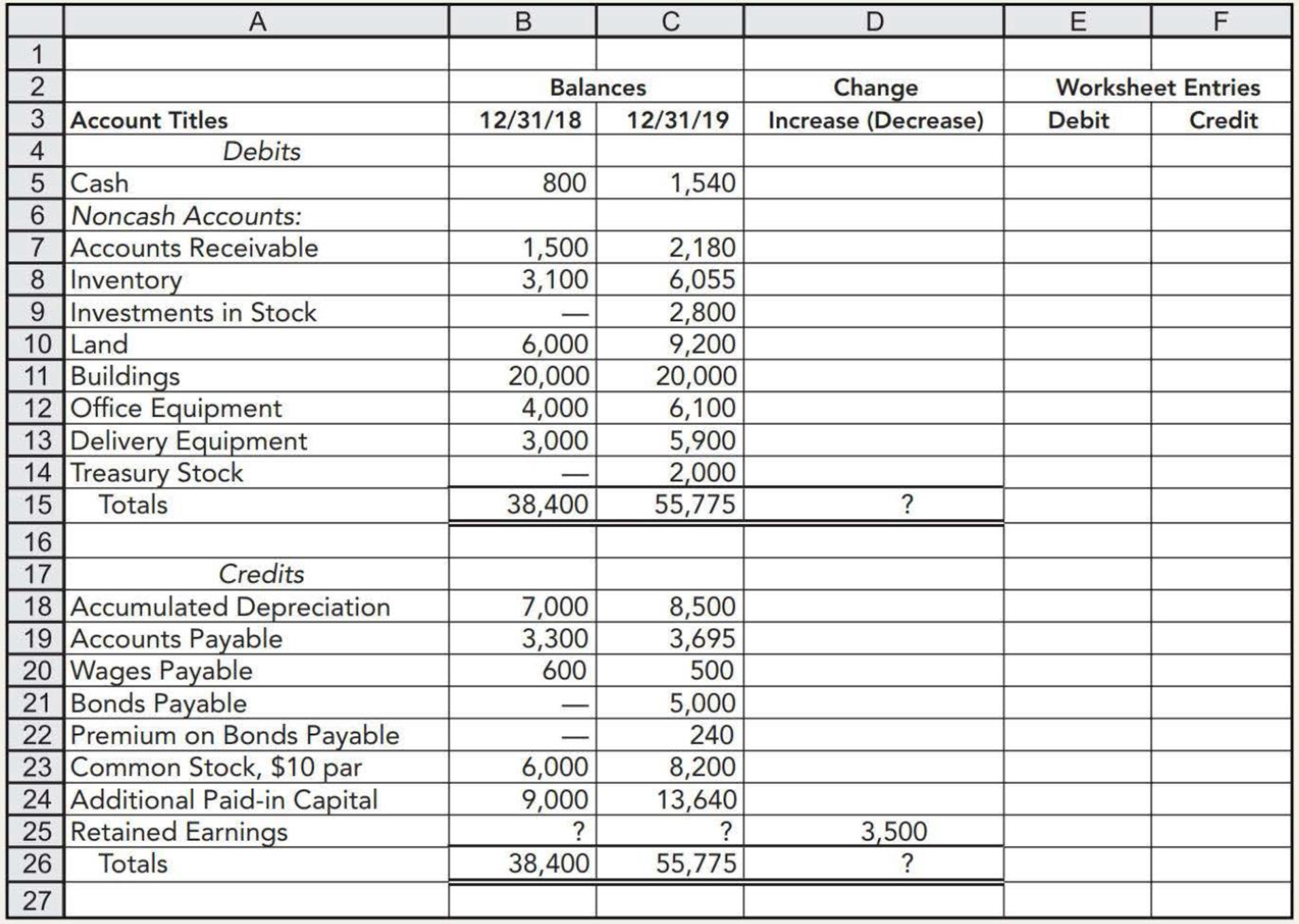

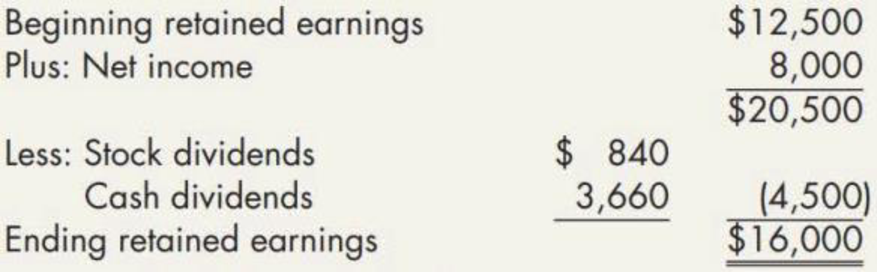

Partially Completed Spreadsheet The following partially completed spreadsheet has been prepared for Perrin Company’s 2019 statement of

Additional relevant information:

- a.

Accumulated depreciation is a contra account for all the depreciable assets. Depreciation on these assets totaled $2,200 for the year. - b. On January 1, 2019, the company issued 10% bonds with a face value of $5,000 at 106. Interest was paid semiannually on June 30 and December 31. The bonds mature on January 1, 2024. Straight-line amortization is used for bond discount or premium. Bond interest expense was $440.

- c. Land was purchased for $3,200 during the year.

- d. Two hundred shares of common stock were issued for delivery equipment valued at $2,900 and office equipment valued at $3,100.

- e. Twenty shares of stock were issued as a stock dividend. The market price per share was $42.

- f. Office equipment with a cost of $1,000 and a book value of $300 was sold for $50.

- g. Fifty shares of its own common stock were reacquired by the company as

treasury stock . The company purchased the shares for $40 per share. - h. One hundred shares of Doe Company stock were purchased for $28 per share at year-end.

Required:

Complete the spreadsheet.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

ayco Inc. started its operations in 2022. Its sales during 2022, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2022, its fiscal year-end, and determined the account balance to be $14,000.

The unadjusted balances of selected accounts at December 31, 2023 are as follows:

Accounts receivable

$

300,000

Allowance for doubtful accounts (debit)

10,000

Sales revenue (including 80 percent in sales on account)

800,000

Aging of the accounts receivable on December 31, 2023, resulted in an estimate of $11,000 in potentially uncollectible accounts.

Required:

1. Prepare the journal entries to record all the transactions during 2022 and post them to appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)…

Calculate the sample size based on the specifications in Buhi's contract. Make sure it is within budget, reasonable to obtain, and that you use appropriate inputs relative to market research best practices.

Use the calculator to adjust the sample size statement.

Use the agreed-upon sample size in Buhi's contract: 996.

In your secondary research, find the target population size (an estimate of those in the United States looking to purchase luggage in the category in the next two years). You will use this target population size for each sample size estimate.

Adjust the provided sample size calculator inputs to find the rest of the figures that get you to the agreed-upon sample size.

The caveats from Buhi are that you must:

Use the market research standard for your confidence level.

Use a confidence interval that is better than the market research standard for your confidence interval.

The partnership of Keenan and Kludlow paid the following wages during this year:

Line Item Description

Amount

M. Keenan (partner)

$108,000

S. Kludlow (partner)

96,000

N. Perry (supervisor)

54,700

T. Lee (factory worker)

35,100

R. Rolf (factory worker)

27,200

D. Broch (factory worker)

6,300

S. Ruiz (bookkeeper)

26,000

C. Rudolph (maintenance)

5,200

In addition, the partnership owed $250 to Rudolph for work he performed during December. However, payment for this work will not be made until January of the following year. The state unemployment tax rate for the company is 2.95% on the first $9,000 of each employee's earnings. Compute the following:

ound your answers to the nearest cent.

a. Net FUTA tax for the partnership for this year

b. SUTA tax for this year

Chapter 21 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 21 - What information does the statement of cash flows...Ch. 21 - Briefly describe the three types of activities a...Ch. 21 - Thompson Company sold a piece of equipment that...Ch. 21 - Give two examples of a companys (a) cash inflows...Ch. 21 - Prob. 5GICh. 21 - Prob. 6GICh. 21 - Prob. 7GICh. 21 - Prob. 8GICh. 21 - Prob. 9GICh. 21 - List the three operating cash inflows that a...

Ch. 21 - Prob. 11GICh. 21 - Prob. 12GICh. 21 - Prob. 13GICh. 21 - Dunn Company recognized a 5,000 unrealized holding...Ch. 21 - Jordan Company recognized a 5,000 unrealized...Ch. 21 - Indicate how a company computes the amount of...Ch. 21 - Prob. 17GICh. 21 - Prob. 18GICh. 21 - Prob. 19GICh. 21 - Which of the following would be considered a cash...Ch. 21 - In a statement of cash flows (indirect method),...Ch. 21 - The net cash provided by operating activities in...Ch. 21 - The retirement of long-term debt by the issuance...Ch. 21 - Prob. 5MCCh. 21 - Selected information from Brook Corporations...Ch. 21 - Prob. 7MCCh. 21 - Prob. 8MCCh. 21 - Which of the following need not be disclosed in a...Ch. 21 - The following information was taken from Oregon...Ch. 21 - Prob. 1RECh. 21 - Prob. 2RECh. 21 - Given the following information, convert Cardinal...Ch. 21 - Given the following information, convert Robin...Ch. 21 - In the current year, Harrisburg Corporation had...Ch. 21 - Tifton Co. had the following cash transactions...Ch. 21 - Tifton Co. had the following cash transactions...Ch. 21 - Trenton Corporation has the following items....Ch. 21 - Prob. 9RECh. 21 - In the current year, Harrisburg Corporation...Ch. 21 - Providence Company sold equipment for 25,000 cash....Ch. 21 - Annapolis Corporation paid 270,000 to retire bonds...Ch. 21 - Given the following information, compute Lemon...Ch. 21 - Prob. 14RECh. 21 - Prob. 1ECh. 21 - Prob. 2ECh. 21 - Visual Inspection Noble Companys accounting...Ch. 21 - Prob. 4ECh. 21 - Prob. 5ECh. 21 - Prob. 6ECh. 21 - Prob. 7ECh. 21 - Prob. 8ECh. 21 - Partially Completed Spreadsheet Hanks Company has...Ch. 21 - Spreadsheet The following 2019 information is...Ch. 21 - Spreadsheet and Statement The following 2019...Ch. 21 - Fixed Asset Transactions The following is an...Ch. 21 - Retirement of Debt Moore Company is preparing its...Ch. 21 - Interest and Income Taxes Staggs Company has...Ch. 21 - Investments On October 4, 2019, Collins Company...Ch. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Investing Activities and Depreciable Assets...Ch. 21 - Spreadsheet and Statement The following 2019...Ch. 21 - (Appendix 21.1) Operating Cash Flows The following...Ch. 21 - (Appendix 21.1) Statement of Cash Flows The...Ch. 21 - (Appendix 21.1) Visual Inspection The following...Ch. 21 - Prob. 22ECh. 21 - Classification of Cash Flows A company's statement...Ch. 21 - Prob. 2PCh. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Partially Completed Spreadsheet The following...Ch. 21 - Spreadsheet and Statement of Cash Flows The...Ch. 21 - Prob. 7PCh. 21 - Spreadsheet from Trial Balance Heinz Companys post...Ch. 21 - Prepare Ending Balance Sheet On December 31, 2019,...Ch. 21 - Infrequent Transactions The following transactions...Ch. 21 - Prob. 11PCh. 21 - Comprehensive Angel Company has prepared its...Ch. 21 - Comprehensive The following are Farrell...Ch. 21 - (Appendix 21.1) Operating Cash Flows Refer to the...Ch. 21 - (Appendix 21.1) Statement of Cash Flows The...Ch. 21 - Comprehensive The following are Farrell...Ch. 21 - (Appendix 21.1) Comprehensive The following are...Ch. 21 - Prob. 18PCh. 21 - Financial Statement Interrelationships Prepare an...Ch. 21 - Statement of Cash Flows A friend of yours is...Ch. 21 - Prob. 3CCh. 21 - Operating, Investing, and Financing Activities The...Ch. 21 - Prob. 5CCh. 21 - Spreadsheet Method The spreadsheet method is...Ch. 21 - Prob. 7CCh. 21 - Inflows and Outflows Alfred Engineering Company is...Ch. 21 - Ethics and Cash Flows You are the accountant for...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License