Concept explainers

Standard-costing method, spoilage. Refer to the information in Exercise 18-29. Suppose LogicCo determines standard costs of $215 per equivalent unit for direct materials and $92 per equivalent unit for conversion costs for both beginning work in process and work done in the current period.

- 1. Do Exercise 18-29 using the standard-costing method.

Required

- 2. What issues should the manager focus on when reviewing the equivalent units calculation?

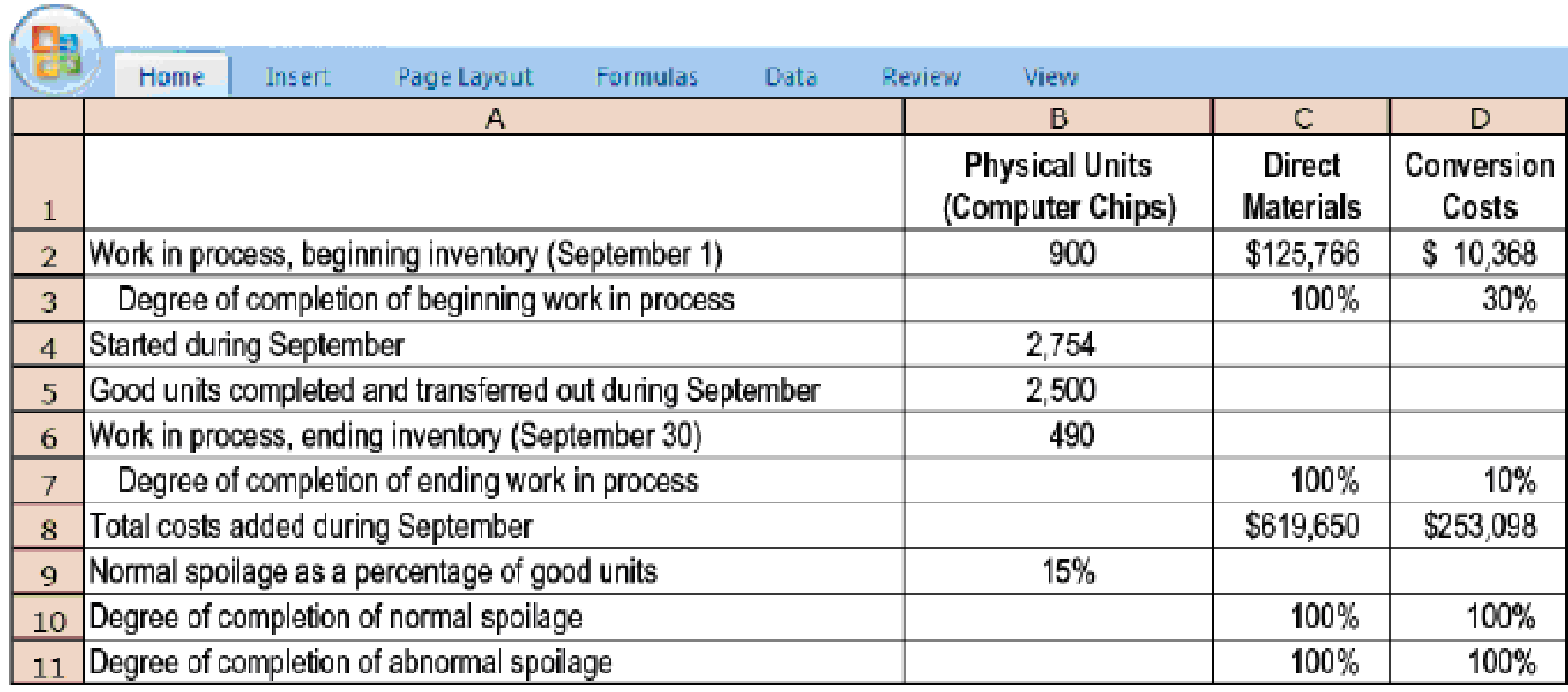

18-29 Weighted-average method, spoilage. LogicCo is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. LogicCo uses the weighted-average method of

Summary data for September 2017 are as follows:

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

- The following data have been extracted from the records of Puzzle Incorporated: Production level, in units Variable costs Fixed costs Mixed costs Total costs Required A Required B Required: a. Calculate the missing costs. b. Calculate the cost formula for mixed cost using the high-low method. c. Calculate the total cost that would be incurred for the production of 12,880 units. d. Identify the two key cost behavior assumptions made in the calculation of your answer to part c. Required C Production level, in units Variable costs Fixed costs Mixed costs Total costs Complete this question by entering your answers in the tabs below. Calculate the missing costs. Note: Do not round intermediate calculations. February 9,200 $ 19,320 ? 16,312 $ 71,532 February 9,200 $ 19,320 $ 2 X 16,312 $ 71,532 Required D August August 20, 240 $? 35,900 ? $ 106,970 Answer is not complete. 20,240 34,255 35,900 52,475 $ 106,970arrow_forwardCompute cost per equivalent unit of production for both direct materials and conversion. For the first column under "cost per equivalent unit of production" the options are: costs added this period, costs of beginning work in process, costs of ending work in process, costs transfered out. The rest of the empty spaces are numbersarrow_forwardNeed some help making a cheet sheet for an up coming test. please provide examples. The exam covers chapters 1 through 13. Here are some suggested study topics: Cost Classifications - variable, fixed and mixed, period and product, direct and indirect, opportunity, sunk, relevant, traceable, common, etc. Calculate the results of changes to cost assumptions (CVP) Calculate net income based on contribution margin values either dollars or % Application of Manufacturing Overhead - calculate predetermined overhead rate or activity rates applied to a product or job - job order using a predetermined overhead rate or rates and activity-based costing calculate over and underapplied overhead calculate adjusted cost of goods sold Job Costing What is the total cost of the job and average cost per unit. Cost of Goods Manufactured and cost of goods sold Calculate break even and target profit Create a contribution format income statement Gross margin calculations - absorption or variable costing…arrow_forward

- Exercise 9-34 and 9-35 (Algo) [The following information applies to the questions displayed below.] Benton Corporation manufactures computer microphones, which come in two models: Standard and Premium. Data for a representative quarter for the two models follow: Units produced Production runs per quarter Direct materials cost per unit Direct labor cost per unit Supervision Setup labor Incoming inspection Total overhead Standard 10,800 $ 222,750 251,775 186,300 $ 660,825 50 $ 30 50 Manufacturing overhead in the plant has three main functions: supervision, setup labor, and incoming materfal inspection. Data on manufacturing overhead for a representative quarter follow: Premium 2,700 25 $ 64 75arrow_forwardFIFO method (continuation of 17-36).1. Do Problem 17-36 using the FIFO method of process costing. Explain any difference between the cost per equivalent unit in the assembly department under the weighted-average method and the FIFO method.2. Should Larsen’s managers choose the weighted-average method or the FIFO method? Explain briefly.arrow_forwardThe inspection department at Swifty Industries receives manufactured parts from its own production department and then meticulously checks every part before packaging it for sale. This month, the production department focused on automobile side mirrors. The inspection department began April with just 180 side mirrors in process. These beginning units were 70% of the way through the inspection process. During April, 4,010 more side mirrors were transferred-in from the production department. By month's end, 3,770 units had been fully inspected and packaged (packaging occurs when the units reach the 95% completion point in the inspection department). April's ending WIP Inventory units in the inspection department were 40% of the way through the inspection process. (a) Determine Swifty's equivalent units for transferred-in costs, DM, and conversion costs in April, assuming the company uses the FIFO method of process costing. Total equivalent units of work done Transferred-in DM Conversion…arrow_forward

- For process costing, the FIFO method provides a major advantage over the weighted-average method in that: A. the calculation of equivalent units is less complex under the FIFO method. B. the FIFO method treats units in the beginning inventory as if they were started and completed during the current period. C. the FIFO method separates the work done during the current period to provide measurements of work done during the current period. D. the FIFO method considers units in the work done in the ending work-in-process inventories. E. the FIFO method more correctly computes the equivalent units of direct materials when they are added at the beginning of the production process.arrow_forwardThe cost behavior patterns below are lettered A through H. The vertical axes of the graphs represent total dollars of expense, and the horizontal axes represent production in units, machine hours, or direct labor hours. In each case, the zero point is at the intersection of the two axes. Each graph may be used no more than once. Required: Select the graph that matches the lettered cost described here. a. Depreciation of equipmentthe amount of depreciation charged is computed based on the number of machine hours that the equipment was operated. b. Electricity billflat fixed charge, plus a variable cost after a certain number of kilowatt hours are used. c. City water billcomputed as follows: d. Depreciation of equipmentthe amount is computed by the straight-line method. e. Rent on a factory building donated by the citythe agreement calls for a fixed fee payment, unless 200,000 labor hours are worked, in which case no rent need be paid. f. Salaries of repair workersone repair worker is needed for every 1,000 machine hours or less (i.e., 0 to 1,000 hours requires one repair worker, 1,001 to 2,000 hours requires two repair workers, etc.).arrow_forwardActivity-based costing systems: A. use a single predetermined overhead rate based on machine hours instead of on direct labor B. frequently increase the overhead allocation to at least one product while decreasing the overhead allocation to at least one other product C. limit the number of cost pools D. always result in an increase of at least one products selling pricearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,