Foundations Of Finance

10th Edition

ISBN: 9780134897264

Author: KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher: Pearson,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

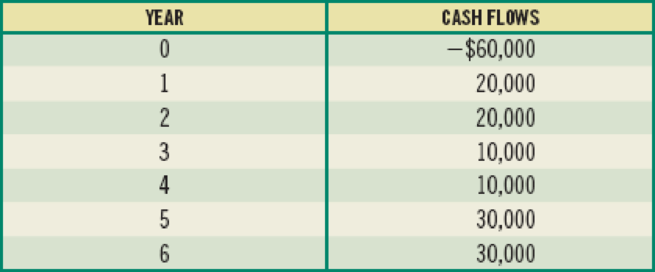

Chapter 10, Problem 14SP

(

Should the project be accepted?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

All techniques: Decision among mutually exclusive investments Pound Industries is attempting to select the best of three mutually exclusive

projects. The initial investment and subsequent cash inflows associated with these projects are shown in the following table.

Cash flows

Initial investment (CF)

Project A

$170,000

Project B

$200,000

Cash inflows (CF), t = 1 to 5

$50,000

$61,500

a. Calculate the payback period for each project.

Project C

$200,000

$63,000

b. Calculate the net present value (NPV) of each project, assuming that the firm has a cost of capital equal to 11%.

c. Calculate the internal rate of return (IRR) for each project.

d. Indicate which project you would recommend.

a. The payback period of project A is

years. (Round to two decimal places.)

years. (Round to two decimal places.)

years. (Round to two decimal places.)

(Round to the nearest cent.)

(Round to the nearest cent.)

(Round to the nearest cent.)

%. (Round to two decimal places.)

%. (Round to two decimal places.)…

A loan of $5,000 is taken at 6% for 3 years. What is the simple interest?A) $800B) $900C) $1,000D) $700

A loan of $5,000 is taken at 6% for 3 years. What is the simple interest?A) $800B) $900C) $1,000D) $700 Need help

Chapter 10 Solutions

Foundations Of Finance

Ch. 10 - Why is capital budgeting such an important...Ch. 10 - What are the disadvantages of using the payback...Ch. 10 - Prob. 4RQCh. 10 - What are mutually exclusive projects? Why might...Ch. 10 - Prob. 6RQCh. 10 - When might two mutually exclusive projects having...Ch. 10 - Prob. 1SPCh. 10 - Prob. 2SPCh. 10 - Prob. 3SPCh. 10 - Prob. 4SP

Ch. 10 - (NPV, PI, and IRR calculations) Fijisawa Inc. is...Ch. 10 - (Payback period, NPV, PI, and IRR calculations)...Ch. 10 - (NPV, PI, and IRR calculations) You are...Ch. 10 - (Payback period calculations) You are considering...Ch. 10 - (NPV with varying required rates of return)...Ch. 10 - Prob. 10SPCh. 10 - (NPV with varying required rates of return) Big...Ch. 10 - (NPV with different required rates of return)...Ch. 10 - (IRR with uneven cash flows) The Tiffin Barker...Ch. 10 - (NPV calculation) Calculate the NPV given the...Ch. 10 - (NPV calculation) Calculate the NPV given the...Ch. 10 - (MIRR calculation) Calculate the MIRR given the...Ch. 10 - (PI calculation) Calculate the PI given the...Ch. 10 - (Discounted payback period) Gios Restaurants is...Ch. 10 - (Discounted payback period) You are considering a...Ch. 10 - (Discounted payback period) Assuming an...Ch. 10 - (IRR) Jella Cosmetics is considering a project...Ch. 10 - (IRR) Your investment advisor has offered you an...Ch. 10 - (IRR, payback, and calculating a missing cash...Ch. 10 - (Discounted payback period) Sheinhardt Wig Company...Ch. 10 - (IRR of uneven cash-flow stream) Microwave Oven...Ch. 10 - (MIRR) Dunder Mifflin Paper Company is considering...Ch. 10 - (MIRR calculation) Arties Wrestling Stuff is...Ch. 10 - (Capital rationing) The Cowboy Hat Company of...Ch. 10 - Prob. 29SPCh. 10 - (Size-disparity problem) The D. Dorner Farms...Ch. 10 - (Replacement chains) Destination Hotels currently...Ch. 10 - Prob. 32SPCh. 10 - Prob. 33SPCh. 10 - Why is the capital-budgeting process so important?Ch. 10 - Prob. 2MCCh. 10 - What is the payback period on each project? If...Ch. 10 - What are the criticisms of the payback period?Ch. 10 - Prob. 5MCCh. 10 - Prob. 6MCCh. 10 - Prob. 7MCCh. 10 - Prob. 8MCCh. 10 - Prob. 9MCCh. 10 - Determine the IRR for each project. Should either...Ch. 10 - How does a change in the required rate of return...Ch. 10 - Caledonia is considering two investments with...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The annual report is considered by some to be the single most important printed document that companies produce...

Accounting Information Systems (14th Edition)

11-13. Discuss how your team is going to identify the existing competitors in your chosen market. Based on the ...

Business Essentials (12th Edition) (What's New in Intro to Business)

S3-5 Identifying types of adjusting entries

Learning Objective 3

A select list of transactions for Anuradh...

Horngren's Accounting (12th Edition)

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

(Record inventory transactions in the periodic system) Wexton Technologies began the year with inventory of 560...

Financial Accounting (12th Edition) (What's New in Accounting)

3. Which method almost always produces the most depreciation in the first year?

a. Units-of-production

b. Strai...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Need help!! What does ROI stand for in finance?A) Rate of InflationB) Return on InvestmentC) Ratio of IncomeD) Return on Insurancearrow_forwardAnswer! What does ROI stand for in finance?A) Rate of InflationB) Return on InvestmentC) Ratio of IncomeD) Return on Insurancearrow_forwardNeed steps! Which one is a short-term source of finance?A) Bank loanB) DebentureC) Trade creditD) Equityarrow_forward

- Which one is a short-term source of finance?A) Bank loanB) DebentureC) Trade creditD) Equity need answer.arrow_forwardNeed help! Which one is a short-term source of finance? A) Bank loanB) DebentureC) Trade creditD) Equityarrow_forwardWhich one is a short-term source of finance?A) Bank loanB) DebentureC) Trade creditD) Equityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License