HORNGRENS COST ACCOUNTING W/ACCESS

16th Edition

ISBN: 9781323687604

Author: Datar

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 18.30E

FIFO method, spoilage. Refer to the information in Exercise 18-29.

- 1. Do Exercise 18-29 using the FIFO method of

process costing .

Required

- 2. Should LogicCo’s managers choose the weighted-average method or the FIFO method? Explain briefly.

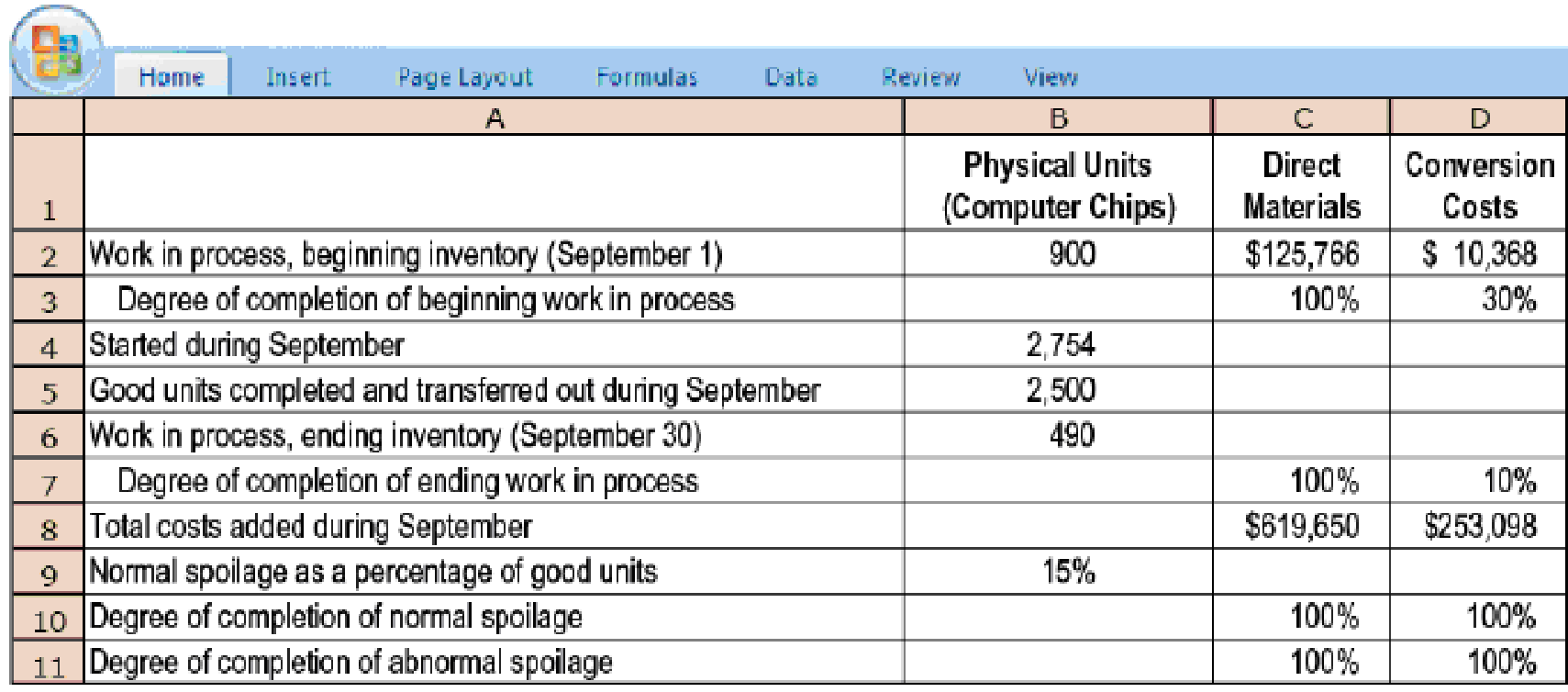

18-29 Weighted-average method, spoilage. LogicCo is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. LogicCo uses the weighted-average method of process costing.

Summary data for September 2017 are as follows:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Summarize the total costs to account for; calculate the cost per equivalent unit for each cost category; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process.

Central Perk, LLC, a manufacturer of coffee beans, is considering switching its

operations to an Activity Based Costing system. The following manufacturing

overhead activities and cost drivers have been identified:

Activity.

Machine setup

Machine assembly

Product inspection

Product movement

General factory

Cost Driver

Number of machine setups

Machine hours logged

Inspection hours logged

Number of moves

Machine hours logged

Based on the above descriptions, which of the following correctly pairs the activity

with its appropriate cost level?

O A. Product Inspection... batch level cost

OB. Product Movement... facility level cost

O C. Machine Assembly... unit level cost

O D. General Factory... batch level cost

O E. Machine Setup... unit level cost

Perez Industries produces two electronic decoders, P and Q. Decoder P is more sophisticated and requires more programming and testing than does Decoder Q. Because of these product differences, the company wants to use activity-based costing to allocate overhead costs. It has identified four activity pools. Relevant information follows:

b. Determine the overhead cost allocated to each product.

Chapter 18 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

Ch. 18 - Why is there an unmistakable trend in...Ch. 18 - Distinguish among spoilage, rework, and scrap.Ch. 18 - Normal spoilage is planned spoilage. Discuss.Ch. 18 - Costs of abnormal spoilage are losses. Explain.Ch. 18 - What has been regarded as normal spoilage in the...Ch. 18 - Units of abnormal spoilage are inferred rather...Ch. 18 - In accounting for spoiled units, we are dealing...Ch. 18 - Total input includes abnormal as well as normal...Ch. 18 - Prob. 18.9QCh. 18 - The unit cost of normal spoilage is the same as...

Ch. 18 - In job costing, the costs of normal spoilage that...Ch. 18 - The costs of rework are always charged to the...Ch. 18 - Abnormal rework costs should be charged to a loss...Ch. 18 - When is a company justified in inventorying scrap?Ch. 18 - How do managers use information about scrap?Ch. 18 - Prob. 18.16MCQCh. 18 - Which of the following is a TRUE statement...Ch. 18 - Healthy Dinners Co. produces frozen dinners for...Ch. 18 - Fresh Products, Inc. incurred the following costs...Ch. 18 - Normal and abnormal spoilage in units. The...Ch. 18 - Weighted-average method, spoilage, equivalent...Ch. 18 - Weighted-average method, assigning costs...Ch. 18 - FIFO method, spoilage, equivalent units. Refer to...Ch. 18 - FIFO method, assigning costs (continuation of...Ch. 18 - Weighted-average method, spoilage. LaCroix Company...Ch. 18 - FIFO method, spoilage. 1. Do Exercise 18-25 using...Ch. 18 - Spoilage, journal entries. Plastique produces...Ch. 18 - Recognition of loss from spoilage. Spheres Toys...Ch. 18 - Weighted-average method, spoilage. LogicCo is a...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Standard-costing method, spoilage. Refer to the...Ch. 18 - Spoilage and job costing. (L. Bamber) Barrett...Ch. 18 - Reworked units, costs of rework. Heyer Appliances...Ch. 18 - Scrap, job costing. The Russell Company has an...Ch. 18 - Weighted-average method, spoilage. World Class...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Weighted-average method, shipping department...Ch. 18 - FIFO method, shipping department (continuation of...Ch. 18 - Physical units, inspection at various levels of...Ch. 18 - Spoilage in job costing. Jellyfish Machine Shop is...Ch. 18 - Rework in job costing, journal entry (continuation...Ch. 18 - Scrap at time of sale or at time of production,...Ch. 18 - Physical units, inspection at various stages of...Ch. 18 - Weighted-average method, inspection at 80%...Ch. 18 - Job costing, classifying spoilage, ethics....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Detailed processarrow_forwardWojtek Nakowski has prepared the following list of statements about process cost accounting. Identify each statement as true or false. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Process cost systems are used to apply costs to similar products that are mass-produced in a continuous fashion. A process cost system is used when each finished unit is indistinguishable from another. Companies that produce soft drinks, motion pictures, and computer chips would all use process cost accounting. In a process cost system, costs are tracked by individual jobs. Job-order costing and process costing track different manufacturing cost components. Both job-order costing and process costing account for direct materials, direct labour, and manufacturing overhead. Costs flow through the accounts in the same basic way for both job-order costing and process costing. In a process cost system, only one work in process inventory account is used. In a process cost system, costs are summarized in a job cost sheet. In a…arrow_forwardFor each cost category, compute equivalent units. Show physical units in the first column of your schedule.arrow_forward

- A new product Zico was recently introduced by Philadelphia Co., in order to complement its other products, Novo and Domo. The accountant used to allocate the indirect cost according to the units produced. With the recent addition of an expanded computer system, Sonata would like to investigate the possibility of implementing ABC. Before making a final decision, management has come to you for advice. You collected the following information regarding manufacturing overhead: Table (1) Mfg. Overhead Mfg. Overhead Costs Allocation bases Set-up $ 40,000 Number of set-ups Ordering materials $ 45,000 Number of material orders Handling materials $ 9,000 Number of times material was handled Inspection $ 21,000 Number of inspection hours $115,000 Table (2) Activity Products Zico Novo Domo Total Number of set-ups 5 20 55 Total…arrow_forwardA new product Zico was recently introduced by Philadelphia Co., in order to complement its other products, Novo and Domo. The accountant used to allocate the indirect cost according to the units produced. With the recent addition of an expanded computer system, Sonata would like to investigate the possibility of implementing ABC. Before making a final decision, management has come to you for advice. You collected the following information regarding manufacturing overhead: Table (1) Mfg. Overhead Mfg. Overhead Allocation bases Costs $ 40,000 $ 45,000 $ 9,000 $ 21,000 Number of set-ups Set-up Ordering materials Handling materials Inspection Number of material orders Number of times material was handled Number of inspection hours $115,000 Table (2) Products Activity Zico Novo Domo Total Number of set-ups 5 20 55 Total Number of material orders 1 2 7 Total Number of times material was handled 1 17 Total Number of inspection hours Number of units produced 3 10 6,000 3,000 1,000 Required: 1.…arrow_forward4. Mr Khizar has prepared the following list of statements about process cost accounting. а. 1. Process cost systems are used to apply costs to similar products that are mass-produced in a continuous fashion. b. 2. A process cost system is used when each finished unit is indistinguishable from another. 3. Companies that produce soft drinks, motion pictures, and computer chips would all use process cost accounting. С. d. 4. In a process cost system, costs are tracked by individual jobs. 5. Job order costing and process costing е. track different manufacturing cost elements. f. 6. Both job order costing and process costing account for direct materials, direct labor, and manufacturing overhead. Instructions: Identify each statement as true or false. If false, indicate how to correct the statement.arrow_forward

- Subject- accountarrow_forward1. Explain the role of activity drivers in assigning costs to products. 2. Why are the accounting requirements for job order costing more demanding than those of process costing? 3. Folio Glass produces custom glass platters. For one job, the trainee assigned to cut the glass set the template incorrectly into the computer. This template was unusable and had to be discarded; another template was cut to the correct dimensions. How is the cost of the spoiled template handled?arrow_forwardWhat is the best reponse to this post? ob costing is a way for businesses to manage the costs and profitability of a specific job or project. This type of cost accounting is most beneficial to companies that make custom/unique products. An industry that may choose job costing is a construction company. They may specialize in a particular service, such as installing water pipes underground, but each project will vary in size, length, location, etc. They would use this method because each project would vary widely, so you could not spread the costs evenly for each one. Process costing is a way of evenly spreading costs for their products because all products are either mass-produced or very similar. An example of a company that would use process costing is a paper company. They produce one product in large quantities to allocate the costs evenly for each batch produced. The main difference between the two is how the overhead is assigned to the product, where job costing is more for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY