Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 19E

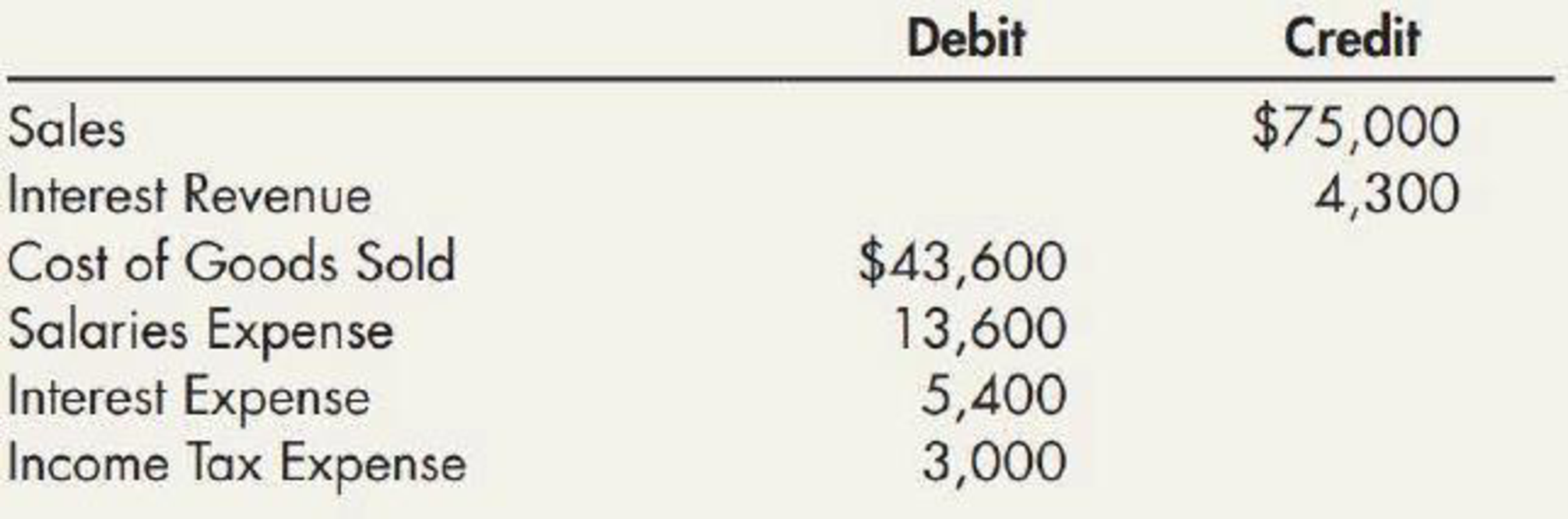

(Appendix 21.1) Operating

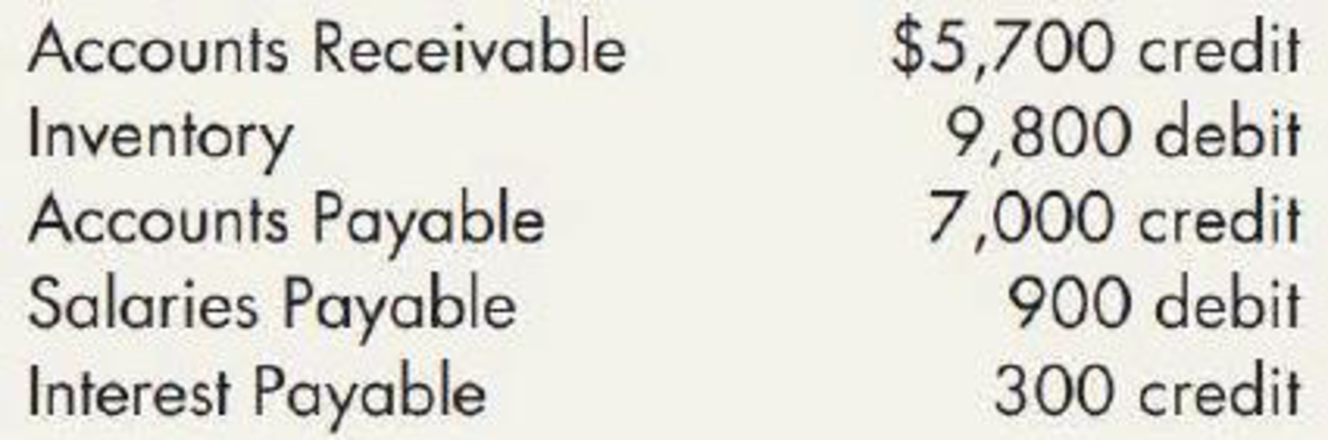

In addition, the following changes occurred in selected accounts during 2019:

Required:

Using the direct method, prepare the cash flows from operating activities section of the 2019 statement of cash flows for Woodrail.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Solve this financial accounting problem

Need answer the financial accounting question not use ai and chatgpt

What is the material price variance?

Chapter 21 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 21 - What information does the statement of cash flows...Ch. 21 - Briefly describe the three types of activities a...Ch. 21 - Thompson Company sold a piece of equipment that...Ch. 21 - Give two examples of a companys (a) cash inflows...Ch. 21 - Prob. 5GICh. 21 - Prob. 6GICh. 21 - Prob. 7GICh. 21 - Prob. 8GICh. 21 - Prob. 9GICh. 21 - List the three operating cash inflows that a...

Ch. 21 - Prob. 11GICh. 21 - Prob. 12GICh. 21 - Prob. 13GICh. 21 - Dunn Company recognized a 5,000 unrealized holding...Ch. 21 - Jordan Company recognized a 5,000 unrealized...Ch. 21 - Indicate how a company computes the amount of...Ch. 21 - Prob. 17GICh. 21 - Prob. 18GICh. 21 - Prob. 19GICh. 21 - Which of the following would be considered a cash...Ch. 21 - In a statement of cash flows (indirect method),...Ch. 21 - The net cash provided by operating activities in...Ch. 21 - The retirement of long-term debt by the issuance...Ch. 21 - Prob. 5MCCh. 21 - Selected information from Brook Corporations...Ch. 21 - Prob. 7MCCh. 21 - Prob. 8MCCh. 21 - Which of the following need not be disclosed in a...Ch. 21 - The following information was taken from Oregon...Ch. 21 - Prob. 1RECh. 21 - Prob. 2RECh. 21 - Given the following information, convert Cardinal...Ch. 21 - Given the following information, convert Robin...Ch. 21 - In the current year, Harrisburg Corporation had...Ch. 21 - Tifton Co. had the following cash transactions...Ch. 21 - Tifton Co. had the following cash transactions...Ch. 21 - Trenton Corporation has the following items....Ch. 21 - Prob. 9RECh. 21 - In the current year, Harrisburg Corporation...Ch. 21 - Providence Company sold equipment for 25,000 cash....Ch. 21 - Annapolis Corporation paid 270,000 to retire bonds...Ch. 21 - Given the following information, compute Lemon...Ch. 21 - Prob. 14RECh. 21 - Prob. 1ECh. 21 - Prob. 2ECh. 21 - Visual Inspection Noble Companys accounting...Ch. 21 - Prob. 4ECh. 21 - Prob. 5ECh. 21 - Prob. 6ECh. 21 - Prob. 7ECh. 21 - Prob. 8ECh. 21 - Partially Completed Spreadsheet Hanks Company has...Ch. 21 - Spreadsheet The following 2019 information is...Ch. 21 - Spreadsheet and Statement The following 2019...Ch. 21 - Fixed Asset Transactions The following is an...Ch. 21 - Retirement of Debt Moore Company is preparing its...Ch. 21 - Interest and Income Taxes Staggs Company has...Ch. 21 - Investments On October 4, 2019, Collins Company...Ch. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Investing Activities and Depreciable Assets...Ch. 21 - Spreadsheet and Statement The following 2019...Ch. 21 - (Appendix 21.1) Operating Cash Flows The following...Ch. 21 - (Appendix 21.1) Statement of Cash Flows The...Ch. 21 - (Appendix 21.1) Visual Inspection The following...Ch. 21 - Prob. 22ECh. 21 - Classification of Cash Flows A company's statement...Ch. 21 - Prob. 2PCh. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Partially Completed Spreadsheet The following...Ch. 21 - Spreadsheet and Statement of Cash Flows The...Ch. 21 - Prob. 7PCh. 21 - Spreadsheet from Trial Balance Heinz Companys post...Ch. 21 - Prepare Ending Balance Sheet On December 31, 2019,...Ch. 21 - Infrequent Transactions The following transactions...Ch. 21 - Prob. 11PCh. 21 - Comprehensive Angel Company has prepared its...Ch. 21 - Comprehensive The following are Farrell...Ch. 21 - (Appendix 21.1) Operating Cash Flows Refer to the...Ch. 21 - (Appendix 21.1) Statement of Cash Flows The...Ch. 21 - Comprehensive The following are Farrell...Ch. 21 - (Appendix 21.1) Comprehensive The following are...Ch. 21 - Prob. 18PCh. 21 - Financial Statement Interrelationships Prepare an...Ch. 21 - Statement of Cash Flows A friend of yours is...Ch. 21 - Prob. 3CCh. 21 - Operating, Investing, and Financing Activities The...Ch. 21 - Prob. 5CCh. 21 - Spreadsheet Method The spreadsheet method is...Ch. 21 - Prob. 7CCh. 21 - Inflows and Outflows Alfred Engineering Company is...Ch. 21 - Ethics and Cash Flows You are the accountant for...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello experts please answer the financial accounting questionarrow_forwardhello tutor please help mearrow_forwardWalker Manufacturing uses a predetermined overhead rate based on direct labor cost to apply manufacturing overhead to jobs. Last year, the company's estimated manufacturing overhead was $1,800,000, and its estimated level of activity was 60,000 direct labor-hours. The company's direct labor wage rate is $15 per hour. Actual manufacturing overhead amounted to $1,720,000, with actual direct labor cost of $930,000. For the year, manufacturing overhead was_.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License