HORNGRENS COST ACCOUNTING W/ACCESS

16th Edition

ISBN: 9781323687604

Author: Datar

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 18.25E

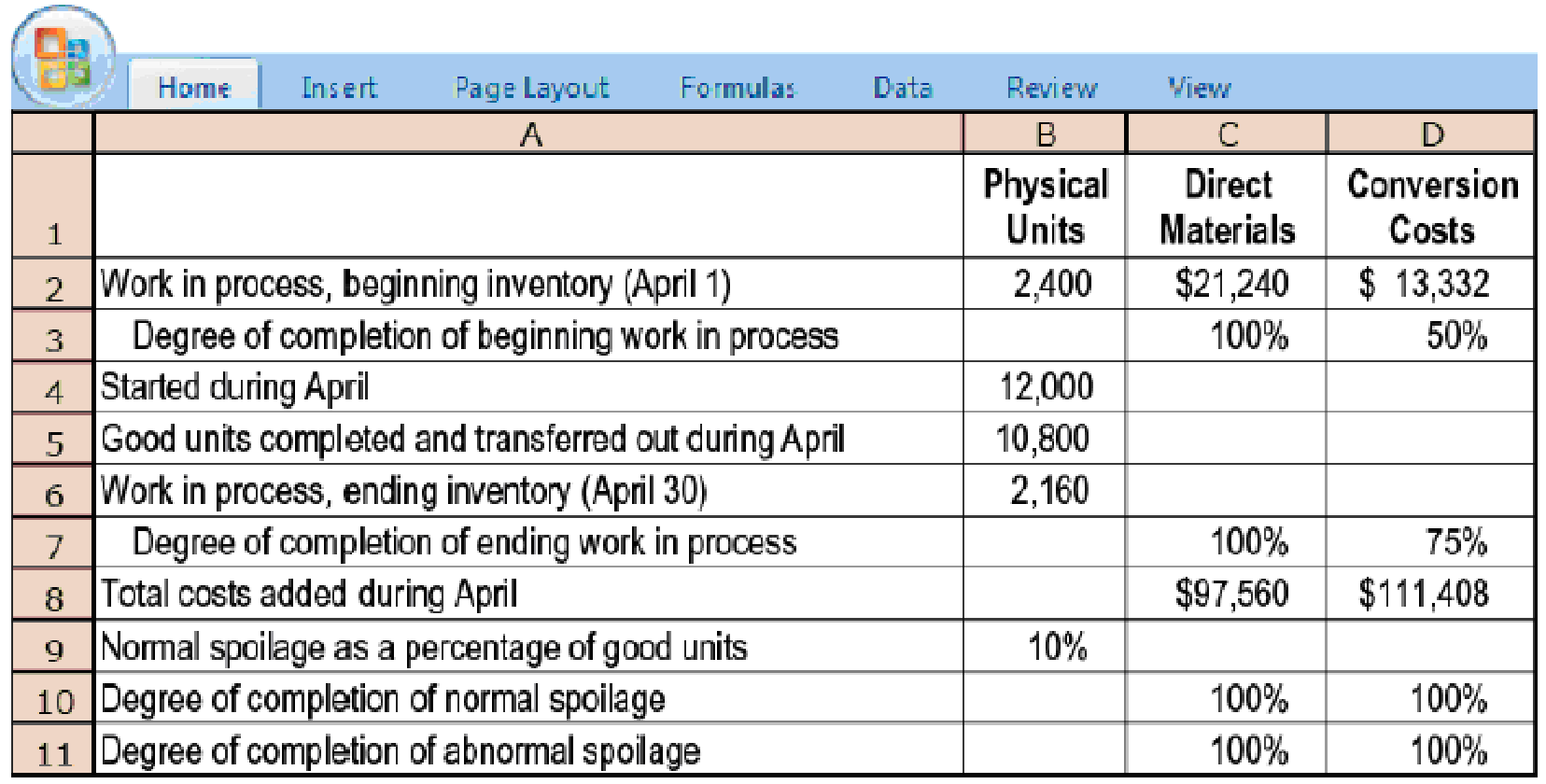

Weighted-average method, spoilage. LaCroix Company produces handbags from leather of moderate quality. It distributes the product through outlet stores and department store chains. At LaCroix’s facility in northeast Ohio, direct materials (primarily leather hides) are added at the beginning of the process, while conversion costs are added evenly during the process. Given the importance of minimizing product returns, spoiled units are detected upon inspection at the end of the process and are discarded at a net disposal value of zero.

LaCroix uses the weighted-average method of

- 1. For each cost category, calculate equivalent units. Show physical units in the first column of your schedule.

Required

- 2. Summarize the total costs to account for; calculate the cost per equivalent unit for each cost category; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Determine the amount charged to Finished Goods for the period and the costs of spoilage charged to revenue.

Husky Ltd. manufactures toys using a continuous production process that flows through two departments: Forming and Finishing. In the forming department, various components are built and are transferred to the finishing department. In the finishing department, those components are assembled into Husky’s final product and once finished, are transferred to Husky’s Finished Goods Inventory. Any spoilage is detected at the end of the process (i.e. when the toys are 100% complete). Husky uses the FIFO method of accounting for costs. In the Finishing Department, Direct materials are added at 70% of conversion and conversion costs are added evenly throughout the process. Finishing DepartmentPhysical UnitsTransferred InDirect Materials Conversion Work in Process January 1 37,000 $ 76,400 $ 0 $ 30,062Degree of Completion in beginning WIP 65%Units Transferred in from Forming in January 232,500Good Units Transferred Out 240,000Work In Process January 31 24,000Normal Spoilage as a percentage of…

LogicCo is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are

spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. LogicCo uses the weighted-average method of process costing. Summary

data for September 2020 are:

(Click the icon to view the data.)

Read the requirements.

Requirement 1. For each cost category, compute equivalent units. Show physical units in the first column of your schedule.

Enter the physical units in first, then calculate the equivalent units.

Flow of Production

Work in process beginning

Started during current period

To account for

Completed and transferred out during current period

Normal spoilage

Abnormal spoilage

Work in process, ending

Accounted for

Work done to date

Physical

Units

Requirements

1. For each cost category, compute…

Chapter 18 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

Ch. 18 - Why is there an unmistakable trend in...Ch. 18 - Distinguish among spoilage, rework, and scrap.Ch. 18 - Normal spoilage is planned spoilage. Discuss.Ch. 18 - Costs of abnormal spoilage are losses. Explain.Ch. 18 - What has been regarded as normal spoilage in the...Ch. 18 - Units of abnormal spoilage are inferred rather...Ch. 18 - In accounting for spoiled units, we are dealing...Ch. 18 - Total input includes abnormal as well as normal...Ch. 18 - Prob. 18.9QCh. 18 - The unit cost of normal spoilage is the same as...

Ch. 18 - In job costing, the costs of normal spoilage that...Ch. 18 - The costs of rework are always charged to the...Ch. 18 - Abnormal rework costs should be charged to a loss...Ch. 18 - When is a company justified in inventorying scrap?Ch. 18 - How do managers use information about scrap?Ch. 18 - Prob. 18.16MCQCh. 18 - Which of the following is a TRUE statement...Ch. 18 - Healthy Dinners Co. produces frozen dinners for...Ch. 18 - Fresh Products, Inc. incurred the following costs...Ch. 18 - Normal and abnormal spoilage in units. The...Ch. 18 - Weighted-average method, spoilage, equivalent...Ch. 18 - Weighted-average method, assigning costs...Ch. 18 - FIFO method, spoilage, equivalent units. Refer to...Ch. 18 - FIFO method, assigning costs (continuation of...Ch. 18 - Weighted-average method, spoilage. LaCroix Company...Ch. 18 - FIFO method, spoilage. 1. Do Exercise 18-25 using...Ch. 18 - Spoilage, journal entries. Plastique produces...Ch. 18 - Recognition of loss from spoilage. Spheres Toys...Ch. 18 - Weighted-average method, spoilage. LogicCo is a...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Standard-costing method, spoilage. Refer to the...Ch. 18 - Spoilage and job costing. (L. Bamber) Barrett...Ch. 18 - Reworked units, costs of rework. Heyer Appliances...Ch. 18 - Scrap, job costing. The Russell Company has an...Ch. 18 - Weighted-average method, spoilage. World Class...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Weighted-average method, shipping department...Ch. 18 - FIFO method, shipping department (continuation of...Ch. 18 - Physical units, inspection at various levels of...Ch. 18 - Spoilage in job costing. Jellyfish Machine Shop is...Ch. 18 - Rework in job costing, journal entry (continuation...Ch. 18 - Scrap at time of sale or at time of production,...Ch. 18 - Physical units, inspection at various stages of...Ch. 18 - Weighted-average method, inspection at 80%...Ch. 18 - Job costing, classifying spoilage, ethics....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mystic Bottling Company bottles popular beverages in the Bottling Department. The beverages are produced by blending concentrate with water and sugar. The concentrate is purchased from a concentrate producer. The concentrate producer sets higher prices for the more popular concentrate flavors. A simplified Bottling Department cost of production report separating the cost of bottling the four flavors follows: Attachment Beginning and ending work in process inventories are negligible, so they are omitted from the cost of production report. The flavor changeover cost represents the cost of cleaning the bottling machines between production runs of different flavors. Prepare a memo to the production manager, analyzing this comparative cost information. In your memo, provide recommendations for further action, along with supporting schedules showing the total cost per case and cost per case by cost element.Round all supporting calculations to the nearest cent.arrow_forwardWeighted-average method, spoilage. World Class Steaks is a meat-processing rm based in Texas. It operates under the weighted-average method of process costing and has two departments: preparation (prep) and shipping. For the prep department, conversion costs are added evenly during the process, and direct materials are added at the beginning of the process. Spoiled units are detected upon inspection at the end of the prep process and are disposed of at zero net disposal value. All completed work is transferred to the shipping department. Summary data for May follow:arrow_forwardSummarize the total costs to account for; calculate the cost per equivalent unit for each cost category; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process.arrow_forward

- ii) Assign total cost to:a. Units completed and transferred out to the Drying Departmentb. Units rejected as abnormal spoilagec. Units in the Molding department work in process inventory.arrow_forwarda) What are the normal and abnormal spoilage units, respectively, for March when using FIFO? b) Using above problem, what costs would be associated with normal and abnormal spoilage, respectively, using the FIFO method of process costing?arrow_forwardRequired:(a) Compute the equivalent units for direct materials (From Moulding & Direct materialsadded) and conversion costs.(b) Compute the: Cost per equivalent unit for direct materials and conversion costs Total cost of the skis completed and transferred out to the Packing Department. Cost of the unexpected losses Cost of ending work in process inventory in the Spraying Department.arrow_forward

- Note:- • Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. • Answer completely. • You will get up vote for sure.arrow_forwardVermont Company uses continuous processing to produce stuffed bears and FIFO process costing to account for its production costs. It uses FIFO because costs are quite unstable due to the volatile price of fine materials it uses in production. The bears are processed through one department. Overhead is applied on the basis of direct labor costs, and the application rate has not changed over the period covered by the problem. The Work-in-Process Inventory account showed the following balances at the start of the current period: Direct materials $ 142,000 Direct labor 315,000 Overhead applied 441,000 These costs were related to 63,000 units that were in process at the start of the period. During the period, 71,000 units were transferred to finished goods inventory. Of the units finished during this period, 70 percent were sold. After units have been transferred to finished goods inventory, no distinction is made between the costs to complete…arrow_forwardSpoilage and job costing. (L. Bamber) Barrett Kitchens produces a variety of items in accordance with special job ordersfrom hospitals, plant cafeterias, and university dormitories. An order for 2,100 cases of mixed vegetables costs $9 percase: direct materials, $4; direct manufacturing labor, $3; and manufacturing overhead allocated, $2. The manufacturingoverhead rate includes a provision for normal spoilage. Consider each requirement independently.1. Assume that a laborer dropped 420 cases. Suppose part of the 420 cases could be sold to a nearby prison for $420cash. Prepare a journal entry to record this event. Calculate and explain briey the unit cost of the remaining 1,680 cases.2. Refer to the original data. Tasters at the company reject 420 of the 2,100 cases. The 420 cases are disposed of for $840.Assume that this rejection rate is considered normal. Prepare a journal entry to record this event, and do the following:a. Calculate the unit cost if the rejection is attributable to…arrow_forward

- If you were the manager of Kardash Cosmetics, would you continue to process the petal residue into Romance perfume? Explain your answer.arrow_forwardFolio Glass produces custom glass platters. For one job, the trainee assigned to cut the glass set the template incorrectly into the computer. This template was unusable and had to be discarded; another template was cut to the correct dimensions. How is the cost of the spoiled template handled?arrow_forwardPrepare the Cost of Production Report of Hanks, Inc. using the FIFO Costing Method. Refer to our sample problem for the given.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY