Concept explainers

Computing

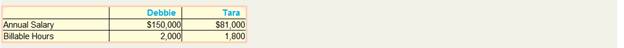

McBride and Associates employs two professional appraisers, each having a different specialty. Debbie specializes in commercial appraisals and Tara specializes in residential appraisals. The company expects to incur total overhead costs of $346,500 during the year and applies overhead based on annual salary costs. The salaries and billable hours of the two appraisers are estimated to be as follows:

The accountant for McBride and Associates is computing the hourly rate that should be used to charge clients for Debbie and Tara's services. The hourly billing rate should be set to cover the total cost of services (salary plus overhead) plus a 20 percent markup.

Required:

1. Compute the predetermined overhead rate.

2. Compute the hourly billing rate for Debbie and Tara.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

MANAGERIAL ACCOUNTING >C<

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardRavi Mehta bought 400 shares of Bright Future Tech for $92 per share. He paid a commission of $70 when he purchased this stock. He sold the stock 5 years later for $118 per share. At the time of sale, he paid a commission of $90. While holding the stock, he received dividends of $3.50 per share each year. What was Ravi’s total dollar return on this stock?arrow_forwardI need help with this solution and accounting questionarrow_forward

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardCan you solve this financial accounting problem with appropriate steps and explanations?arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- What was sales revenue for the year?arrow_forwardA regional savings bank negotiates the purchase of a one-year interest rate cap with a cap rate of 3.85 percent with a large financial institution. The option has a notional principal of 2.2 million and costs 3,400. In one year, interest rates are 4.95 percent. The regional savings bank's net profit, ignoring commissions and taxes, was_.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub