Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 18MCQ

2-18 Use the following information for Multiple- Choice Questions 2-13 through 2-18:

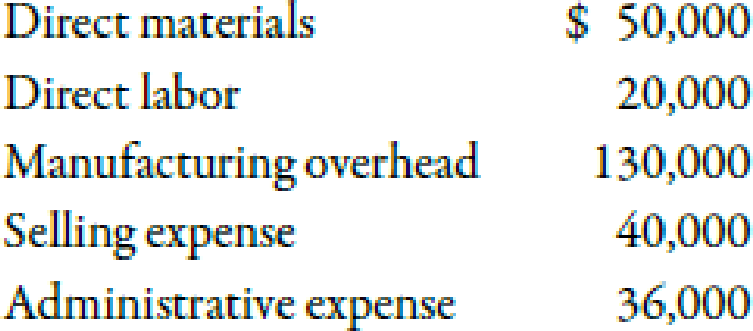

Last year, Barnard Company incurred the following costs:

Barnard produced and sold 10,000 units at a price of $31 each.

Refer to the information for Barnard Company on the previous page. Operating income is

- a. $34,000.

- b. $110,000.

- c. $234,000.

- d. $270,000.

- e. $74,000.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Consider the following Information for the business Harry's Vintage Records.

Actuals from the year ended 31st December 2021;

Total Sales Revenue

Total Fixed Costs

$380,000

$90,000

0.20

Contribution Margin Ratio

Calculate Harry's profit or loss in 2021

Select one:

O a. (13,000)

O b. 11,000

c. 12,000

d. (14,000)

Take a look at the following company information:

Sales (000s)

Direct Materials (000s)

Direct Labour (000s)

Gross Profit (000s)

Selling and Admin Expense (000s)

Net profit

$ 1566

$554

$ 211

$801

Answer:

$ 162.5

$

If we decrease the direct materials cost by 2%, what is the new Net Profit?

Show your answer to 2 decimals and include the correct unit.

How do you get this answer

A company manufactured

50.000 units of a product at

a cost of $450,000. It sold

45,000 units at $15 each.

The gross profit is:

a. $225,000

b. $750,000

c. $225,000

wwww

d. $600,000

e. $270,000

Chapter 2 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 2 - Explain the difference between cost and expense.Ch. 2 - What is the difference between accumulating costs...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - What is a direct cost? An indirect cost? Can the...Ch. 2 - What is allocation?Ch. 2 - What is the difference between a product and a...Ch. 2 - Define manufacturing overhead.Ch. 2 - Explain the difference between direct materials...Ch. 2 - Define prime cost and conversion cost. Why cant...Ch. 2 - How does a period cost differ from a product cost?

Ch. 2 - Define selling cost. Give five examples of selling...Ch. 2 - What is the cost of goods manufactured?Ch. 2 - What is the difference between cost of goods...Ch. 2 - What is the difference between the income...Ch. 2 - Why do firms like to calculate a percentage column...Ch. 2 - Accumulating costs means that a. costs must be...Ch. 2 - Product (or manufacturing) costs consist of a....Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Prob. 4MCQCh. 2 - The accountant in a factory that produces biscuits...Ch. 2 - Which of the following is an indirect cost? a. The...Ch. 2 - Prob. 7MCQCh. 2 - Kelloggs makes a variety of breakfast cereals....Ch. 2 - Prob. 9MCQCh. 2 - Stone Inc. is a company that purchases goods...Ch. 2 - JackMan Company produces die-cast metal bulldozers...Ch. 2 - Prob. 12MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple- Choice...Ch. 2 - Prob. 16MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - 2-18 Use the following information for Multiple-...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Direct Materials Used in Production Slapshot...Ch. 2 - Cost of Goods Manufactured Slapshot Company makes...Ch. 2 - Cost of Goods Sold Slapshot Company makes ice...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Prob. 26BEACh. 2 - Prob. 27BEBCh. 2 - Prob. 28BEBCh. 2 - Direct Materials Used in Production Morning Smiles...Ch. 2 - 2-30 Cost of Goods Manufactured Morning Smiles...Ch. 2 - Cost of Goods Sold Morning Smiles Coffee Company...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercise:...Ch. 2 - Service Organization Income Statement Healing...Ch. 2 - Prob. 35ECh. 2 - Products versus Services, Cost Assignment Holmes...Ch. 2 - Assigning Costs to a Cost Object, Direct and...Ch. 2 - Total and Unit Product Cost Martinez Manufacturing...Ch. 2 - Cost Classification Loring Company incurred the...Ch. 2 - Classifying Cost of Production A factory...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Direct Materials Used Hannah Banana Bakers makes...Ch. 2 - Cost of Goods Sold Allyson Ashley makes jet skis....Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Understanding the Relationship between Cost Flows,...Ch. 2 - Manufacturing, Cost Classification, Product Costs...Ch. 2 - Cost Assignment, Direct Costs Harry Whipple, owner...Ch. 2 - Cost of Direct Materials, Cost of Goods...Ch. 2 - Preparation of Income Statement: Manufacturing...Ch. 2 - Cost of Goods Manufactured, Cost of Goods Sold...Ch. 2 - Cost Identification Following is a list of cost...Ch. 2 - Income Statement, Cost of Services Provided,...Ch. 2 - Cost of Goods Manufactured, Income Statement W. W....Ch. 2 - Cost Definitions Luisa Giovanni is a student at...Ch. 2 - Cost Identification and Analysis, Cost Assignment,...Ch. 2 - Cost Analysis, Income Statement Five to six times...Ch. 2 - Cost Classification, Income Statement Gateway...Ch. 2 - Cost Information and Ethical Behavior, Service...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information for Multiple-Choice Questions 2-13 through 2-18: Last year, Barnard Company incurred the following costs: Barnard produced and sold 10,000 units at a price of 31 each. 2-13Refer to the information for Barnard Company above. Prime cost per unit is a. 7.00. b. 20.00. c. 15.00. d. 5.00. e. 27.60.arrow_forwardUse the following information for Multiple- Choice Questions 2-13 through 2-18: Last year, Barnard Company incurred the following costs: Barnard produced and sold 10,000 units at a price of 31 each. 2-15 Refer to the information for Barnard Company on the previous page. The cost of goods sold per unit is a. 7.00. b. 20.00. c. 15.00. d. 5.00. e. 27.60.arrow_forwardCan you please answer the questionarrow_forward

- 2. The records of the Dodge Corporation show the following results for the most recent year: Given the provided date, identify the contribution margin. There is not a word length requirement for this question; however, you must show your work. sales (16000 units) 256,000 variable expenses 160,000 net operating income 32,000arrow_forwardQuestions 7 & 8. A company produces a product w/ a per-unit costs: DM $15; DL $6; MOH $19 Last year, they produced & sold 2,000 units @ $75 each. Total SG&A expense was $30,000. Question 7. Conversion cost per unit was: A. $21 B. $25 C. $34 D. $40 Question 8. Total gross margin for last year was: A. $40,000 B. $70,000 C. $80,000 D. $88,000 E. $100,000arrow_forwardUse the following information for Multiple-Choice Questions 2-13 through 2-18: Last year, Barnard Company incurred the following costs: Barnard produced and sold 10,000 units at a price of 31 each. 2-14Refer to the information for Barnard Company above. Conversion cost per unit is a. 7.00. b. 20.00. c. 15.00. d. 5.00. e. 27.60.arrow_forward

- Cost Classification Loring Company incurred the following costs last year: Required: 1. Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, 216,000. 2. What was the total product cost for last year? 3. What was the total period cost for last year? 4. If 30,000 units were produced last year, what was the unit product cost?arrow_forwardA company uses charging rates to allocate service department costs to the using departments. The accountant compiled the following information on one of the service departments: If Department K plans to use 1,350 hours of the service departments service in the coming year, how much of the service departments cost is allocated to Department K? a. 3,375 b. 27,300 c. 26,325 d. 23,950arrow_forwardPlease Solve In 20minsarrow_forward

- Provide solution of this questionarrow_forward2. Burnham Industries incurs the following costs for the month: Direct materials $2,000 Direct labor 3,000 Factory depreciation expense 3,500 Factory utilities expense 750 CEO's salary 4,000 How much is the prime cost? How much is the conversion cost? PLEASE NOTE: All amounts rounded to whole dollar and shown with "$" and commas as needed (i.e. $12,345).arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Relevant Costing Explained; Author: Kaplan UK;https://www.youtube.com/watch?v=hnsh3hlJAkI;License: Standard Youtube License