Concept explainers

Determine the balance of the following T account:

- a. 94,100 debit

- b. 54,900 debit

- c. 133,300 credit

- d. 54,900 credit

- e. 133,300 debit

State the option that is the balance of the T-account.

Answer to Problem 1QY

b. 54,900 debit.

Explanation of Solution

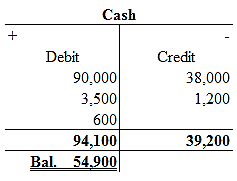

T-account:

Trial balance is the summary of accounts, and their debit and credit balances at a given time. It is usually prepared at end of the accounting period. Debit balances are listed in left column and credit balances are listed in right column. The totals of debit and credit column should be equal. Trial balance is useful in the preparation of the financial statements.

Justification for the incorrect options of a, c, d and e:

94,100 debit, 133,300 credit, 54,900 credit and 133,300 debit are not the balance of the T-account. Therefore, these are incorrect options.

Justification for the correct option b:

Balance in T-accounts:

Each side (debit and credit) is added separately and the totals (footings) are recorded. Now, find out the difference between large footing and small footing and then place the balance on the large footing side.

Balance of T-account is calculated as follows:

Therefore, according to the above explanation, option b. 54,900 debit is the correct answer and the other options of a, c, d and e are incorrect.

Want to see more full solutions like this?

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Foundations Of Finance

Essentials of MIS (13th Edition)

Business in Action

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Intermediate Accounting (2nd Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- Damerly Company (a Utah employer) wants to give a holiday bonus check of $375 to each employee. As it wants the check amount to be $375, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. Besides being subject to social security taxes and federal income tax (supplemental rate), a 4.95% Utah income tax must be withheld on supplemental payments.arrow_forwardPlease given correct answer general Accountingarrow_forwardHii ticher please given correct answer general Accountingarrow_forward

- On a particular date, FedEx has a stock price of $89.27 and an EPS of $7.11. Its competitor, UPS, had an EPS of $0.38. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? A) $4.77 B) $7.16 C) $9.54 D) $10.50arrow_forwardHow much will you accumulated after 35 year? General accountingarrow_forwardGiven correct answer general Accountingarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,