Concept explainers

FIFO method, spoilage. Refer to the information in Problem 18-35.

Required

Do Problem 18-35 using the FIFO method of

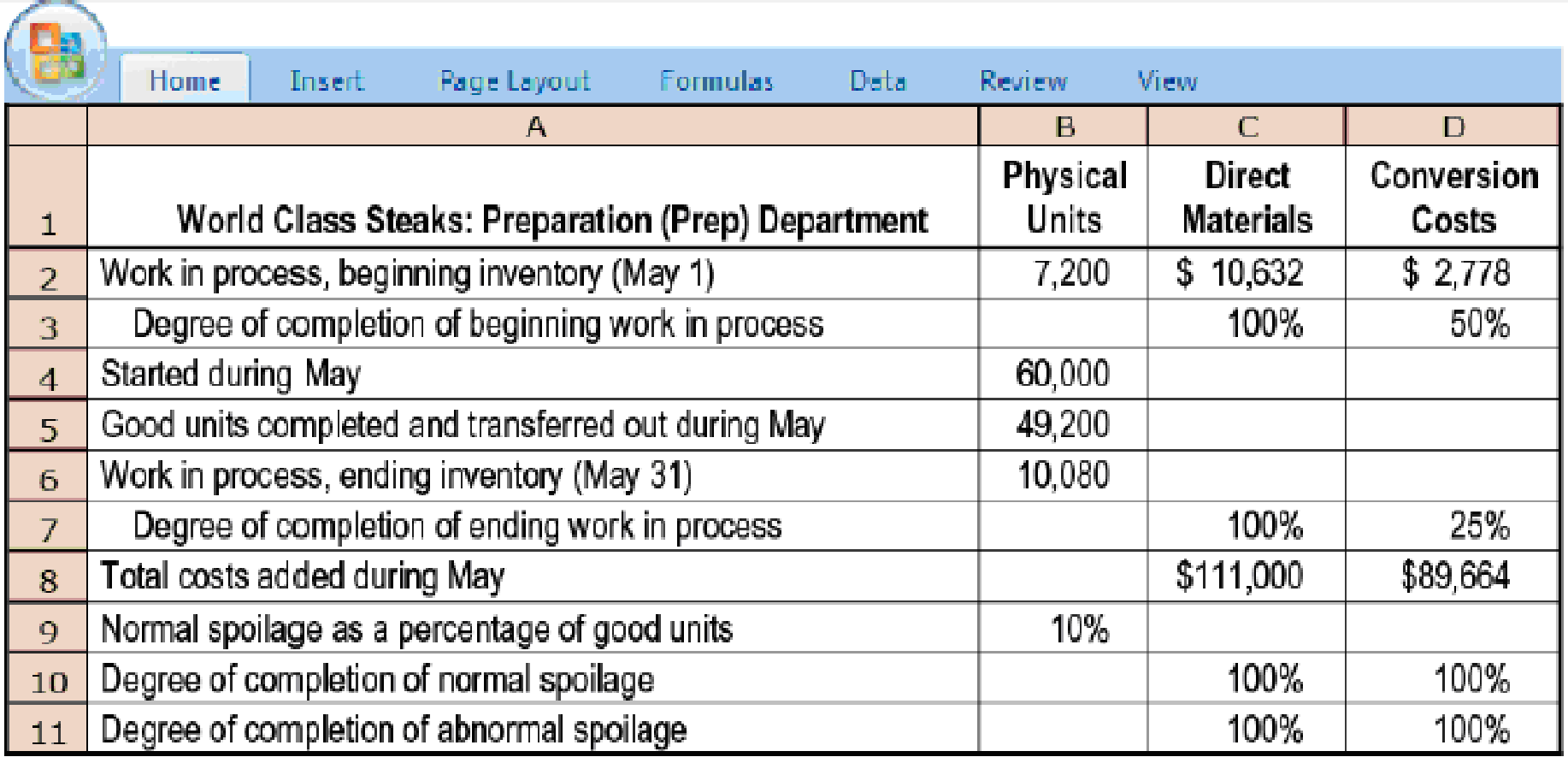

18-35 Weighted-average method, spoilage. World Class Steaks is a meat-processing firm based in Texas. It operates under the weighted-average method of process costing and has two departments: preparation (prep) and shipping. For the prep department, conversion costs are added evenly during the process, and direct materials are added at the beginning of the process. Spoiled units are detected upon inspection at the end of the prep process and are disposed of at zero net disposal value. All completed work is transferred to the shipping department. Summary data for May follow:

Required

For the prep department, summarize the total costs to account for and assign those costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. (Problem 18-37 explores additional facets of this problem.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- On December 31, Year 8, Suzi McDowell wants to have $60,000. She plans to make 6 deposits in a fund to provide this amount. Interest compounds annually at 12%. Required: Compute the equal annual amounts that Suzi must deposit assuming that he makes the first deposit on: December 31, Year 3 December 31, Year 2arrow_forwardHello tutor please help me this questionarrow_forwardcorrect answer pleasearrow_forward

- hi expert please help mearrow_forwardE14.10 (LO 1) (Information Related to Various Bond Issues) Pawnee Inc. has issued three types of debt on January 1, 2022, the start of the company's fiscal year. a. $10 million, 10-year, 13% unsecured bonds, interest payable quarterly. Bonds were priced to yield 12%. b. $25 million par of 10-year, zero-coupon bonds at a price to yield 12% per year. c. $15 million, 10-year, 10% mortgage bonds, interest payable annually to yield 12%. Instructions Prepare a schedule that identifies the following items for each bond: (1) maturity value, (2) number of interest periods over life of bond, (3) stated rate per each interest period, (4) effective-interest rate per each interest period, (5) payment amount per period, and (6) present value of bonds at date of issue. Hint: you don't need to prepare the amortization schedule to answer this question. Just a simple table is enough.arrow_forwardNeed correct answer of this question general Accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning