Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 18.29E

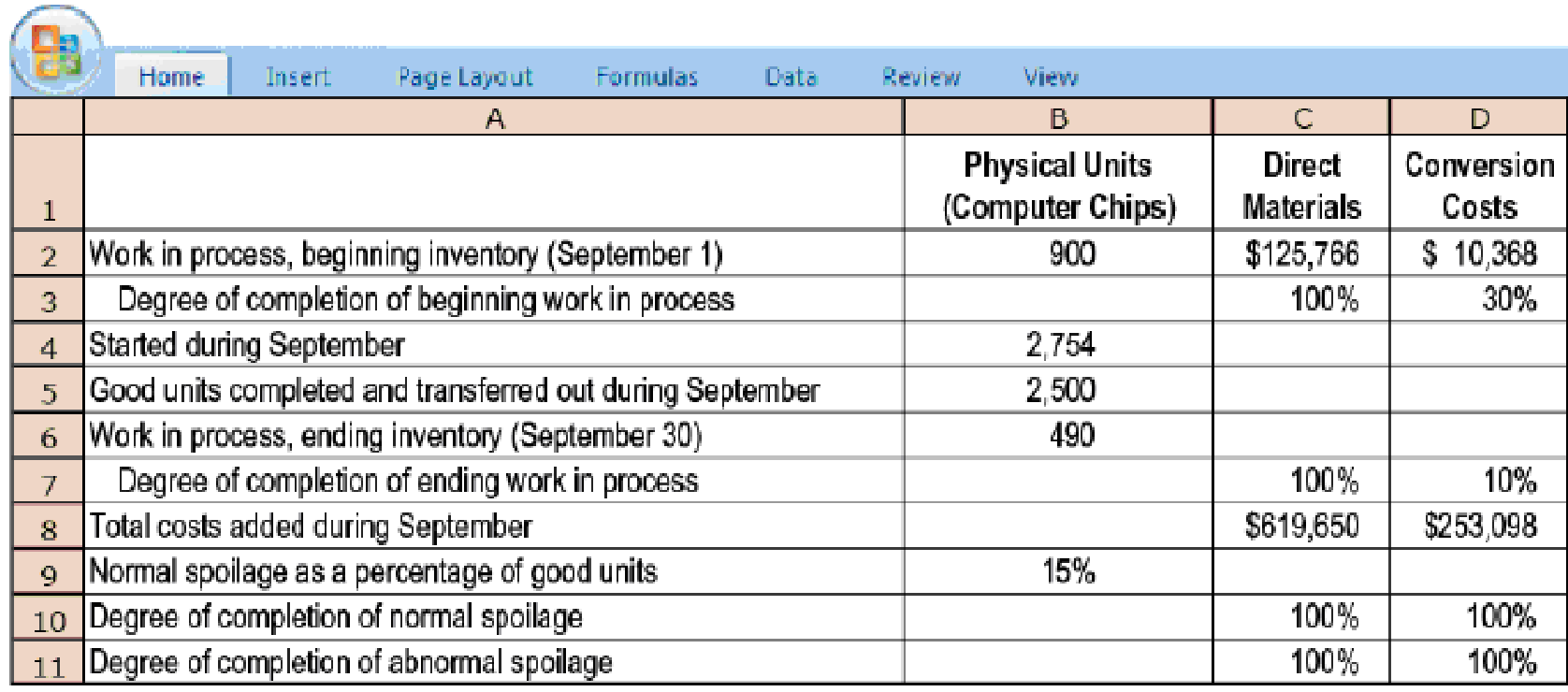

Weighted-average method, spoilage. LogicCo is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. LogicCo uses the weighted-average method of

Summary data for September 2017 are as follows:

- 1. For each cost category, compute equivalent units. Show physical units in the first column of your schedule.

Required

- 2. Summarize the total costs to account for; calculate the cost per equivalent unit for each cost category; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Costing Problem 4 points

Answer this cost accounting question

Please need answer this general accounting question not use ai

Chapter 18 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 18 - Why is there an unmistakable trend in...Ch. 18 - Distinguish among spoilage, rework, and scrap.Ch. 18 - Normal spoilage is planned spoilage. Discuss.Ch. 18 - Costs of abnormal spoilage are losses. Explain.Ch. 18 - What has been regarded as normal spoilage in the...Ch. 18 - Units of abnormal spoilage are inferred rather...Ch. 18 - In accounting for spoiled units, we are dealing...Ch. 18 - Total input includes abnormal as well as normal...Ch. 18 - Prob. 18.9QCh. 18 - The unit cost of normal spoilage is the same as...

Ch. 18 - In job costing, the costs of normal spoilage that...Ch. 18 - The costs of rework are always charged to the...Ch. 18 - Abnormal rework costs should be charged to a loss...Ch. 18 - When is a company justified in inventorying scrap?Ch. 18 - How do managers use information about scrap?Ch. 18 - Prob. 18.16MCQCh. 18 - Which of the following is a TRUE statement...Ch. 18 - Healthy Dinners Co. produces frozen dinners for...Ch. 18 - Fresh Products, Inc. incurred the following costs...Ch. 18 - Normal and abnormal spoilage in units. The...Ch. 18 - Weighted-average method, spoilage, equivalent...Ch. 18 - Weighted-average method, assigning costs...Ch. 18 - FIFO method, spoilage, equivalent units. Refer to...Ch. 18 - FIFO method, assigning costs (continuation of...Ch. 18 - Weighted-average method, spoilage. LaCroix Company...Ch. 18 - FIFO method, spoilage. 1. Do Exercise 18-25 using...Ch. 18 - Spoilage, journal entries. Plastique produces...Ch. 18 - Recognition of loss from spoilage. Spheres Toys...Ch. 18 - Weighted-average method, spoilage. LogicCo is a...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Standard-costing method, spoilage. Refer to the...Ch. 18 - Spoilage and job costing. (L. Bamber) Barrett...Ch. 18 - Reworked units, costs of rework. Heyer Appliances...Ch. 18 - Scrap, job costing. The Russell Company has an...Ch. 18 - Weighted-average method, spoilage. World Class...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Weighted-average method, shipping department...Ch. 18 - FIFO method, shipping department (continuation of...Ch. 18 - Physical units, inspection at various levels of...Ch. 18 - Spoilage in job costing. Jellyfish Machine Shop is...Ch. 18 - Rework in job costing, journal entry (continuation...Ch. 18 - Scrap at time of sale or at time of production,...Ch. 18 - Physical units, inspection at various stages of...Ch. 18 - Weighted-average method, inspection at 80%...Ch. 18 - Job costing, classifying spoilage, ethics....

Additional Business Textbook Solutions

Find more solutions based on key concepts

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Inspection and Quality control in Manufacturing. What is quality inspection?; Author: Educationleaves;https://www.youtube.com/watch?v=Ey4MqC7Kp7g;License: Standard youtube license