Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 11MCQ

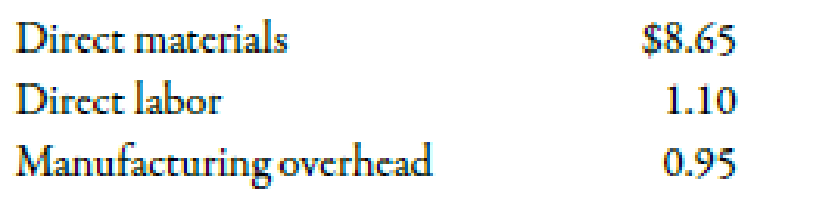

JackMan Company produces die-cast metal bulldozers for toy shops. JackMan estimated the following average costs per bulldozer:

Prime cost per unit is

- a. $8.65.

- b. $1.10.

- c. $0.95.

- d. $2.05.

- e. $9.75.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Davenport Industries is working on its direct labor budget for the next two months. Each unit of output requires 0.48 direct labor hours. The direct labor rate is $9.20 per direct labor hour. The production budget calls for producing 7,200 units in July and 7,800 units in August. If the direct labor workforce is fully adjusted to the total direct labor hours needed each month, what would be the total combined direct labor cost for the two months?

What was the dollar amount of underallocated or overallocated manufacturing overhead?

The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $520,000; Office salaries, $104,000; Federal

income taxes withheld, $156,000; State income taxes withheld, $35,000; Social security taxes withheld, $38,688; Medicare taxes

withheld, $9,048; Medical insurance premiums, $12,500; Life insurance premiums, $9,500; Union dues deducted, $6,500; and Salaries

subject to unemployment taxes, $61,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes

are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%.

1. & 2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll, including

employee deductions, and cash payment of the net payroll (salaries payable) for July.

3. Using the above information, complete the below table.

4. Record the accrued employer payroll taxes and other related employment expenses and the cash payment of all liabilities…

Chapter 2 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 2 - Explain the difference between cost and expense.Ch. 2 - What is the difference between accumulating costs...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - What is a direct cost? An indirect cost? Can the...Ch. 2 - What is allocation?Ch. 2 - What is the difference between a product and a...Ch. 2 - Define manufacturing overhead.Ch. 2 - Explain the difference between direct materials...Ch. 2 - Define prime cost and conversion cost. Why cant...Ch. 2 - How does a period cost differ from a product cost?

Ch. 2 - Define selling cost. Give five examples of selling...Ch. 2 - What is the cost of goods manufactured?Ch. 2 - What is the difference between cost of goods...Ch. 2 - What is the difference between the income...Ch. 2 - Why do firms like to calculate a percentage column...Ch. 2 - Accumulating costs means that a. costs must be...Ch. 2 - Product (or manufacturing) costs consist of a....Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Prob. 4MCQCh. 2 - The accountant in a factory that produces biscuits...Ch. 2 - Which of the following is an indirect cost? a. The...Ch. 2 - Prob. 7MCQCh. 2 - Kelloggs makes a variety of breakfast cereals....Ch. 2 - Prob. 9MCQCh. 2 - Stone Inc. is a company that purchases goods...Ch. 2 - JackMan Company produces die-cast metal bulldozers...Ch. 2 - Prob. 12MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple- Choice...Ch. 2 - Prob. 16MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - 2-18 Use the following information for Multiple-...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Direct Materials Used in Production Slapshot...Ch. 2 - Cost of Goods Manufactured Slapshot Company makes...Ch. 2 - Cost of Goods Sold Slapshot Company makes ice...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Prob. 26BEACh. 2 - Prob. 27BEBCh. 2 - Prob. 28BEBCh. 2 - Direct Materials Used in Production Morning Smiles...Ch. 2 - 2-30 Cost of Goods Manufactured Morning Smiles...Ch. 2 - Cost of Goods Sold Morning Smiles Coffee Company...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercise:...Ch. 2 - Service Organization Income Statement Healing...Ch. 2 - Prob. 35ECh. 2 - Products versus Services, Cost Assignment Holmes...Ch. 2 - Assigning Costs to a Cost Object, Direct and...Ch. 2 - Total and Unit Product Cost Martinez Manufacturing...Ch. 2 - Cost Classification Loring Company incurred the...Ch. 2 - Classifying Cost of Production A factory...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Direct Materials Used Hannah Banana Bakers makes...Ch. 2 - Cost of Goods Sold Allyson Ashley makes jet skis....Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Understanding the Relationship between Cost Flows,...Ch. 2 - Manufacturing, Cost Classification, Product Costs...Ch. 2 - Cost Assignment, Direct Costs Harry Whipple, owner...Ch. 2 - Cost of Direct Materials, Cost of Goods...Ch. 2 - Preparation of Income Statement: Manufacturing...Ch. 2 - Cost of Goods Manufactured, Cost of Goods Sold...Ch. 2 - Cost Identification Following is a list of cost...Ch. 2 - Income Statement, Cost of Services Provided,...Ch. 2 - Cost of Goods Manufactured, Income Statement W. W....Ch. 2 - Cost Definitions Luisa Giovanni is a student at...Ch. 2 - Cost Identification and Analysis, Cost Assignment,...Ch. 2 - Cost Analysis, Income Statement Five to six times...Ch. 2 - Cost Classification, Income Statement Gateway...Ch. 2 - Cost Information and Ethical Behavior, Service...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of the year, Vanguard Systems, Inc. determined that estimated overhead costs would be $720,000, while actual overhead costs for the year totaled $770,000. Furthermore, it was determined that the estimated allocation basis would be 75,000 direct labor hours, while direct laborers actually worked 78,000 hours. What was the dollar amount of underallocated or overallocated manufacturing overhead?arrow_forwardWhat are impaired assets and its pros and cons?arrow_forwardMing Chen started a business and had the following transactions in June. a. Owner invested $60,000 cash in the company along with $15,000 of equipment. b. The company paid $2,000 cash for rent of office space for the month. c. The company purchased $18,000 of additional equipment on credit (payment due within 30 days). d. The company completed work for a client and immediately collected $1,600 cash. e. The company completed work for a client and sent a bill for $7,300 to be received within 30 days. f. The company purchased additional equipment for $5,000 cash. g. The company paid an assistant $2,400 cash as wages for the month. h. The company collected $4,500 cash as a partial payment for the amount owed by the client in transaction e. i. The company paid $18,000 cash to settle the liability created in transaction c. j. The owner withdrew $1,500 cash from the company for personal use.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License