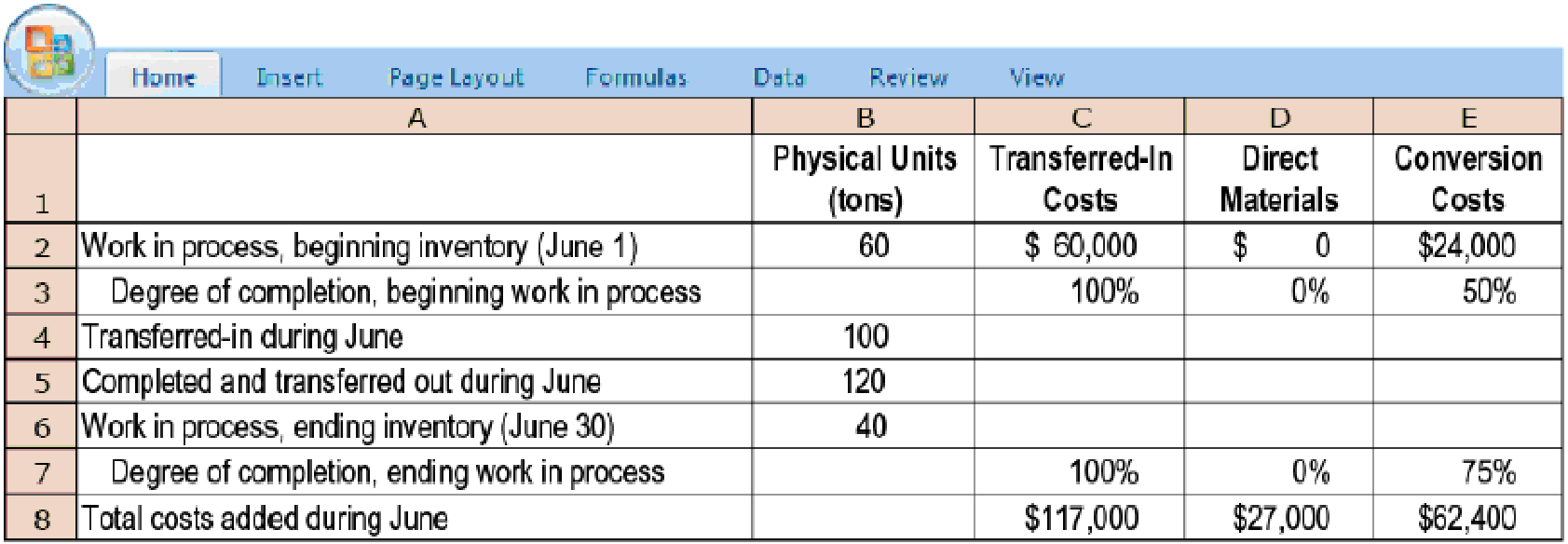

Transferred-in costs, FIFO method. Refer to the information in Exercise 17-31. Suppose that Trendy uses the FIFO method instead of the weighted-average method in all of its departments. The only changes to Exercise 17-31 under the FIFO method are that total transferred-in costs of beginning work in process on June 1 are $45,000 (instead of $60,000) and total transferred-in costs added during June are $114,000 (instead of $117,000).

Required

Do Exercise 17-31 using the FIFO method. Note that you first need to calculate equivalent units of work done in the current period (for transferred-in costs, direct materials, and conversion costs) to complete beginning work in process, to start and complete new units, and to produce ending work in process.

17-31 Transferred-in costs, weighted-average method. Trendy Clothing, Inc. is a manufacturer of winter clothes. It has a knitting department and a finishing department. This exercise focuses on the finishing department. Direct materials are added at the end of the process. Conversion costs are added evenly during the process. Trendy uses the weighted-average method of

- 1. Calculate equivalent units of transferred-in costs, direct materials, and conversion costs.

Required

- 2. Summarize the total costs to account for, and calculate the cost per equivalent unit for transferred-in costs, direct materials, and conversion costs.

- 3. Assign costs to units completed (and transferred out) and to units in ending work in process.

Learn your wayIncludes step-by-step video

Chapter 17 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

Additional Business Textbook Solutions

Foundations Of Finance

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Financial Accounting: Tools for Business Decision Making, 8th Edition

Horngren's Accounting (12th Edition)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,