Concept explainers

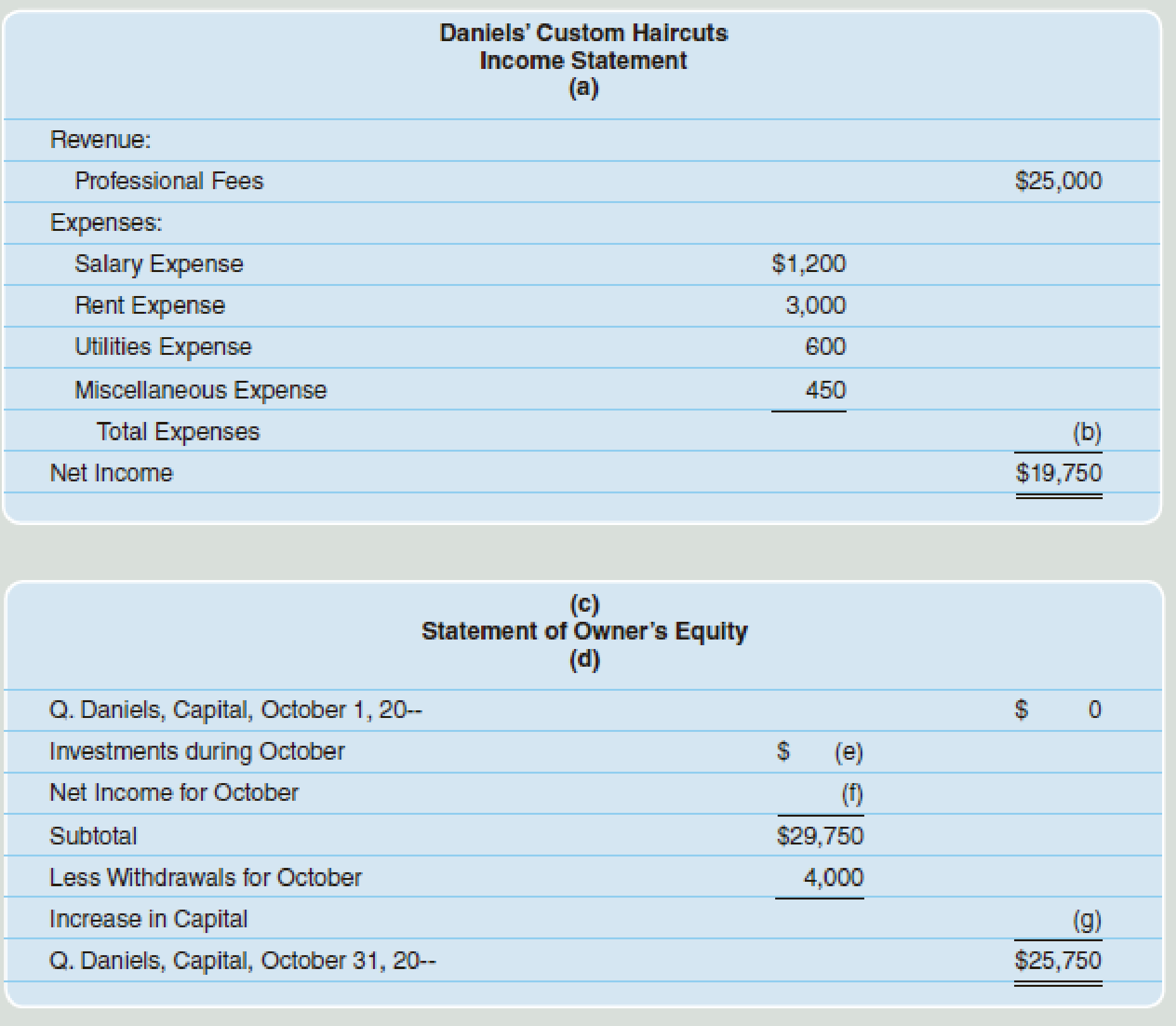

The financial statements for Daniels’ Custom Haircuts for the month of October follow.

Required

Solve for the missing information.

Solve the missing information.

Answer to Problem 5PA

(a) For the year ended October 31

(b) 5,250.

(c) Company D.

(d) For the year ended October 31.

(e) 10,000.

(f) 19,750.

(g) 25,750.

(h) For the year ended October 31.

(i) 36,400.

(j) 25,750.

(k)36,400.

Explanation of Solution

Financial statement:

Financial statements are condensed summary of transactions communicated in the form of reports for the purpose of decision making. The financial statements reports, and shows the financial status of the business. The financial statements consist of the balance sheet, income statement, statement of retained earnings, and the cash flow statement.

Missing information (a):

In this case, information regarding “Period of time” (For the year ended October 31) is missing in the income statement.

| Company D |

| Income Statement |

| (a) For the year ended October 31 |

Table (1)

Missing information (b):

The amount of total expense is missing in the income statement and it is calculated by adding all expenses:

| Company D | ||

| Income Statement | ||

| (a) For the year ended October 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Professional Fees | 25,000 | |

| Expenses: | ||

| Salary Expense | 1,200 | |

| Rent Expense | 3,000 | |

| Utilities Expense | 600 | |

| Miscellaneous Expense | 450 | |

| Total Expenses | (b)5,250 | |

| Net income | 19,750 | |

Table (2)

Therefore, the amount of total expenses is (b) 5,250.

Missing information (c):

In this case, “Name of the Company “(Company D) is missing in the statement of owners’ equity.

| (c) Company D |

| Statement of Owners' equity |

| (d) For the year ended October 31 |

Table (3)

Missing information (d):

In this case, information regarding “Period of time” (For the year ended October 31) is missing in the statement of owners’ equity.

| (c) Company D |

| Statement of Owners' equity |

| (d) For the year ended October 31 |

Table (4)

Missing information (e):

In this case, the amount of investments made during the month of October is missing and it is calculated as follows:

| (c) Company D | ||

| Statement of Owners' equity | ||

| (d) For the year ended October 31 | ||

| Particulars | Amount($) | Amount($) |

| Person Capital, October 1 | ||

| Investments during October (1) | (e) 10,000 | |

| Net income for October | (f) 19,750 | |

| Subtotal | 29,750 | |

Table (5)

Therefore, the amount of investments during October is (e) $10,000.

Working note:

(1) Calculate the amount of investment made during October:

Missing information (f):

In this case, the net income mentioned in the income statement is recorded in the statement of owners’ equity. Therefore, amount of net income is $19,750.

| (c) Company D | ||

| Statement of Owners' equity | ||

| (d) For the year ended October 31 | ||

| Particulars | Amount($) | Amount($) |

| Person Capital, October 1 | ||

| Investments during October (1) | (e) 10,000 | |

| Net income for October | (f) 19,750 | |

| Subtotal | 29,750 | |

Table (6)

Note:

The net income or net loss computed in the income statement is reported in the statement of owners’ equity for ascertaining the amount of ending capital balance. Then, the balance of ending capital is reported in the balance sheet (owners’ equity section). Therefore, any transaction affecting the income statement eventually, affects the balance sheet through the balance of owners’ equity.

Missing information (g):

In this case, the amount of increase in capital is (g) $25,750 and it is same as the Ending capital of Person Q as on October 31, since the amount of beginning capital is given as zero. Suppose, If the amount of beginning capital is given, then the increase in capital is computed by deducting the ending capital from the beginning capital.

| (c ) Company D | ||

| Statement of Owners' equity | ||

| (d) For the year ended October 31 | ||

| Particulars | Amount($) | Amount($) |

| Person Capital, October 1 | ||

| Investments during October | (e) 10,000 | |

| Net income for October | (f) 19,750 | |

| Subtotal | 29,750 | |

| Less: Withdrawals for October | 4,000 | |

| Increase in capital | (g)25,750 | |

| Person Q, Capital, October 31 | 25,750 | |

Table (7)

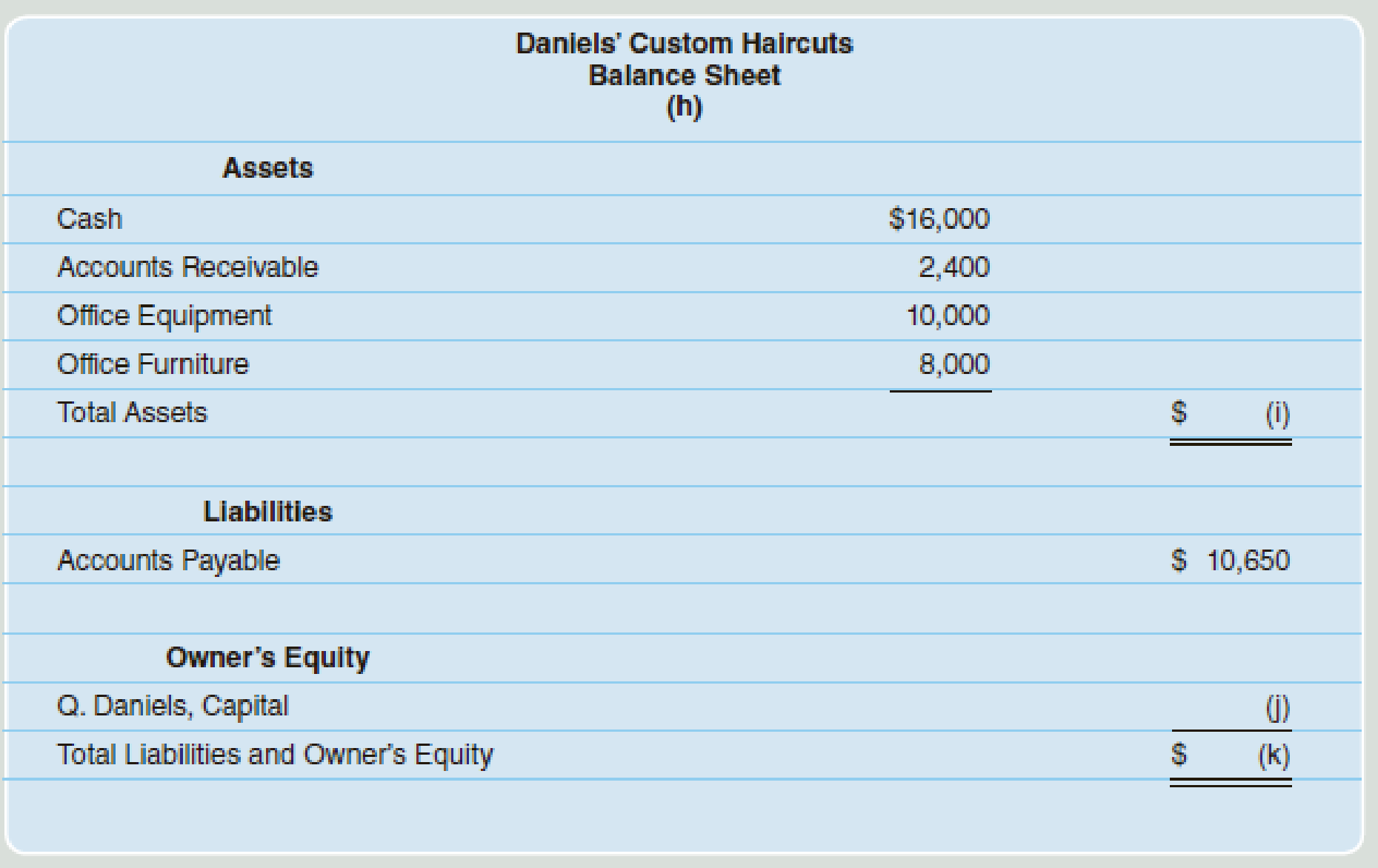

Missing information (h):

In this case, information regarding “Period of time” (For the year ended October 31) is missing in the balance sheet.

| Company D |

| Balance Sheet |

| (h) For the year ended October 31 |

Table (8)

Missing information (i):

In this case, the amount of total assets is missing and it is calculated as follows;

| Company D | ||

| Balance Sheet | ||

| (h) For the year ended October 31 | ||

| Assets | Amount ($) | Amount ($) |

| Cash | 16,000 | |

| Accounts receivable | 2,400 | |

| office Equipment | 10,000 | |

| Office Furniture | 8,000 | |

| Total Assets | (i) 36,400 | |

Table (9)

Therefore, the amount of total assets is (i) 36,400.

Missing information (j):

In this case, the amount of Person Q, Capital is (j) $25,750 and it is the same as the amount of ending capital of Person Q that is calculated in the statement of owners’ equity.

| Company D | ||

| Balance Sheet | ||

| (h) For the year ended October 31 | ||

| Assets | Amount ($) | Amount ($) |

| Cash | 16,000 | |

| Accounts receivable | 2,400 | |

| office Equipment | 10,000 | |

| Office Furniture | 8,000 | |

| Total Assets | (i) 36,400 | |

| Liabilities | ||

| Accounts Payable | 10,650 | |

| Owners' Equity | ||

| Person Q, Capital | (j) 25,750 | |

Table (10)

Note:

The net income or net loss computed in the income statement is reported in the statement of owners’ equity for ascertaining the amount of ending capital balance. Then, the balance of ending capital is reported in the balance sheet (owners’ equity section). Therefore, any transaction affecting the income statement eventually, affects the balance sheet through the balance of owners’ equity.

Missing information (k):

In this case, the amount of total liabilities and owners’ equity is same as the amount of total assets ($36,400) and it is calculated as follows:

| Company D | ||

| Balance Sheet | ||

| (h) For the year ended October 31 | ||

| Assets | Amount ($) | Amount ($) |

| Cash | 16,000 | |

| Accounts receivable | 2,400 | |

| office Equipment | 10,000 | |

| Office Furniture | 8,000 | |

| Total Assets | (i) 36,400 | |

| Liabilities | ||

| Accounts Payable | 10,650 | |

| Owners' Equity | ||

| Person Q, Capital | (j) 25,750 | |

| Total liabilities and owners’ equity (2) | (k)36,400 | |

Table (11)

Therefore, the total amount of liabilities and owners’ equity is (k) $36,400.

Working note:

(2) Calculate the amount of total liabilities and owners’ equity:

Want to see more full solutions like this?

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Marketing: An Introduction (13th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- Company B had an estimated 230,000 direct labor hours, $486,000 manufacturing overhead, and 27,000 machine hours. The actual were 220,700 direct labor hours, 38,600 machine hours, and $505,000 manufacturing overhead. They determine overhead based upon machine hours. Calculate the predetermined overhead rate.arrow_forwardWhat is the value of ending long term debt? Answer pleasearrow_forwardcan you please solve thisarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning