Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 18.25E

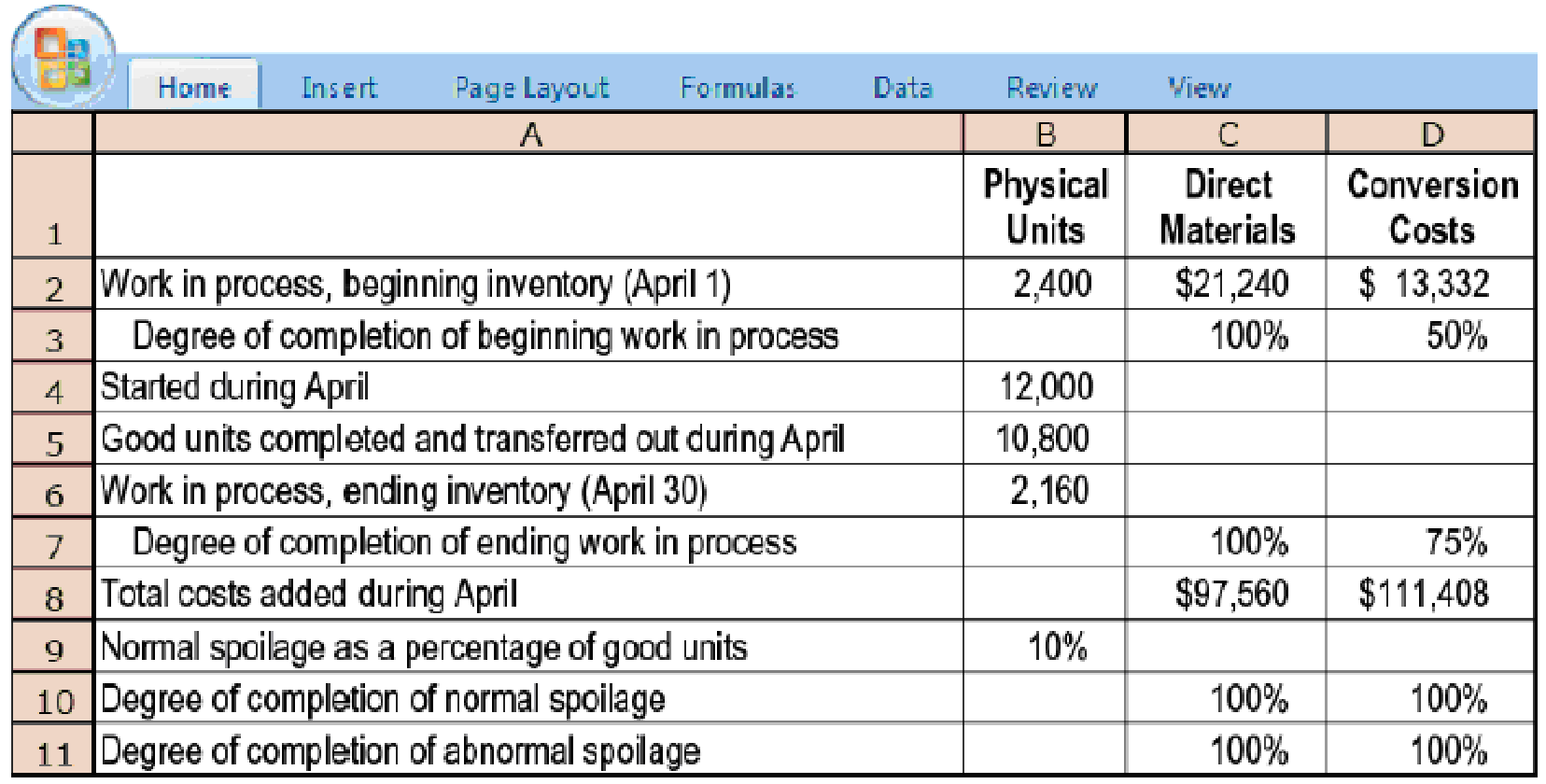

Weighted-average method, spoilage. LaCroix Company produces handbags from leather of moderate quality. It distributes the product through outlet stores and department store chains. At LaCroix’s facility in northeast Ohio, direct materials (primarily leather hides) are added at the beginning of the process, while conversion costs are added evenly during the process. Given the importance of minimizing product returns, spoiled units are detected upon inspection at the end of the process and are discarded at a net disposal value of zero.

LaCroix uses the weighted-average method of

- 1. For each cost category, calculate equivalent units. Show physical units in the first column of your schedule.

Required

- 2. Summarize the total costs to account for; calculate the cost per equivalent unit for each cost category; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

minutes of calls?

What are the required sales?

Calculate freshmarts return on assets for the year accounting

Chapter 18 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 18 - Why is there an unmistakable trend in...Ch. 18 - Distinguish among spoilage, rework, and scrap.Ch. 18 - Normal spoilage is planned spoilage. Discuss.Ch. 18 - Costs of abnormal spoilage are losses. Explain.Ch. 18 - What has been regarded as normal spoilage in the...Ch. 18 - Units of abnormal spoilage are inferred rather...Ch. 18 - In accounting for spoiled units, we are dealing...Ch. 18 - Total input includes abnormal as well as normal...Ch. 18 - Prob. 18.9QCh. 18 - The unit cost of normal spoilage is the same as...

Ch. 18 - In job costing, the costs of normal spoilage that...Ch. 18 - The costs of rework are always charged to the...Ch. 18 - Abnormal rework costs should be charged to a loss...Ch. 18 - When is a company justified in inventorying scrap?Ch. 18 - How do managers use information about scrap?Ch. 18 - Prob. 18.16MCQCh. 18 - Which of the following is a TRUE statement...Ch. 18 - Healthy Dinners Co. produces frozen dinners for...Ch. 18 - Fresh Products, Inc. incurred the following costs...Ch. 18 - Normal and abnormal spoilage in units. The...Ch. 18 - Weighted-average method, spoilage, equivalent...Ch. 18 - Weighted-average method, assigning costs...Ch. 18 - FIFO method, spoilage, equivalent units. Refer to...Ch. 18 - FIFO method, assigning costs (continuation of...Ch. 18 - Weighted-average method, spoilage. LaCroix Company...Ch. 18 - FIFO method, spoilage. 1. Do Exercise 18-25 using...Ch. 18 - Spoilage, journal entries. Plastique produces...Ch. 18 - Recognition of loss from spoilage. Spheres Toys...Ch. 18 - Weighted-average method, spoilage. LogicCo is a...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Standard-costing method, spoilage. Refer to the...Ch. 18 - Spoilage and job costing. (L. Bamber) Barrett...Ch. 18 - Reworked units, costs of rework. Heyer Appliances...Ch. 18 - Scrap, job costing. The Russell Company has an...Ch. 18 - Weighted-average method, spoilage. World Class...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Weighted-average method, shipping department...Ch. 18 - FIFO method, shipping department (continuation of...Ch. 18 - Physical units, inspection at various levels of...Ch. 18 - Spoilage in job costing. Jellyfish Machine Shop is...Ch. 18 - Rework in job costing, journal entry (continuation...Ch. 18 - Scrap at time of sale or at time of production,...Ch. 18 - Physical units, inspection at various stages of...Ch. 18 - Weighted-average method, inspection at 80%...Ch. 18 - Job costing, classifying spoilage, ethics....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide answer with calculationarrow_forwardYour investment department has researched possible investments in corporate debt securities. Among the available investments are the following $100 million bond issues, each dated January 1, 2024. Prices were determined by underwriters at different times during the last few weeks. Company 1. BB Corporation Bond Price $ 109 million Stated Rate 11% 2. DD Corporation $ 100 million 3. GG Corporation $ 91 million 10% 9% Each of the bond issues matures on December 31, 2043, and pays interest semiannually on June 30 and December 31. For bonds of similar risk and maturity, the market yield at January 1, 2024, is 10%. Required: Other things being equal, which of the bond issues offers the most attractive investment opportunity if it can be purchased at the prices stated? The least attractive? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Most attractive investment Least attractive investmentarrow_forwardQ ▼ 0 1 / 3 Тт з Problem Set 1 Cariman Company manufactures and sells three styles of door Handles: Gold, Bronze and Silver Production takes 50, 50, and 20 machine hours to manufacture 1,000-unit batches of Gold, Brune, and Silver Handles, respectively. The following additional data apply: Projected sales in units Gold Bronze Silver 60,000 100,000 80,000 Per Unit data: Selling price $80 540 560 Direct materials $16 $8 $16 Direct labour $30 $5 518 Overhead cost based on direct labour hours (traditional system) $24 56 $18 Hours per 1,000-unit butch: Direct labour hours Machine hours Setup hours Inspection hours 80 50 20 60 20 # 5 8 8 40 40 20 50 20 8558 Activity Total overhead costs and activity levels for the year are estimated as follows: Overhead costs Activity levels Direct labour hours 5,800 hours Machine hours 4,800 hours Setups $931,000 190 setup hours Inspections $810,000 5,400 inspection hours $1741.000 Required: 1. Using the traditional coding system, determine the operating…arrow_forward

- Lawrence Industries produces kitchen knives. The selling price is $25 per unit, and the variable costs are $10 per knife. Fixed costs per month are $6,000. If Lawrence Industries sells 30 more units beyond breakeven, how much does profit increase as a result? Answerarrow_forwardCalculate the standard cost per unit for ABC Company.arrow_forwardWhat is the annual depreciation expense for evergreen builders co.?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY