MANAGERIAL ACCOUNTING >C<

3rd Edition

ISBN: 9781259948503

Author: Whitecotton

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 6E

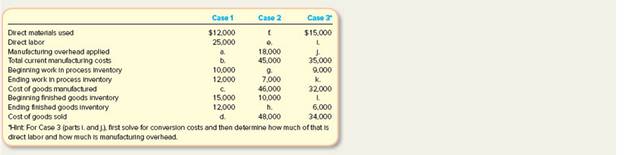

Finding Unknown Values in the Cost of Goods Manufactured Report

Mulligan Manufacturing Company uses a

Hint: For Case 3 (parts i. and j.), first solve for conversion costs and then determine how of that is direct labor and how much is manufacturing overhead.

Required:

Treating each case independently, find the missing amounts letters a to l. You should do them in the order listed.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

provide correct answer

hello tutor please help me

What is the gross margin percentage of this financial accounting question?

Chapter 2 Solutions

MANAGERIAL ACCOUNTING >C<

Ch. 2 - What is the difference between job order and...Ch. 2 - What types of companies are likely to use job...Ch. 2 - What types companies are likely to use process...Ch. 2 - Many service industries use job order costing to...Ch. 2 - Prob. 5QCh. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - Prob. 8QCh. 2 - Prob. 9QCh. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Prob. 12QCh. 2 - Prob. 13QCh. 2 - Prob. 14QCh. 2 - Prob. 15QCh. 2 - Prob. 16QCh. 2 - Prob. 17QCh. 2 - Prob. 18QCh. 2 - Prob. 19QCh. 2 - Prob. 20QCh. 2 - Prob. 21QCh. 2 - Prob. 1MCCh. 2 - Prob. 2MCCh. 2 - Prob. 3MCCh. 2 - Prob. 4MCCh. 2 - Prob. 5MCCh. 2 - Prob. 6MCCh. 2 - Prob. 7MCCh. 2 - Applied overhead costs are recorded a. On the left...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Identifying Companies That Use Job Order versus...Ch. 2 - Prob. 2MECh. 2 - Prob. 3MECh. 2 - Prob. 4MECh. 2 - Prob. 5MECh. 2 - Prob. 6MECh. 2 - Prob. 7MECh. 2 - Prob. 8MECh. 2 - Prob. 9MECh. 2 - Prob. 10MECh. 2 - Prob. 11MECh. 2 - Calculating Over- or Underapplied Overhead Costs...Ch. 2 - Prob. 13MECh. 2 - Prob. 14MECh. 2 - Prob. 15MECh. 2 - Calculating Direct Materials Used in Production...Ch. 2 - Calculating Missing Amounts and Cost or Goods...Ch. 2 - Prob. 19MECh. 2 - Prob. 1ECh. 2 - Preparing Journal Entries Refer to the information...Ch. 2 - Prob. 3ECh. 2 - Preparing Journal Entries Refer to the information...Ch. 2 - Prob. 5ECh. 2 - Finding Unknown Values in the Cost of Goods...Ch. 2 - Prob. 7ECh. 2 - Prob. 8ECh. 2 - Prob. 9ECh. 2 - Prob. 10ECh. 2 - Calculating the Cost of Finished and Unfinished...Ch. 2 - Computing Overhead Rate and Billing Rate for...Ch. 2 - Prob. 13ECh. 2 - Prob. 14ECh. 2 - Prob. 15ECh. 2 - Prob. 16ECh. 2 - Prob. 17ECh. 2 - Prob. 18ECh. 2 - Prob. 19ECh. 2 - Prob. 20ECh. 2 - Prob. 21ECh. 2 - Preparing Journal Entries Floyds Auto Repair Shop...Ch. 2 - Applying Job Order Costing in a Service Setting...Ch. 2 - Prob. 24ECh. 2 - Prob. 1.1GAPCh. 2 - Prob. 1.2GAPCh. 2 - Prob. 1.3GAPCh. 2 - Prob. 1.4GAPCh. 2 - Prob. 1.5GAPCh. 2 - Preparing Journal Entries Refer to the information...Ch. 2 - Prob. 3.1GAPCh. 2 - Prob. 3.2GAPCh. 2 - Prob. 3.3GAPCh. 2 - Prob. 3.4GAPCh. 2 - Prob. 3.5GAPCh. 2 - Prob. 4.1GAPCh. 2 - Prob. 4.2GAPCh. 2 - Prob. 4.3GAPCh. 2 - Prob. 5.1GAPCh. 2 - Prob. 5.2GAPCh. 2 - Recording Manufacturing Costs and Analyzing...Ch. 2 - Prob. 5.4GAPCh. 2 - Prob. 6GAPCh. 2 - Prob. 7.1GAPCh. 2 - Prob. 7.2GAPCh. 2 - Prob. 7.3GAPCh. 2 - Prob. 7.4GAPCh. 2 - Prob. 7.5GAPCh. 2 - Prob. 8.1GAPCh. 2 - Prob. 8.2GAPCh. 2 - Prob. 8.3GAPCh. 2 - Prob. 8.4GAPCh. 2 - Prob. 8.5GAPCh. 2 - Prob. 1.1GBPCh. 2 - Prob. 1.2GBPCh. 2 - Prob. 1.3GBPCh. 2 - Prob. 1.4GBPCh. 2 - Prob. 1.5GBPCh. 2 - Prob. 2GBPCh. 2 - Prob. 3.1GBPCh. 2 - Prob. 3.2GBPCh. 2 - Prob. 3.3GBPCh. 2 - Prob. 3.4GBPCh. 2 - Prob. 3.5GBPCh. 2 - Prob. 4.1GBPCh. 2 - Prob. 4.2GBPCh. 2 - Prob. 4.3GBPCh. 2 - Recording Manufacturing Costs and Analyzing...Ch. 2 - Recording Manufacturing Costs and Analyzing...Ch. 2 - Recording Manufacturing Costs and Analyzing...Ch. 2 - Prob. 5.4GBPCh. 2 - Prob. 6GBPCh. 2 - Prob. 7.1GBPCh. 2 - Prob. 7.2GBPCh. 2 - Prob. 7.3GBPCh. 2 - Prob. 7.4GBPCh. 2 - Prob. 7.5GBPCh. 2 - Prob. 8.1GBPCh. 2 - Prob. 8.2GBPCh. 2 - Prob. 8.3GBPCh. 2 - Prob. 8.4GBPCh. 2 - Prob. 8.5GBP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY