Concept explainers

Applying Job Order Costing in a Service Setting

Marsha Design is an interior design and consulting firm. The uses a

Marsha Design races direct labor and travel costs to each job (client). It assigns indirect costs to clients at a predetermined

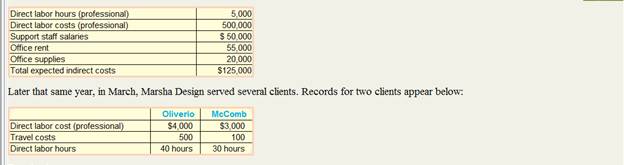

At the beginning of the year, the managing partner, Marsha Cain, prepared the following budget:

Later that same year, in March, Marsha several Records two clients appear below:

1. Compute Marsha Design's predetermined overhead rate current year.

2. Compute the total cost of serving the listed.

3. Assume that Marsha charges clients $250 per hour for interior design services. How much gross profit would she earn on each of the clients above, ignoring any difference between actual and overhead?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

MANAGERIAL ACCOUNTING >C<

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning