Concept explainers

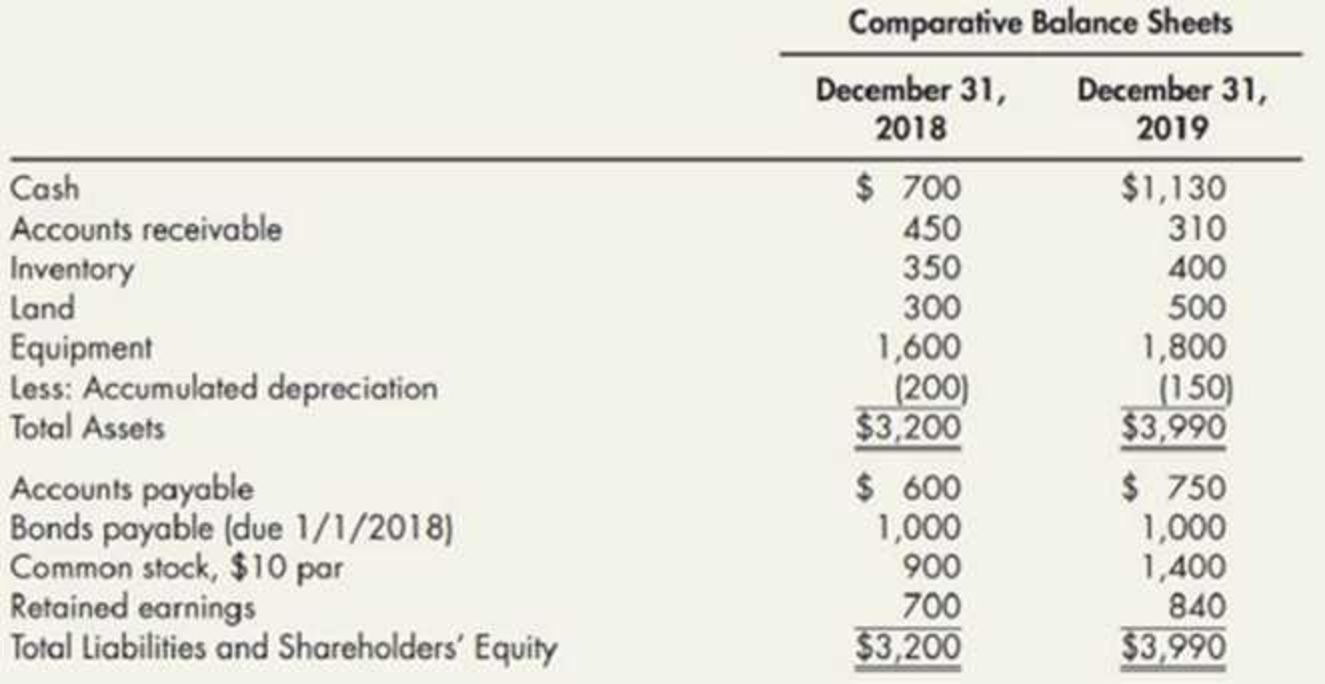

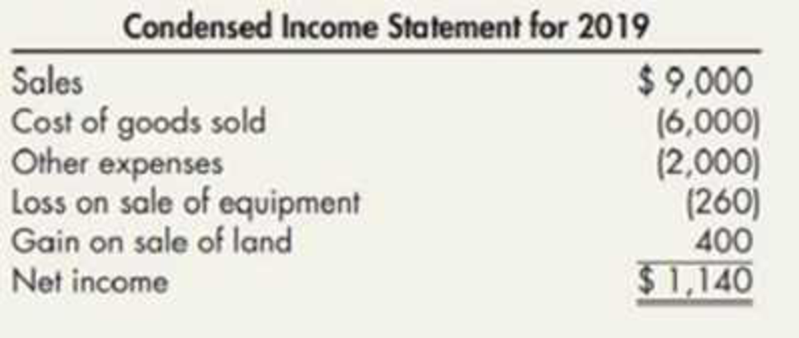

Spreadsheet and Statement The following 2019 information is available for Stewart Company:

Partial additional information:

- The equipment that was sold for cash had cost $400 and had a book value of $300.

- Land that was sold brought a cash price of $530.

- Fifty shares of stock were issued at par.

(Appendix 21.1) Operating

Required:

Raised only on the information presented and using the direct method, prepare the cash flows from operating activities section of the 2019 statement of cash flows for Stewart using the spreadsheet method.

Prepare operating activities section in the cash flow statement under direct method of S Company for the year 2019.

Explanation of Solution

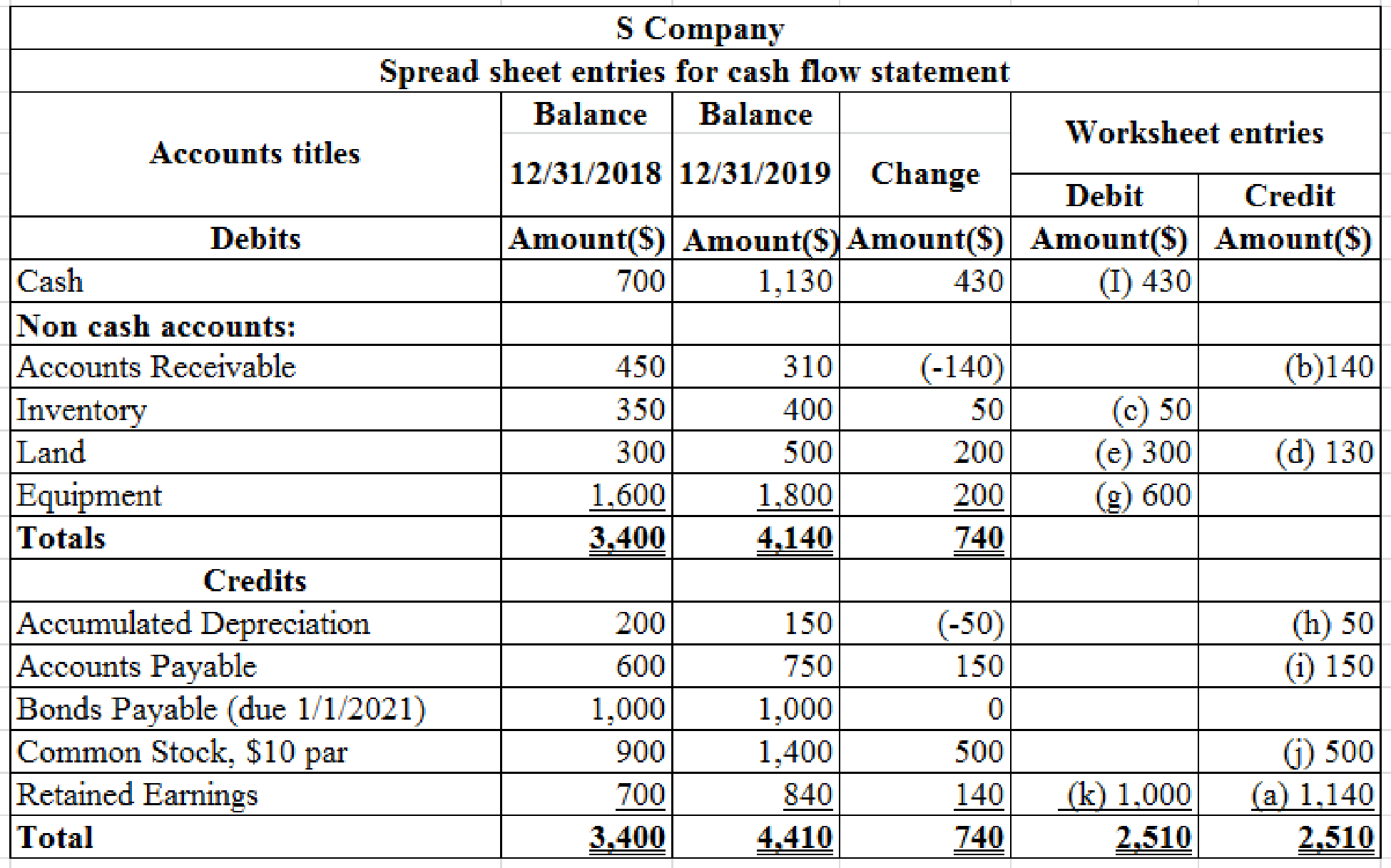

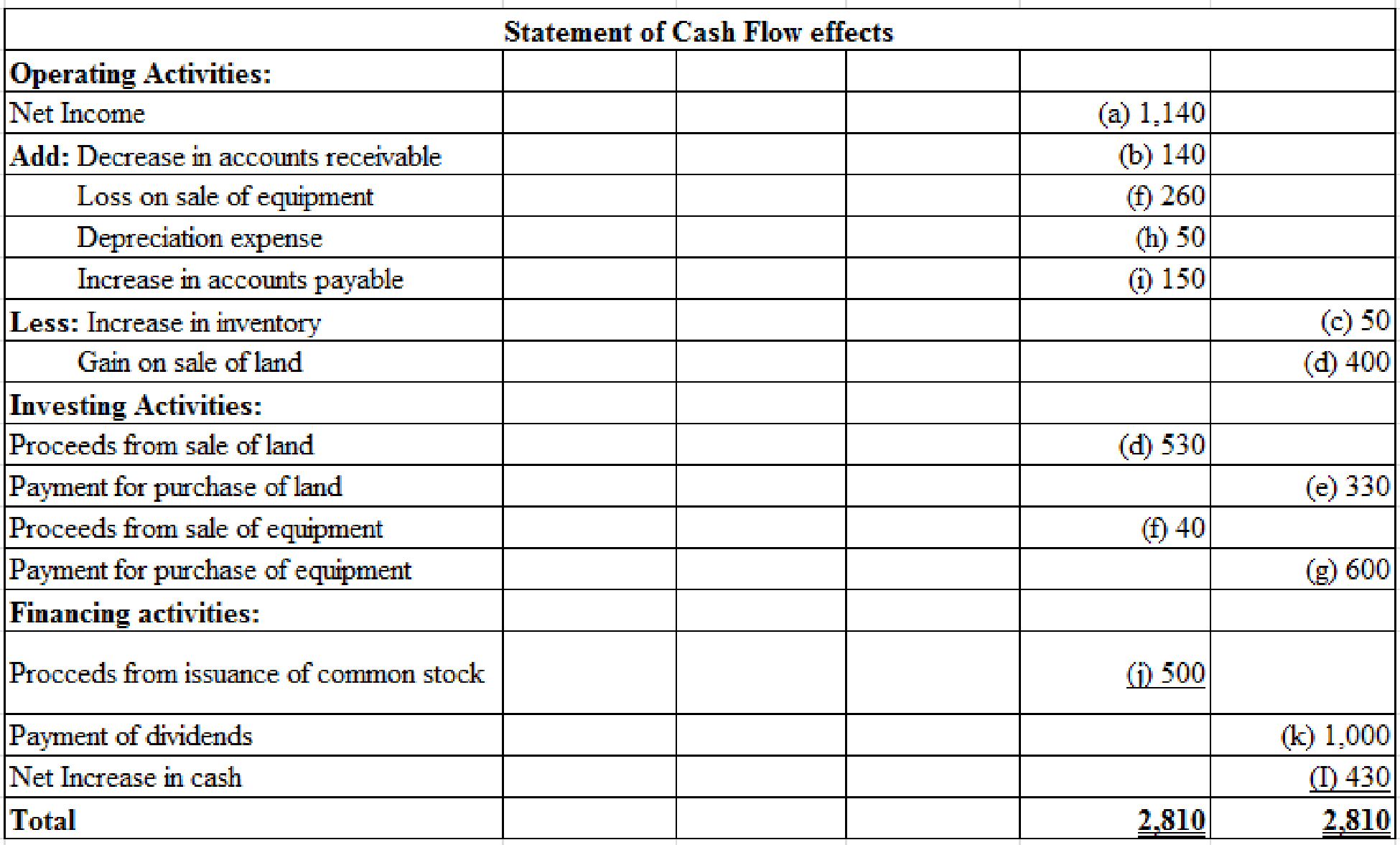

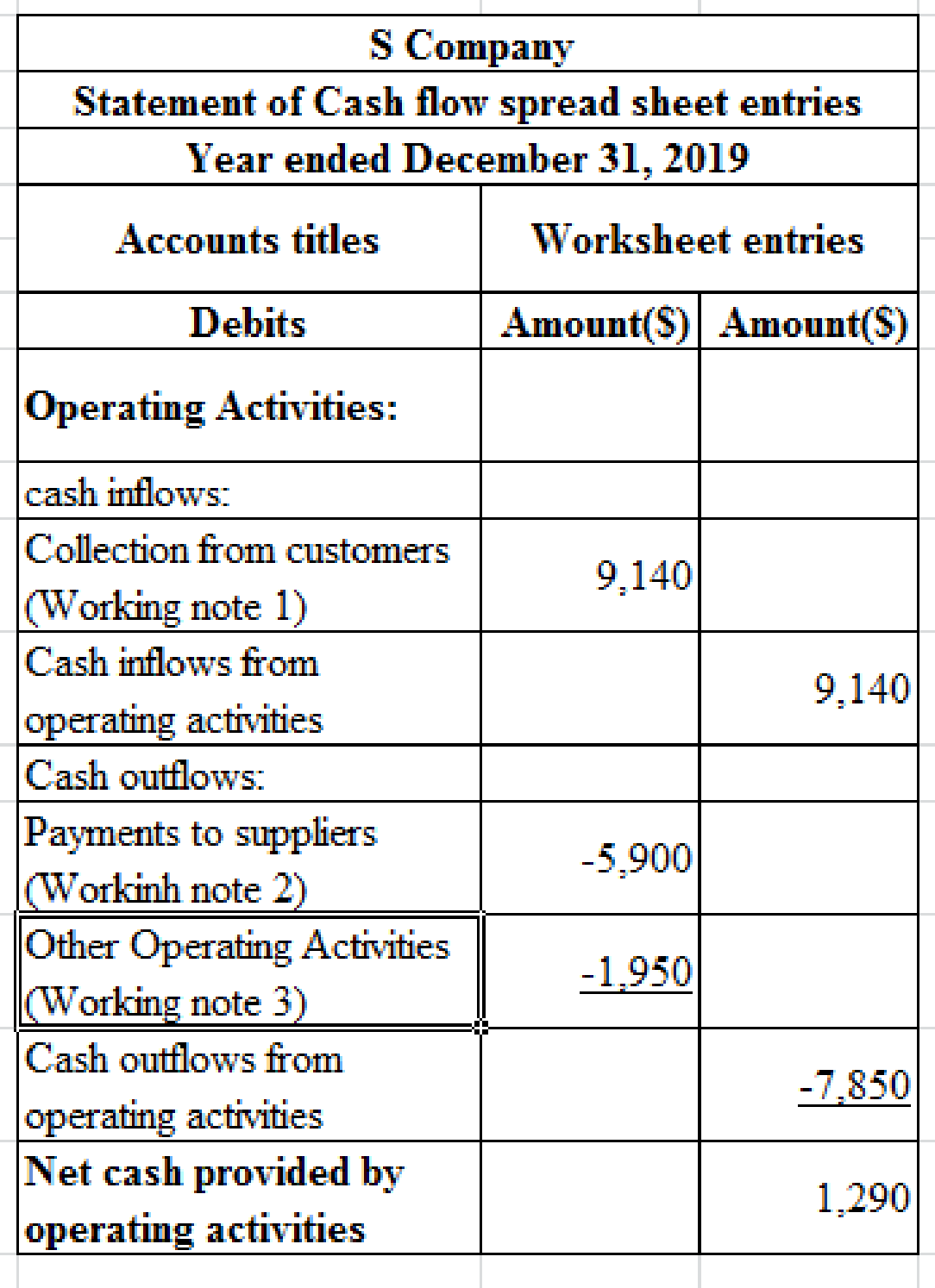

Prepare operating activities section in the cash flow statement under direct method:

Table (1)

Table (2)

Working Note:

(a) Net income for the year ended 2019 is $1,140.

(b) Calculate the decrease in accounts receivable.

(c) Calculate an increase in inventory.

(d) Calculate the cost of land sold.

(e) Calculate the purchase of land.

Step 1: Calculate the balance amount of land after sale.

Step 2: Calculate the purchase of land.

(f) Calculate the Proceeds from Equipment.

(g) Calculate the Purchase of equipment.

Step 1: Calculate the balance amount of equipment after sales.

Step 2: Calculate the purchase of equipment.

(h) Calculate the Depreciation expense.

(i) Calculate an increase in accounts payable.

(j) Calculate the proceeds from issuance of common stock.

(k) Calculate the payment of dividend.

Step 1: Calculate the amount of retained earnings.

Step 2: Calculate the amount of dividend paid.

(I) Calculate the net increase in cash.

Table (3)

Working note 1:

Calculate the collection from customers.

Working note 2:

Calculate the payments to suppliers.

Working note 3:

Calculate the other operating payments.

Accumulated depreciation decreased by $50($200-$150) in total, caused by a $100 decreased due to the sale of equipment with a $400 cost and a $300 book value and a $50 increase due to depreciation expenses.

Therefore, the net cash provided by operating activities is $1,290.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Accounting: Reporting And Analysis

- Provide answerarrow_forwardData below for the year ended December 31, 2024, relates to Houdini Incorporated. Houdini started business January 1, 2024, and uses the LIFO retail method to estimate ending inventory. Cost Retail Beginning inventory $ 69,000 $ 118,000 Net purchases 355,000 520,000 Net markups 30,000 Net markdowns 50,000 Net sales 465,000 Current period cost-to-retail percentage is:arrow_forwardA company sells inventory that is subject to a great deal of price volatility. A recent item of inventory that cost $20.60 was marked up $12.20, marked down for a sale by $6.80 and then had a markdown cancellation of $4.30. The latest selling price is?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub