Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 39E

Cost Classification

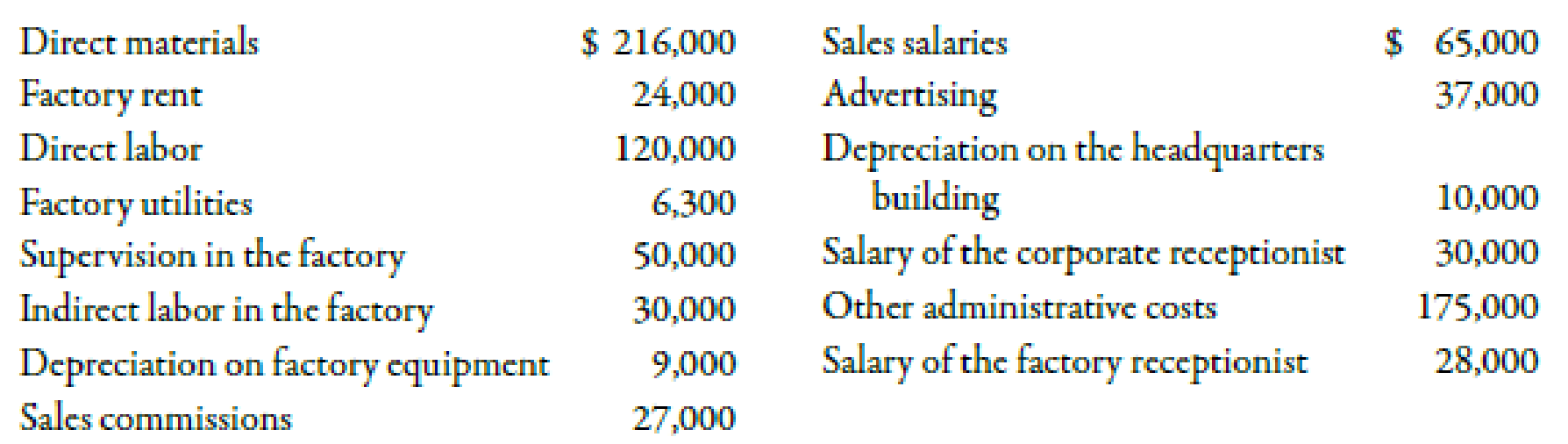

Loring Company incurred the following costs last year:

Required:

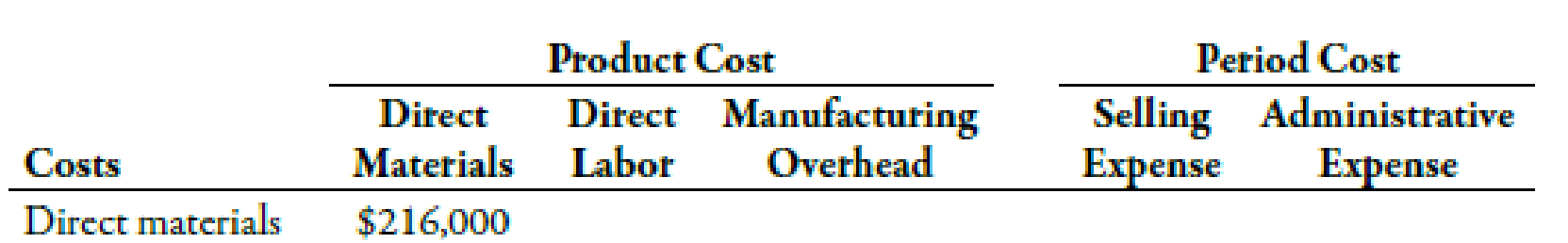

- 1. Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, $216,000.

- 2. What was the total product cost for last year?

- 3. What was the total period cost for last year?

- 4. If 30,000 units were produced last year, what was the unit product cost?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Bandar Industries Berhad of Malaysia manufactures sporting

equipment. One of the company's products, a football helmet for the

North American market, requires a special plastic. During the quarter

ending June 30, the company manufactured 3,500 helmets, using 2,555

kilograms of plastic. The plastic cost the company $19,418. According

to the standard cost card, each helmet should require 0.65 kilograms of

plastic at a cost of $8.00 per kilogram.

According to the standards, what cost for plastic should have been

incurred to make 3,500 helmets?

How much greater or less is this than the cost that was incurred?

Answer this provide financial accounting question

Pearl Leasing Company agrees to lease equipment to Martinez Corporation on January 1, 2025. The following information relates to the lease agreement.

1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years.

2. The cost of the machinery is $541,000, and the fair value of the asset on January 1, 2025, is $760,000.

3. Z At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $45,000, Maz estimates that the expected residual value at the end of the lease term will be $45,000. Martinez amortizes its leased equipment on a straight-line basis.

4. The lease agreement requires equal annual rental payments, beginning on January 1, 2025.

5. The collectibility of the lease payments is probable.

6. Pearl desires a 10% rate of return on its investments. Martinez's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown.

Question? (Assume the accounting period ends on…

Chapter 2 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 2 - Explain the difference between cost and expense.Ch. 2 - What is the difference between accumulating costs...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - What is a direct cost? An indirect cost? Can the...Ch. 2 - What is allocation?Ch. 2 - What is the difference between a product and a...Ch. 2 - Define manufacturing overhead.Ch. 2 - Explain the difference between direct materials...Ch. 2 - Define prime cost and conversion cost. Why cant...Ch. 2 - How does a period cost differ from a product cost?

Ch. 2 - Define selling cost. Give five examples of selling...Ch. 2 - What is the cost of goods manufactured?Ch. 2 - What is the difference between cost of goods...Ch. 2 - What is the difference between the income...Ch. 2 - Why do firms like to calculate a percentage column...Ch. 2 - Accumulating costs means that a. costs must be...Ch. 2 - Product (or manufacturing) costs consist of a....Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Prob. 4MCQCh. 2 - The accountant in a factory that produces biscuits...Ch. 2 - Which of the following is an indirect cost? a. The...Ch. 2 - Prob. 7MCQCh. 2 - Kelloggs makes a variety of breakfast cereals....Ch. 2 - Prob. 9MCQCh. 2 - Stone Inc. is a company that purchases goods...Ch. 2 - JackMan Company produces die-cast metal bulldozers...Ch. 2 - Prob. 12MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple- Choice...Ch. 2 - Prob. 16MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - 2-18 Use the following information for Multiple-...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Direct Materials Used in Production Slapshot...Ch. 2 - Cost of Goods Manufactured Slapshot Company makes...Ch. 2 - Cost of Goods Sold Slapshot Company makes ice...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Prob. 26BEACh. 2 - Prob. 27BEBCh. 2 - Prob. 28BEBCh. 2 - Direct Materials Used in Production Morning Smiles...Ch. 2 - 2-30 Cost of Goods Manufactured Morning Smiles...Ch. 2 - Cost of Goods Sold Morning Smiles Coffee Company...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercise:...Ch. 2 - Service Organization Income Statement Healing...Ch. 2 - Prob. 35ECh. 2 - Products versus Services, Cost Assignment Holmes...Ch. 2 - Assigning Costs to a Cost Object, Direct and...Ch. 2 - Total and Unit Product Cost Martinez Manufacturing...Ch. 2 - Cost Classification Loring Company incurred the...Ch. 2 - Classifying Cost of Production A factory...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Direct Materials Used Hannah Banana Bakers makes...Ch. 2 - Cost of Goods Sold Allyson Ashley makes jet skis....Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Understanding the Relationship between Cost Flows,...Ch. 2 - Manufacturing, Cost Classification, Product Costs...Ch. 2 - Cost Assignment, Direct Costs Harry Whipple, owner...Ch. 2 - Cost of Direct Materials, Cost of Goods...Ch. 2 - Preparation of Income Statement: Manufacturing...Ch. 2 - Cost of Goods Manufactured, Cost of Goods Sold...Ch. 2 - Cost Identification Following is a list of cost...Ch. 2 - Income Statement, Cost of Services Provided,...Ch. 2 - Cost of Goods Manufactured, Income Statement W. W....Ch. 2 - Cost Definitions Luisa Giovanni is a student at...Ch. 2 - Cost Identification and Analysis, Cost Assignment,...Ch. 2 - Cost Analysis, Income Statement Five to six times...Ch. 2 - Cost Classification, Income Statement Gateway...Ch. 2 - Cost Information and Ethical Behavior, Service...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Patterson Brothers recently reported an EBITDA of $8.8 million and a net income of $2.4 million. It had $2 million in interest expense, and its corporate tax rate was 45%. What was its charge for depreciation and amortization? Answer this questionarrow_forwardA firm has a profit margin of 19 percent on sales of $24,000,000. If the firm has total assets of $23,500,000, and an after-tax interest cost on total debt of 5 percent, what is the firm's ROA? a. 12.9% b. 19.4% c. 12.0% d. 13.3% e. 15.1%arrow_forwardHow many units must company sell?arrow_forward

- What is the effect of using standard costs? A. Can make management planning more difficult. B. Promotes greater economy. C. Does not help in setting prices. D. Weakens management control.arrow_forwardPatterson Brothers recently reported an EBITDA of $8.8 million and a net income of $2.4 million. It had $2 million in interest expense, and its corporate tax rate was 45%. What was its charge for depreciation and amortization?arrow_forwardWhat was it's charges for depression and amortizationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License