Concept explainers

Cost Classification, Income Statement

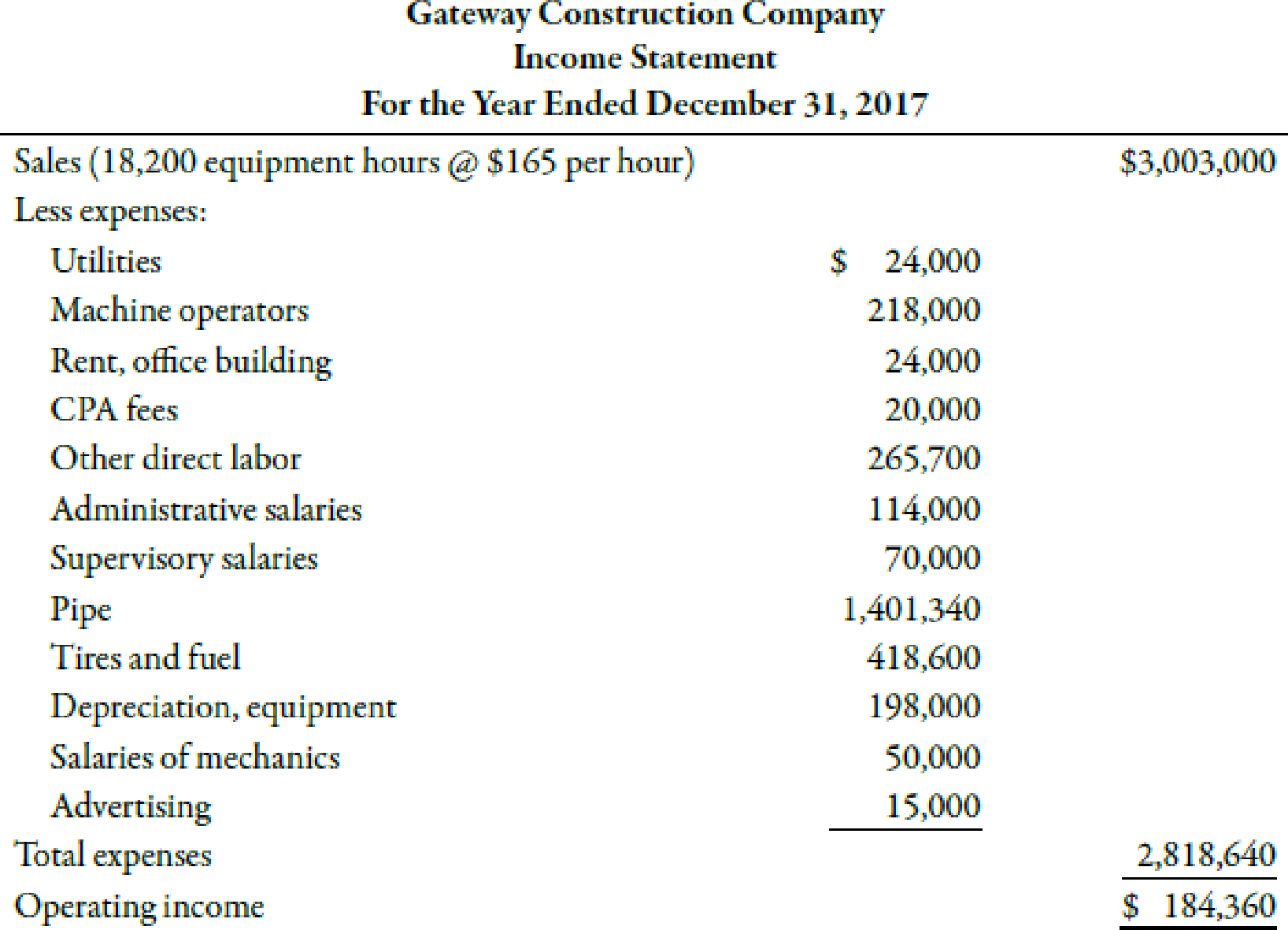

Gateway Construction Company, run by Jack Gateway, employs 25 to 30 people as subcontractors for laying gas, water, and sewage pipelines. Most of Gateway’s work comes from contracts with city and state agencies in Nebraska. The company’s sales volume averages $3 million, and profits vary between 0 and 10% of sales.

Sales and profits have been somewhat below average for the past 3 years due to a recession and intense competition. Because of this competition, Jack constantly reviews the prices that other companies bid for jobs. When a bid is lost, he analyzes the reasons for the differences between his bid and that of his competitors and uses this information to increase the competitiveness of future bids.

Jack believes that Gateway’s current accounting system is deficient. Currently, all expenses are simply deducted from revenues to arrive at operating income. No effort is made to distinguish among the costs of laying pipe, obtaining contracts, and administering the company. Yet all bids are based on the costs of laying pipe.

With these thoughts in mind, Jack looked more carefully at the income statement for the previous year (see below). First, he noted that jobs were priced on the basis of equipment hours, with an average price of $165 per equipment hour. However, when it came to classifying and assigning costs, he needed some help. One thing that really puzzled him was how to classify his own $114,000 salary. About half of his time was spent in bidding and securing contracts, and the other half was spent in general administrative matters.

Required:

- 1. Classify the costs in the income statement as (1) costs of laying pipe (production costs), (2) costs of securing contracts (selling costs), or (3) costs of general administration. For production costs, identify direct materials, direct labor, and

overhead costs. The company never has significant work in process (most jobs are started and completed within a day). - 2. Assume that a significant driver is equipment hours. Identify the expenses that would likely be traced to jobs using this driver. Explain why you feel these costs are traceable using equipment hours. What is the cost per equipment hour for these traceable costs?

Trending nowThis is a popular solution!

Chapter 2 Solutions

Cengagenowv2, 1 Term Printed Access Card For Mowen/hansen/heitger?s Managerial Accounting: The Cornerstone Of Business Decision-making, 7th

- please help mearrow_forwardFrieden Company's contribution format income statement for the most recent month is given below: Sales (41,000 units) Variable expenses Contribution margin Fixed expenses Net operating income. $ 820,000 574,000 246,000 196,800 $ 49,200 The industry in which Frieden Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is studying ways of improving profits. Required: 1. New equipment has come on the market that would allow Frieden Company to automate a pation of its operations. Variable expenses would be reduced by $6.00 per unit. However, fixed expenses would increase to a total of $442,800 each month. Prepare two contribution format income statements: one showing present operations, and one showing how operations would appear if the new equipment were purchased. (Input all amounts as positive values except losses which…arrow_forward! Required information The Personnel Department at Hernandez Bros. is centralized and provides services to the two operating units: Miami and New York. The Miami unit is the original unit of the company and is well established. The New York unit is new, much like a start-up company. The costs of the Personnel Department are allocated to each unit based on the number of employees in order to determine unit profitability. The current rate is $560 per employee. Data for the fiscal year just ended show the following. Number of employees Number of new hires Number of employees departing Allocation based on Employees Transitions Orlando, the manager of the New York unit, is unhappy with the results of the controller's study. He asks the controller to develop separate rates for fixed and variable costs in the Personnel Department. The controller reports back to Orlando that the rates would be as follows: Miami 1,260 16 14 Miami New York Variable Rate $ 80 per employee $2,060 per transition…arrow_forward

- ! Required information The Personnel Department at Hernandez Bros. is centralized and provides services to the two operating units: Miami and New York. The Miami unit is the original unit of the company and is well established. The New York unit is new, much like a start-up company. The costs of the Personnel Department are allocated to each unit based on the number of employees in order to determine unit profitability. The current rate is $560 per employee. Data for the fiscal year just ended show the following. Number of employees Number of new hires Number of employees departing Miami New York 1,260 16 14 360 26 24 Required: a. Compute the cost allocated to each unit using the current allocation system. b. Livan, the manager of the Miami unit, is unhappy with the allocation from Personnel. He believes that he gets little benefit other than the occasional hire and termination help. He asks the controller's office to estimate the amount of Personnel Department cost associated with…arrow_forwardSports-Reps, Inc., represents professional athletes and movie and television stars. The agency had revenue of 12,345,000 last year, with total variable costs of 5,678,700 and fixed costs of 2,192,400. Required: 1. What is the contribution margin ratio for Sports-Reps based on last years data? What is the break-even point in sales revenue? 2. What was the margin of safety for Sports-Reps last year? 3. One of Sports-Repss agents proposed that the firm begin cultivating high school sports stars around the nation. This proposal is expected to increase revenue by 230,000 per year, with increased fixed costs of 122,500. Is this proposal a good idea? Explain.arrow_forwardRoper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)arrow_forward

- Finny Inc's contribution format income statement for the most recent month is given below: Sales (58,000 units) Variable expenses Contribution margin Fixed expenses Net operating income $1,160,000 812,000 348,000 278,400 69,600 $ The industry in which Finny Inc. operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is studying ways of improving profits. Required: 1. New equipment has come on the market that would allow Finny Inc. to automate a portion of its operations. Variable expenses would be reduced by $6 per unit. However, fixed expenses would increase to a total of $626,400 each month. Prepare two contribution format income statements: one showing present operations, and one showing how operations would appear if the new equipment were purchased. Amount Present Per Unit Percentage % CAR % % Amount Proposed Per Unit…arrow_forwardLeander Office Products Inc. produces and sells small storage and organizational products for office use. During the first month of operations, the products sold well. Andrea Leander, the owner of the company, was surprised to see a loss for the month on her income statement. This statement was prepared by a local bookkeeping service recommended to her by her bank manager. The statement follows: LEANDER OFFICE PRODUCTS INC. Income Statement Sales (43,000 units) Variable expenses: Variable cost of goods sold✶ Variable selling and administrative expenses Contribution margin Fixed expenses: Fixed manufacturing overhead Fixed selling and administrative expenses Operating loss $253,700 $116,530 49,880 166,410 87,290 89,586 17,200 106,786 $(19,496) *Consists of direct materials, direct labour, and variable manufacturing overhead. Leander is discouraged over the loss shown for the month, particularly since she had planned to use the statement to encourage investors to purchase shares in the…arrow_forwardLeander Office Products Inc. produces and sells small storage and organizational products for office use. During the first month of operations, the products sold well. Andrea Leander, the owner of the company, was surprised to see a loss for the month on her income statement. This statement was prepared by a local bookkeeping service recommended to her by her bank manager. The statement follows: LEANDER OFFICE PRODUCTS INC. Income Statement Sales (43,000 units) Variable expenses: Variable cost of goods sold*< Variable selling and administrative expenses Contribution margin Fixed expenses: Fixed manufacturing overhead Fixed selling and administrative expenses Operating loss $253,700 $116,530 49,880 166,410 87,290 89,586 17,200 106,786 $(19,496) *Consists of direct materials, direct labour, and variable manufacturing overhead. Leander is discouraged over the loss shown for the month, particularly since she had planned to use the statement to encourage investors to purchase shares in the…arrow_forward

- Frieden Company's contribution format income statement for last month is shown below: Sales (30,000 units) Variable expenses Contribution margin Fixed expenses Operating income $1,200,000 720,000 480,000 384,000 $ 96,000 Competition is intense, and Frieden Company's profits vary considerably from one year to the next. Management is exploring opportunities to increase profitability. Required: 1. Frieden's management is considering a major upgrade to the manufacturing equipment, which would result in fixed expenses increasing by $480,000 per month. However, variable expenses would decrease by $16 per unit. Selling price would not change. Prepare two contribution format income statements, one showing current operations and one showing how operations would appear if the upgrade is completed. Show an Amount column, a Per Unit column, and a Percentage column on each statement. $ FRIEDEN COMPANY Contribution Margin Income Statement Present Amount 0 $ 0 Per Unit 0 % 0 $ Amount Proposed Per…arrow_forwardI need help on another practice quiz question.arrow_forwardMorton Company's contribution format income statement for last month is given below. Sales (46,000 units x $21 per unit) Variable expenses Contribution margin Fixed expenses $ 966,000 676, 200 289, 890 231, 840 Net operating incone $ 57,960 The industry in which Morton Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is studying ways of improving profits. Complete this question by entering your answers in the tabs below. Requlred 1 Requlred 2 Required 3 Required 4 New equipment has come onto the market that would alow Morton Company to automate a portion of ts operations. Varible expenses would be reduced by $6.30 per unt. Hovever fived expenses would increase to a ota of $2,64 each month. Preare two contributon format income statements, one showing present operations and one showing how operations would appear i the…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College