College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 4PA

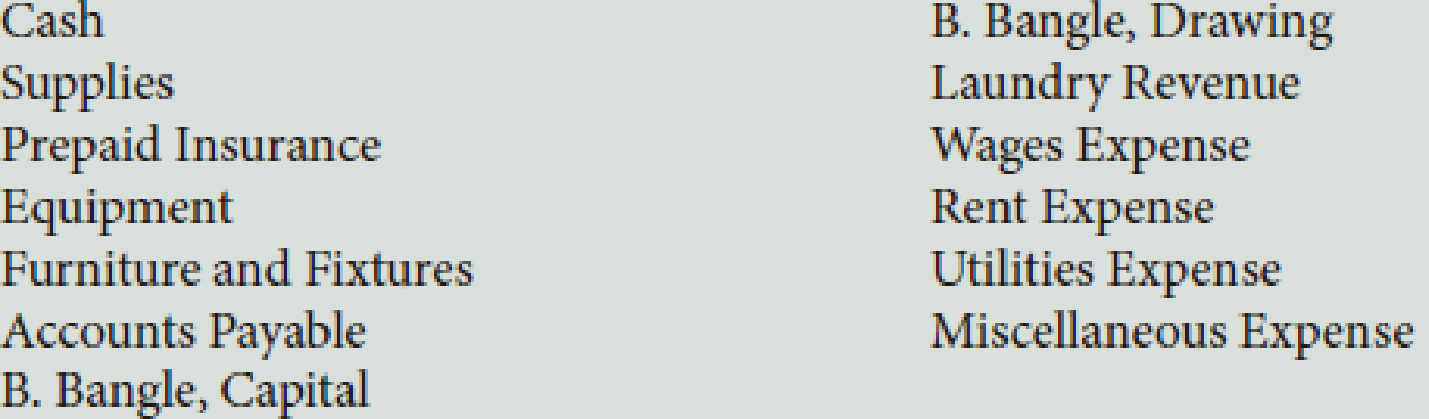

On May 1, B. Bangle opened Self-Wash Laundry. His accountant listed the following chart of accounts:

The following transactions were completed during May:

- a. Bangle deposited $35,000 in a bank account in the name of the business.

- b. Bought chairs and tables, paying cash, $1,870, Ck. No. 1000.

- c. Bought supplies on account from Barnes Supply Company, $225.

- d. Paid the rent for the current month, $875, Ck. No. 1001.

- e. Bought washing machines and dryers from Lara Equipment Company, $12,500, paying $3,600 in cash and placing the balance on account, Ck. No. 1002.

- f. Sold services for cash for the first half of the month, $1,925.

- g. Bought insurance for one year, $1,560, Ck. No. 1003.

- h. Paid on account to Lara Equipment Company, $1,800, Ck. No. 1004.

- i. Received and paid electric bill, $285, Ck. No. 1005.

- j. Sold services for cash for the second half of the month, $1,835.

- k. Paid wages to an employee, $940, Ck. No. 1006.

- l. Bangle withdrew cash for his personal use, $800, Ck. No. 1007.

- m. Paid on account to Barnes Supply Company, $225, Ck. No. 1008.

- n. Received and paid bill from the county for sidewalk repair assessment, $280, Ck. No. 1009.

Required

- 1. Record the owner’s name in the Capital and Drawing T accounts.

- 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts.

- 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction.

- 4. Foot the T accounts and show the balances.

- 5. Prepare a

trial balance as of May 31, 20--. - 6. Prepare an income statement for May 31, 20--.

- 7. Prepare a statement of owner’s equity for May 31, 20--.

- 8. Prepare a

balance sheet as of May 31, 20--.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

provide correct answer

subject-general accounting

ayco Inc. started its operations in 2022. Its sales during 2022, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2022, its fiscal year-end, and determined the account balance to be $14,000.

The unadjusted balances of selected accounts at December 31, 2023 are as follows:

Accounts receivable

$

300,000

Allowance for doubtful accounts (debit)

10,000

Sales revenue (including 80 percent in sales on account)

800,000

Aging of the accounts receivable on December 31, 2023, resulted in an estimate of $11,000 in potentially uncollectible accounts.

Required:

1. Prepare the journal entries to record all the transactions during 2022 and post them to appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)…

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - On a sheet of paper, draw the fundamental...Ch. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - A fellow accounting student has difficulty...Ch. 2 - What Would You Do? A new bookkeeper cant find the...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Which of the following is a primary activity in the value chain?

purchasing

accounting

post-sales service

human...

Accounting Information Systems (14th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

11-9. Identify a company with a product that interests you. Consider ways the company could use customer relati...

Business Essentials (12th Edition) (What's New in Intro to Business)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the sample size based on the specifications in Buhi's contract. Make sure it is within budget, reasonable to obtain, and that you use appropriate inputs relative to market research best practices. Use the calculator to adjust the sample size statement. Use the agreed-upon sample size in Buhi's contract: 996. In your secondary research, find the target population size (an estimate of those in the United States looking to purchase luggage in the category in the next two years). You will use this target population size for each sample size estimate. Adjust the provided sample size calculator inputs to find the rest of the figures that get you to the agreed-upon sample size. The caveats from Buhi are that you must: Use the market research standard for your confidence level. Use a confidence interval that is better than the market research standard for your confidence interval.arrow_forwardThe partnership of Keenan and Kludlow paid the following wages during this year: Line Item Description Amount M. Keenan (partner) $108,000 S. Kludlow (partner) 96,000 N. Perry (supervisor) 54,700 T. Lee (factory worker) 35,100 R. Rolf (factory worker) 27,200 D. Broch (factory worker) 6,300 S. Ruiz (bookkeeper) 26,000 C. Rudolph (maintenance) 5,200 In addition, the partnership owed $250 to Rudolph for work he performed during December. However, payment for this work will not be made until January of the following year. The state unemployment tax rate for the company is 2.95% on the first $9,000 of each employee's earnings. Compute the following: ound your answers to the nearest cent. a. Net FUTA tax for the partnership for this year b. SUTA tax for this yeararrow_forwardGiven answer financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY