HORNGRENS COST ACCOUNTING W/ACCESS

16th Edition

ISBN: 9781323687604

Author: Datar

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 18.26E

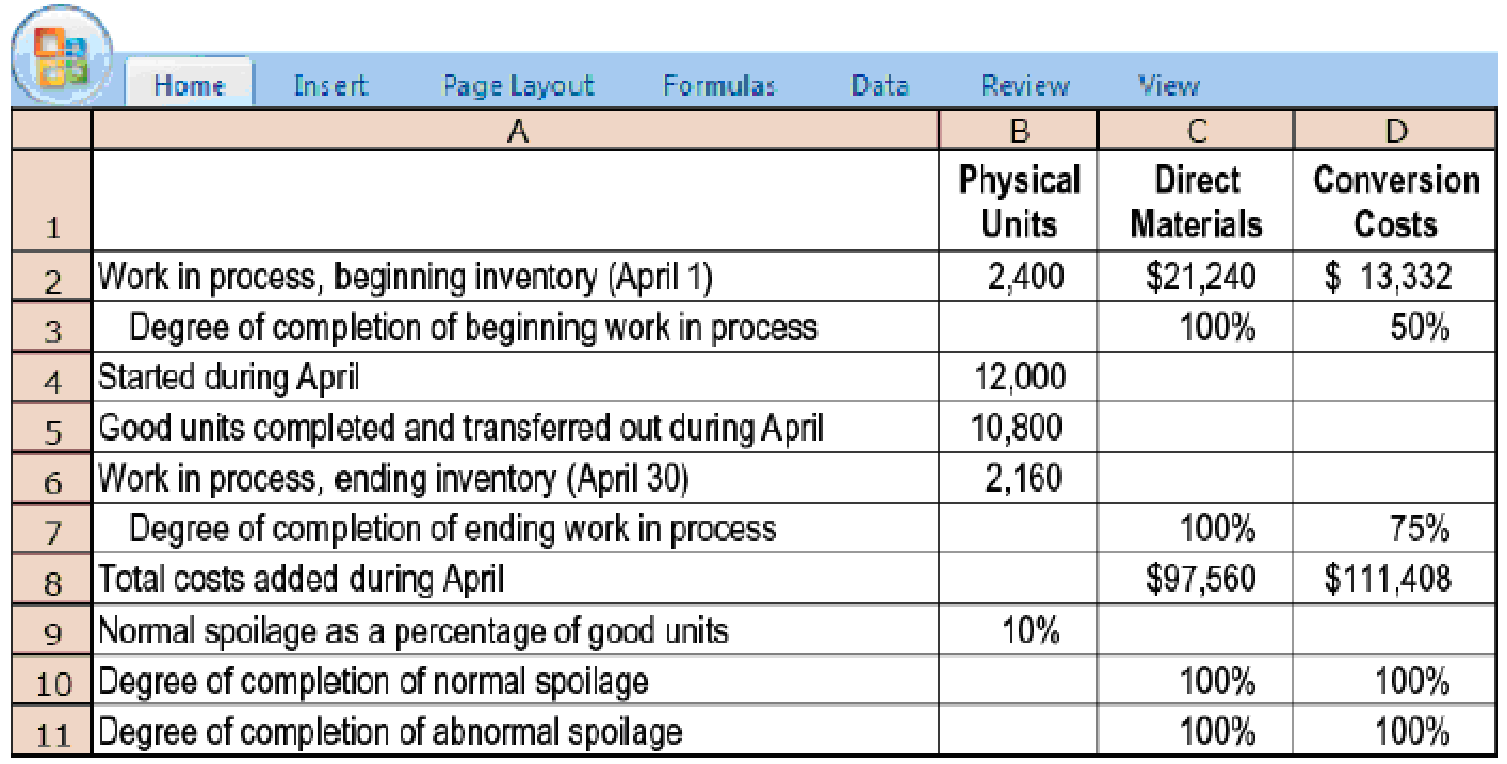

FIFO method, spoilage.

- 1. Do Exercise 18-25 using the FIFO method.

Required

- 2. What are the managerial issues involved in selecting or reviewing the percentage of spoilage considered normal? Flow would your answer to requirement 1 differ if all spoilage were viewed as normal?

18-25 Weighted-average method, spoilage. LaCroix Company produces handbags from leather of moderate quality. It distributes the product through outlet stores and department store chains. At LaCroix’s facility in northeast Ohio, direct materials (primarily leather hides) are added at the beginning of the process, while conversion costs are added evenly during the process. Given the importance of minimizing product returns, spoiled units are detected upon inspection at the end of the process and are discarded at a net disposal value of zero.

LaCroix uses the weighted-average method of

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Planning and control decisions.

Gregor Company makes and sells brooms and mops. It takes the following actions, not necessarily in the order given. For each action,

state whether it is a planning decision or a control decision.

Gregor asks its advertising team to develop fresh advertisements to market its newest product.

Gregor calculates customer satisfaction scores after introducing its newest product.

Gregor compares costs it actually incurred with costs it expected to incur for the production of the new product.

Gregor’s design team proposes a new product to compete directly with the Swiffer.

Gregor estimates the costs it will incur to distribute 30,000 units of the new product in the first quarter of next fiscal year.

Management of a T-shirt manufacturer believes if the company applies lean principles, then cycle efficiency can be improved. The

following are estimated completion times for different activities in the manufacturing process.

Activity

Cutting and sewing processing

Wait time before moving to ironing

Moving shirts to ironing

Ironing shirts

Wait time before moving to packaging

Moving shirts to packaging

Packaging shirts

Quality inspection

Activity

Cycle efficiency

Traditional

Traditional

22 minutes

9 minutes

11 minutes

11 minutes

4 minutes

2 minutes

17 minutes.

22 minutes

Compute cycle efficiency for the (a) traditional approach and (b) lean approach.

Note: Round your answers to 2 decimal places.

Lean

Lean

22 minutes

6 minutes

7 minutes

11 minutes.

5 minutes

3 minutes

17 minutes

7 minutes

Subject: accounting

Chapter 18 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

Ch. 18 - Why is there an unmistakable trend in...Ch. 18 - Distinguish among spoilage, rework, and scrap.Ch. 18 - Normal spoilage is planned spoilage. Discuss.Ch. 18 - Costs of abnormal spoilage are losses. Explain.Ch. 18 - What has been regarded as normal spoilage in the...Ch. 18 - Units of abnormal spoilage are inferred rather...Ch. 18 - In accounting for spoiled units, we are dealing...Ch. 18 - Total input includes abnormal as well as normal...Ch. 18 - Prob. 18.9QCh. 18 - The unit cost of normal spoilage is the same as...

Ch. 18 - In job costing, the costs of normal spoilage that...Ch. 18 - The costs of rework are always charged to the...Ch. 18 - Abnormal rework costs should be charged to a loss...Ch. 18 - When is a company justified in inventorying scrap?Ch. 18 - How do managers use information about scrap?Ch. 18 - Prob. 18.16MCQCh. 18 - Which of the following is a TRUE statement...Ch. 18 - Healthy Dinners Co. produces frozen dinners for...Ch. 18 - Fresh Products, Inc. incurred the following costs...Ch. 18 - Normal and abnormal spoilage in units. The...Ch. 18 - Weighted-average method, spoilage, equivalent...Ch. 18 - Weighted-average method, assigning costs...Ch. 18 - FIFO method, spoilage, equivalent units. Refer to...Ch. 18 - FIFO method, assigning costs (continuation of...Ch. 18 - Weighted-average method, spoilage. LaCroix Company...Ch. 18 - FIFO method, spoilage. 1. Do Exercise 18-25 using...Ch. 18 - Spoilage, journal entries. Plastique produces...Ch. 18 - Recognition of loss from spoilage. Spheres Toys...Ch. 18 - Weighted-average method, spoilage. LogicCo is a...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Standard-costing method, spoilage. Refer to the...Ch. 18 - Spoilage and job costing. (L. Bamber) Barrett...Ch. 18 - Reworked units, costs of rework. Heyer Appliances...Ch. 18 - Scrap, job costing. The Russell Company has an...Ch. 18 - Weighted-average method, spoilage. World Class...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Weighted-average method, shipping department...Ch. 18 - FIFO method, shipping department (continuation of...Ch. 18 - Physical units, inspection at various levels of...Ch. 18 - Spoilage in job costing. Jellyfish Machine Shop is...Ch. 18 - Rework in job costing, journal entry (continuation...Ch. 18 - Scrap at time of sale or at time of production,...Ch. 18 - Physical units, inspection at various stages of...Ch. 18 - Weighted-average method, inspection at 80%...Ch. 18 - Job costing, classifying spoilage, ethics....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dropping a customer, activity-based costing, ethics. Justin Anders is the management accountant for Carey Restaurant Supply (CRS). Sara Brinkley, the CRS sales manager, and Justin are meeting to discuss the profitability of one of the customers, Donnelly’s Pizza. Justin hands Sara the following analysis of Donnelly’s activity during the last quarter, taken from CRS’s activity-based costing system: Sara looks at the report and remarks, “I’m glad to see all my hard work is paying off with Donnelly’s. Sales have gone up 10% over the previous quarter!” Justin replies, “Increased sales are great, but I’m worried about Donnelly’s margin, Sara. We were showing a profit with Donnelly’s at the lower sales level, but now we’re showing a loss. Gross margin percentage this quarter was 40%, down five percentage points from the prior quarter. I’m afraid that corporate will push hard to drop them as a customer if things don’t turn around.” “That’s crazy,” Sara responds. “A lot of that overhead for…arrow_forwardIdentification. Pocket Umbrella, Inc., is considering producing a new type of umbrella. This newpocket-sized umbrella would fit into a coat pocket or purse. Classify the following costs of thisnew product as direct materials, direct labor, manufacturing overhead, selling expense, oradministrative expense.6. The salary of the supervisor of the people who assembled the product7. Wages of the product tester who stands in a shower to make sure the umbrellas do not leak8. Cost of market research survey9. Salary of the company’s sales managers10. Depreciation of administrative office buildingB. Essay. Answer below questions as required.1. Identify the three elements of cost incurred in manufacturing a product and indicate thedistinguishing characteristics of each. 2. What is the general content of a statement of cost of goods manufactured? 3. What is the relationship of the cost of goods manufactured to the income statement? 4. How did you cope up with your studies in this “new normal”…arrow_forwardJason's Outdoors manufactures two products: snow skis and water skis. Jason's managerial accountant suspects that product cost distortion through factory overhead allocation is occurring where snow skis are underpriced and water skis are overpriced. Based on this information, which of the following statements is true? a. Snow skis likely consumed a larger proportion of factory overhead than was allocated. b. Jason's should expand production of snow skis. c. Jason's accountant should ignore the cost distortions. d. Jason's concludes that it is applying its factory overhead properly.arrow_forward

- Can you please check my work bc it keep showing 2 & 4 is wrongarrow_forwardNote:- • Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. • Answer completely. • You will get up vote for sure.arrow_forwardRefer to Exercise 8.29. Suppose Gene determines that next year's Sales Division activities include the following: Research researching current and future conditions in the industry Shipping arranging for shipping of mattresses and handling calls from purchasing agents at retail stores to trace shipments and correct errors Jobbers coordinating the efforts of the independent jobbers who sell the mattresses Basic ads-placing print and television ads for the Sleepeze and Plushette lines Ultima ads choosing and working with the advertising agency on the Ultima account Office management-operating the Sales Division office The percentage of time spent by each employee of the Sales Division on each of the above activities is given in the following table: Research Administrative Gene Assistant Assistant Research 75% Shipping Jobbers 30% 20% 15 10 20 Basic ads 15 40 Ultima ads 30 5 Office management 25 15arrow_forward

- How do you work this problarrow_forwardMastery Problem: Differential Analysis and Product Pricing WoolCorp WoolCorp buys sheep's wool from farmers. The company began operations in January of this year, and is making decisions on product offerings, pricing, and vendors. The company is also examining its method of assigning overhead to products. You've just been hired as a production manager at WoolCorp. Currently WoolCorp makes three products: (1) raw, clean wool to be used as stuffing or insulation; (2) wool yarn for use in the textile industry, and (3) extra-thick yarn for use in rugs. Upper management would like your recommendations regarding a production decision regarding their current and proposed product lines. Continue/Discontinue For the past year, WoolCorp has experimented with its third product, extra-thick rug yarn. The company wishes to consider whether to continue or discontinue manufacturing and selling this product. You decide to prepare a differential analysis of the income related to all three products. To…arrow_forwardDomesticarrow_forward

- Company XYZ Manufacturer Limited is involved in the production of antiseptic products. Recently Company has started manufacturing of Sanitizers due to overwhelming demand of this product in the market. As company has already expertise in production of disinfectants therefore this new product will increase the product line of business. You are required to describe whether this company is involved in Job order costing or Process costing method to calculate product cost also differentiate between these two types. Company’s CEO has directed the financial manger to calculate the total cost of production for sanitizers during the year 2020. For this purpose the accountants have recorded and prepared the following cost data related to production of five thousand sanitizers for year 2020 in company’s accounting record under the title of Job “A111” Indirect Material Rs. 38,000 Other Costs incurred: Rs. Indirect Labor 78,000 Purchases of Raw Material (Both Direct and Indirect)…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardBaird Chairs, Incorporated makes two types of chairs. Model Diamond is a high-end product designed for professional offices. Model Gold is an economical product designed for family use. Jane Silva, the president, is worried about cut-throat price competition in the chairs market. Her company suffered a loss last quarter, an unprecedented event in its history. The company's accountant prepared the following cost data for Ms. Silva: Direct Cost per Unit Direct materials Direct labor Category Unit level Batch level Product level Facility level Total Model Diamond (D) $19.50 per unit $ 19.10/hour x 2.00 hours production time Type of Product Estimated Cost $ 247,500 825,000 704,000 572,000 $ 2,348,500 a. Model Diamond a. Model Gold b. Model Diamond b. Model Gold Cost Driver Number of units. Number of setups Number of TV commercials Number of machine hours The market price for office chairs comparable to Model Diamond is $118 and to Model Gold is $75. Cost per Unit Model Gold (G) $9.90 per…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY