Cengagenowv2, 1 Term Printed Access Card For Mowen/hansen/heitger?s Managerial Accounting: The Cornerstone Of Business Decision-making, 7th

7th Edition

ISBN: 9781337115926

Author: MOWEN, Maryanne M.; Hansen, Don R.; Heitger, Dan L.

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 13MCQ

Use the following information for Multiple-Choice Questions 2-13 through 2-18:

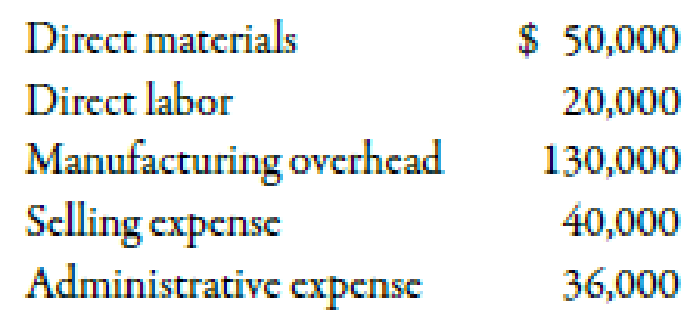

Last year, Barnard Company incurred the following costs:

Barnard produced and sold 10,000 units at a price of $31 each.

2-13 Refer to the information for Barnard Company above. Prime cost per unit is

- a. $7.00.

- b. $20.00.

- c. $15.00.

- d. $5.00.

- e. $27.60.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Robin Inc. provides the following manufacturing costs for the Third quarter of the year in the table below.

Manufacturing Costs for the Third Quarter

Months

Production in Units

Total Costs

July

3,800

$59,550

August

4,200

$62,450

September

5,500

$71,875

Using the high-low method, determine the variable costs per unit.

(Round intermediate calculations and your final answer to two decimal places.)

Group of answer choices

$14.37

$13.07

$7.25

$15.67

LUZEHO438 Corporation produces and sells a single product. The information about their operation for the last month is given below.

Price per unit $240.00

(ID#81414)

Contribution margin ratio 50%

LUZEHO438's Fixed expenses $72,000

LUZEHO438's Operating leverage 2

(Baruch College Exam)

Q. How many units did LUZEHO438 sell during the last month?

A

units

During the month of August, Amer Corporation produced 12,000 units and sold

them for P20 per unit. Total fixed cost for the period were P 154,000, and the

operating profit was P 26,000.

9. Based on the foregoing information, the variable cost per unit is

a. P 4.50

b. P 5.00

с. Р 6.00

d. P 7.17

Data to be used in applying the high-low method shows the highest cost of P69,000

and the lowest cost of P52,000. The data show P148,000 as the highest level of

sales and P97,000 as the lowest level.

10. What is the variable cost per peso sales?

c. P 0.54

d. P 3.00

a. P 0.33

h. P 0.47

Chapter 2 Solutions

Cengagenowv2, 1 Term Printed Access Card For Mowen/hansen/heitger?s Managerial Accounting: The Cornerstone Of Business Decision-making, 7th

Ch. 2 - Explain the difference between cost and expense.Ch. 2 - What is the difference between accumulating costs...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - What is a direct cost? An indirect cost? Can the...Ch. 2 - What is allocation?Ch. 2 - What is the difference between a product and a...Ch. 2 - Define manufacturing overhead.Ch. 2 - Explain the difference between direct materials...Ch. 2 - Define prime cost and conversion cost. Why cant...Ch. 2 - How does a period cost differ from a product cost?

Ch. 2 - Define selling cost. Give five examples of selling...Ch. 2 - What is the cost of goods manufactured?Ch. 2 - What is the difference between cost of goods...Ch. 2 - What is the difference between the income...Ch. 2 - Why do firms like to calculate a percentage column...Ch. 2 - Accumulating costs means that a. costs must be...Ch. 2 - Product (or manufacturing) costs consist of a....Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Prob. 4MCQCh. 2 - The accountant in a factory that produces biscuits...Ch. 2 - Which of the following is an indirect cost? a. The...Ch. 2 - Prob. 7MCQCh. 2 - Kelloggs makes a variety of breakfast cereals....Ch. 2 - Prob. 9MCQCh. 2 - Stone Inc. is a company that purchases goods...Ch. 2 - JackMan Company produces die-cast metal bulldozers...Ch. 2 - Prob. 12MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple- Choice...Ch. 2 - Prob. 16MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - 2-18 Use the following information for Multiple-...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Direct Materials Used in Production Slapshot...Ch. 2 - Cost of Goods Manufactured Slapshot Company makes...Ch. 2 - Cost of Goods Sold Slapshot Company makes ice...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Prob. 26BEACh. 2 - Prob. 27BEBCh. 2 - Prob. 28BEBCh. 2 - Direct Materials Used in Production Morning Smiles...Ch. 2 - 2-30 Cost of Goods Manufactured Morning Smiles...Ch. 2 - Cost of Goods Sold Morning Smiles Coffee Company...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercise:...Ch. 2 - Service Organization Income Statement Healing...Ch. 2 - Prob. 35ECh. 2 - Products versus Services, Cost Assignment Holmes...Ch. 2 - Assigning Costs to a Cost Object, Direct and...Ch. 2 - Total and Unit Product Cost Martinez Manufacturing...Ch. 2 - Cost Classification Loring Company incurred the...Ch. 2 - Classifying Cost of Production A factory...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Direct Materials Used Hannah Banana Bakers makes...Ch. 2 - Cost of Goods Sold Allyson Ashley makes jet skis....Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Understanding the Relationship between Cost Flows,...Ch. 2 - Manufacturing, Cost Classification, Product Costs...Ch. 2 - Cost Assignment, Direct Costs Harry Whipple, owner...Ch. 2 - Cost of Direct Materials, Cost of Goods...Ch. 2 - Preparation of Income Statement: Manufacturing...Ch. 2 - Cost of Goods Manufactured, Cost of Goods Sold...Ch. 2 - Cost Identification Following is a list of cost...Ch. 2 - Income Statement, Cost of Services Provided,...Ch. 2 - Cost of Goods Manufactured, Income Statement W. W....Ch. 2 - Cost Definitions Luisa Giovanni is a student at...Ch. 2 - Cost Identification and Analysis, Cost Assignment,...Ch. 2 - Cost Analysis, Income Statement Five to six times...Ch. 2 - Cost Classification, Income Statement Gateway...Ch. 2 - Cost Information and Ethical Behavior, Service...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information for Multiple-Choice Questions 2-13 through 2-18: Last year, Barnard Company incurred the following costs: Barnard produced and sold 10,000 units at a price of 31 each. 2-17 Refer to the information for Barnard Company on the previous page. The total period expense is a. 276,000. b. 200,000. c. 76,000. d. 40,000. e. 36,000.arrow_forwardUse the following information for Multiple- Choice Questions 2-13 through 2-18: Last year, Barnard Company incurred the following costs: Barnard produced and sold 10,000 units at a price of 31 each. 2-15 Refer to the information for Barnard Company on the previous page. The cost of goods sold per unit is a. 7.00. b. 20.00. c. 15.00. d. 5.00. e. 27.60.arrow_forwardUse the following information for Multiple-Choice Questions 2-13 through 2-18: Last year, Barnard Company incurred the following costs: Barnard produced and sold 10,000 units at a price of 31 each. 2-14Refer to the information for Barnard Company above. Conversion cost per unit is a. 7.00. b. 20.00. c. 15.00. d. 5.00. e. 27.60.arrow_forward

- Use the following information for Multiple-Choice Questions 2-3 and 2-4: Wachman Company produces a product with the following per-unit costs: Last year, Wachman produced and sold 2,000 units at a price of 75 each. Total selling and administrative expense was 30,000. 2-3Refer to the information for Wachman Company on the previous page. Conversion cost per unit was a. 21. b. 25. c. 34. d. 40. e. None of these.arrow_forwardQuestions 7 & 8. A company produces a product w/ a per-unit costs: DM $15; DL $6; MOH $19 Last year, they produced & sold 2,000 units @ $75 each. Total SG&A expense was $30,000. Question 7. Conversion cost per unit was: A. $21 B. $25 C. $34 D. $40 Question 8. Total gross margin for last year was: A. $40,000 B. $70,000 C. $80,000 D. $88,000 E. $100,000arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- Please help me with show all calculation thankuarrow_forwardJohnson Company manufactures and sells a single product. The company's sales and expenses for last year follow: E(Click the icon to view the information.) X Data Table Read the requirements Requirement 1. Fill in the missing numbers in the table. Use the following questions to help fill in the missing numbers in the table: Total Per Unit % a. What is the total contribution margin? $ 81,250 $ Sales 25 ? The total contribution margin is $ ? Variable expenses Contribution.margin. 13,000 Fixed expenses $ 19,500 Operating income Done Printarrow_forwardCost Classification Loring Company incurred the following costs last year: Required: 1. Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, 216,000. 2. What was the total product cost for last year? 3. What was the total period cost for last year? 4. If 30,000 units were produced last year, what was the unit product cost?arrow_forward

- Starling Co. manufactures one product with a selling price of 18 and variable cost of 12. Starlings total annual fixed costs are 38,400. If operating income last year was 28,800, what was the number of units Starling sold? a. 4,800 b. 6,400 c. 5,600 d. 11,200arrow_forward2-18 Use the following information for Multiple- Choice Questions 2-13 through 2-18: Last year, Barnard Company incurred the following costs: Barnard produced and sold 10,000 units at a price of 31 each. Refer to the information for Barnard Company on the previous page. Operating income is a. 34,000. b. 110,000. c. 234,000. d. 270,000. e. 74,000.arrow_forwardUsing the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Relevant Costing Explained; Author: Kaplan UK;https://www.youtube.com/watch?v=hnsh3hlJAkI;License: Standard Youtube License