Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 17MCQ

Use the following information for Multiple-Choice Questions 2-13 through 2-18:

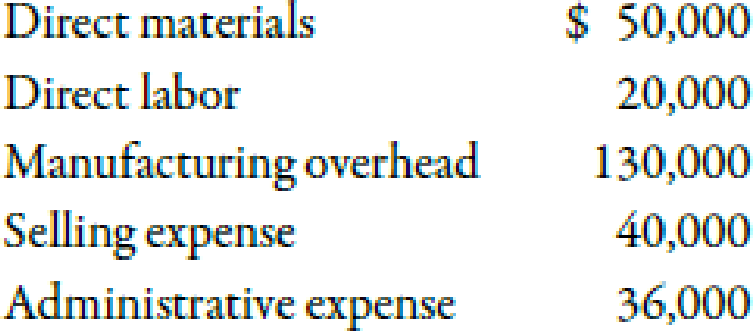

Last year, Barnard Company incurred the following costs:

Barnard produced and sold 10,000 units at a price of $31 each.

2-17 Refer to the information for Barnard Company on the previous page. The total period expense is

- a. $276,000.

- b. $200,000.

- c. $76,000.

- d. $40,000.

- e. $36,000.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Financial Accounting 5.2

Morgan & Co. is currently an all-equity firm with 100,000 shares of stock outstanding at a market price of $30 per share. The company's earnings before interest and taxes are $120,000. Morgan & Co. has decided to add leverage to its financial operations by issuing $750,000 of debt at an 8% interest rate. This $750,000 will be used to repurchase shares of stock. You own 2,500 shares of Morgan & Co. stock. You also loan out funds at an 8% interest rate. How many of your shares of stock in Morgan & Co. must you sell to offset the leverage that the firm is assuming? Assume that you loan out all of the funds you receive from the sale of your stock.

Solve this financial accounting problem

Chapter 2 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 2 - Explain the difference between cost and expense.Ch. 2 - What is the difference between accumulating costs...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - What is a direct cost? An indirect cost? Can the...Ch. 2 - What is allocation?Ch. 2 - What is the difference between a product and a...Ch. 2 - Define manufacturing overhead.Ch. 2 - Explain the difference between direct materials...Ch. 2 - Define prime cost and conversion cost. Why cant...Ch. 2 - How does a period cost differ from a product cost?

Ch. 2 - Define selling cost. Give five examples of selling...Ch. 2 - What is the cost of goods manufactured?Ch. 2 - What is the difference between cost of goods...Ch. 2 - What is the difference between the income...Ch. 2 - Why do firms like to calculate a percentage column...Ch. 2 - Accumulating costs means that a. costs must be...Ch. 2 - Product (or manufacturing) costs consist of a....Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Prob. 4MCQCh. 2 - The accountant in a factory that produces biscuits...Ch. 2 - Which of the following is an indirect cost? a. The...Ch. 2 - Prob. 7MCQCh. 2 - Kelloggs makes a variety of breakfast cereals....Ch. 2 - Prob. 9MCQCh. 2 - Stone Inc. is a company that purchases goods...Ch. 2 - JackMan Company produces die-cast metal bulldozers...Ch. 2 - Prob. 12MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple- Choice...Ch. 2 - Prob. 16MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - 2-18 Use the following information for Multiple-...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Direct Materials Used in Production Slapshot...Ch. 2 - Cost of Goods Manufactured Slapshot Company makes...Ch. 2 - Cost of Goods Sold Slapshot Company makes ice...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Prob. 26BEACh. 2 - Prob. 27BEBCh. 2 - Prob. 28BEBCh. 2 - Direct Materials Used in Production Morning Smiles...Ch. 2 - 2-30 Cost of Goods Manufactured Morning Smiles...Ch. 2 - Cost of Goods Sold Morning Smiles Coffee Company...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercise:...Ch. 2 - Service Organization Income Statement Healing...Ch. 2 - Prob. 35ECh. 2 - Products versus Services, Cost Assignment Holmes...Ch. 2 - Assigning Costs to a Cost Object, Direct and...Ch. 2 - Total and Unit Product Cost Martinez Manufacturing...Ch. 2 - Cost Classification Loring Company incurred the...Ch. 2 - Classifying Cost of Production A factory...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Direct Materials Used Hannah Banana Bakers makes...Ch. 2 - Cost of Goods Sold Allyson Ashley makes jet skis....Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Understanding the Relationship between Cost Flows,...Ch. 2 - Manufacturing, Cost Classification, Product Costs...Ch. 2 - Cost Assignment, Direct Costs Harry Whipple, owner...Ch. 2 - Cost of Direct Materials, Cost of Goods...Ch. 2 - Preparation of Income Statement: Manufacturing...Ch. 2 - Cost of Goods Manufactured, Cost of Goods Sold...Ch. 2 - Cost Identification Following is a list of cost...Ch. 2 - Income Statement, Cost of Services Provided,...Ch. 2 - Cost of Goods Manufactured, Income Statement W. W....Ch. 2 - Cost Definitions Luisa Giovanni is a student at...Ch. 2 - Cost Identification and Analysis, Cost Assignment,...Ch. 2 - Cost Analysis, Income Statement Five to six times...Ch. 2 - Cost Classification, Income Statement Gateway...Ch. 2 - Cost Information and Ethical Behavior, Service...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pam Pet Foods Co. reported net income of $52,000 for the year ended December 31, 2005. January 1 balances in accounts receivable and accounts payable were $30,000 and $28,000, respectively. Year-end balances in these accounts were $27,000 and $31,000, respectively. Assuming that all relevant information has been presented, Pam's cash flows from operating activities would be__.need helparrow_forwardI want to correct answer general accounting questionarrow_forwardFinancial accounting 3arrow_forward

- What is the yield to maturity of this financial accounting question?arrow_forwardThe following information relates to Westline Traders for a trading year. Calculate the overhead expenses as a percentage of the net sales. Details Sales Purchases Sales Returns Purchases Returns Amount $625,000 $410,000 $25,000 $30,000 Opening Stock Value $50,000 Closing Stock Value $55,000 Overhead Expenses $205,000arrow_forwardNeed help with this financial accounting question please answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License