Foundations Of Finance

10th Edition

ISBN: 9780134897264

Author: KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher: Pearson,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 28SP

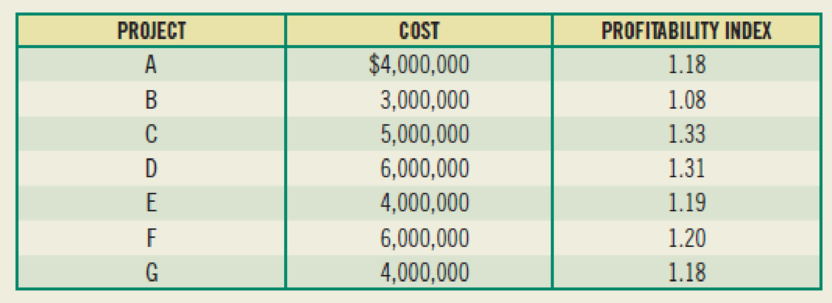

(Capital rationing) The Cowboy Hat Company of Stillwater, Oklahoma, is considering seven capital investment proposals for which the total funds available are limited to a maximum of $12 million. The projects are independent and have the following costs and profitability indexes associated with them:

- a. Under strict capital rationing, which projects should be selected?

- b. What problems are there with capital rationing?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the difference between a contra asset account and a liability?i need help.

What is the significance of a company’s price-to-earnings (P/E) ratio? i need answer.

What is the significance of a company’s price-to-earnings (P/E) ratio?

Chapter 10 Solutions

Foundations Of Finance

Ch. 10 - Why is capital budgeting such an important...Ch. 10 - What are the disadvantages of using the payback...Ch. 10 - Prob. 4RQCh. 10 - What are mutually exclusive projects? Why might...Ch. 10 - Prob. 6RQCh. 10 - When might two mutually exclusive projects having...Ch. 10 - Prob. 1SPCh. 10 - Prob. 2SPCh. 10 - Prob. 3SPCh. 10 - Prob. 4SP

Ch. 10 - (NPV, PI, and IRR calculations) Fijisawa Inc. is...Ch. 10 - (Payback period, NPV, PI, and IRR calculations)...Ch. 10 - (NPV, PI, and IRR calculations) You are...Ch. 10 - (Payback period calculations) You are considering...Ch. 10 - (NPV with varying required rates of return)...Ch. 10 - Prob. 10SPCh. 10 - (NPV with varying required rates of return) Big...Ch. 10 - (NPV with different required rates of return)...Ch. 10 - (IRR with uneven cash flows) The Tiffin Barker...Ch. 10 - (NPV calculation) Calculate the NPV given the...Ch. 10 - (NPV calculation) Calculate the NPV given the...Ch. 10 - (MIRR calculation) Calculate the MIRR given the...Ch. 10 - (PI calculation) Calculate the PI given the...Ch. 10 - (Discounted payback period) Gios Restaurants is...Ch. 10 - (Discounted payback period) You are considering a...Ch. 10 - (Discounted payback period) Assuming an...Ch. 10 - (IRR) Jella Cosmetics is considering a project...Ch. 10 - (IRR) Your investment advisor has offered you an...Ch. 10 - (IRR, payback, and calculating a missing cash...Ch. 10 - (Discounted payback period) Sheinhardt Wig Company...Ch. 10 - (IRR of uneven cash-flow stream) Microwave Oven...Ch. 10 - (MIRR) Dunder Mifflin Paper Company is considering...Ch. 10 - (MIRR calculation) Arties Wrestling Stuff is...Ch. 10 - (Capital rationing) The Cowboy Hat Company of...Ch. 10 - Prob. 29SPCh. 10 - (Size-disparity problem) The D. Dorner Farms...Ch. 10 - (Replacement chains) Destination Hotels currently...Ch. 10 - Prob. 32SPCh. 10 - Prob. 33SPCh. 10 - Why is the capital-budgeting process so important?Ch. 10 - Prob. 2MCCh. 10 - What is the payback period on each project? If...Ch. 10 - What are the criticisms of the payback period?Ch. 10 - Prob. 5MCCh. 10 - Prob. 6MCCh. 10 - Prob. 7MCCh. 10 - Prob. 8MCCh. 10 - Prob. 9MCCh. 10 - Determine the IRR for each project. Should either...Ch. 10 - How does a change in the required rate of return...Ch. 10 - Caledonia is considering two investments with...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License