College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 1PB

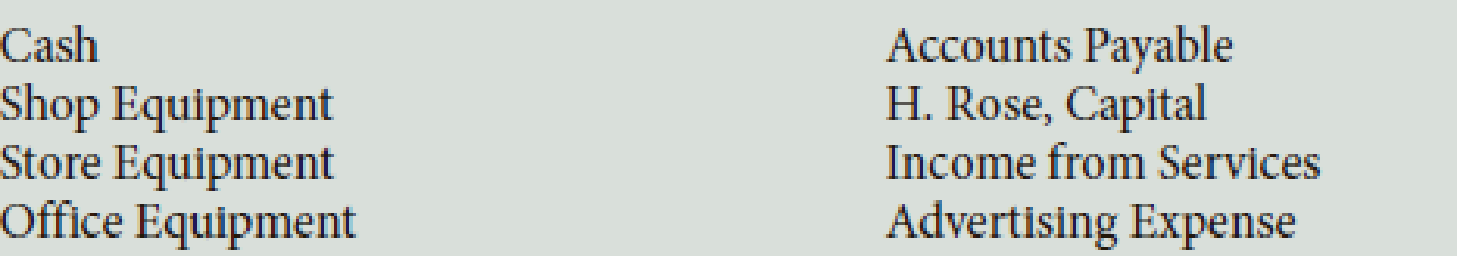

During February of this year, H. Rose established Rose Shoe Hospital. The following asset, liability, and owner’s equity accounts are included in the chart of accounts:

The following transactions occurred during the month of February:

- a. Rose deposited $25,000 cash in a bank account in the name of the business.

- b. Bought shop equipment for cash, $1,525, Ck. No. 1000.

- c. Bought advertising on account from Milland Company, $325.

- d. Bought store shelving on account from Inger Hardware, $750.

- e. Bought office equipment from Shara’s Office Supply, $625, paying $225 in cash and placing the balance on account, Ck. No. 1001.

- f. Paid on account to Inger Hardware, $750, Ck. No. 1002.

- g. Rose invested his personal leather working tools with a fair market value of $800 in the business

- h. Sold services for the month of February for cash, $250.

PART 1: The Accounting Cycle for a Service Business: Analyzing Business Transactions

Required

- 1. Write the account classifications (Assets, Liabilities, Capital, Drawing, Revenue, Expense) in the fundamental

accounting equation , as well as the plus and minus signs and Debit and Credit. - 2. Write the account names on the T accounts under the classifications, place the plus and minus signs for each T account, and label the debit and credit sides of the T accounts.

- 3. Record the amounts in the proper positions in the T accounts. Write the letter next to each entry to identify the transaction.

- 4. Foot and balance the accounts.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For Eckstein Company, the predetermined overhead rate is 118% of direct labor cost. During the month, Eckstein incurred $119,000 in factory labor costs, of which $98,200 is direct labor and $26,400 is indirect labor. The actual overhead incurred was $132,600. Compute the amount of manufacturing overhead applied during the month. Determine the amount of under- or overapplied manufacturing overhead.??

Provide answer with calculation

Hello tutor please provide correct answer general accounting

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - On a sheet of paper, draw the fundamental...Ch. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - A fellow accounting student has difficulty...Ch. 2 - What Would You Do? A new bookkeeper cant find the...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

To what does the lifetime value of the customer refer, and how is it calculated?

MARKETING:REAL PEOPLE,REAL CHOICES

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

What is precedent, and how does it affect common law?

Business in Action

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY