Concept explainers

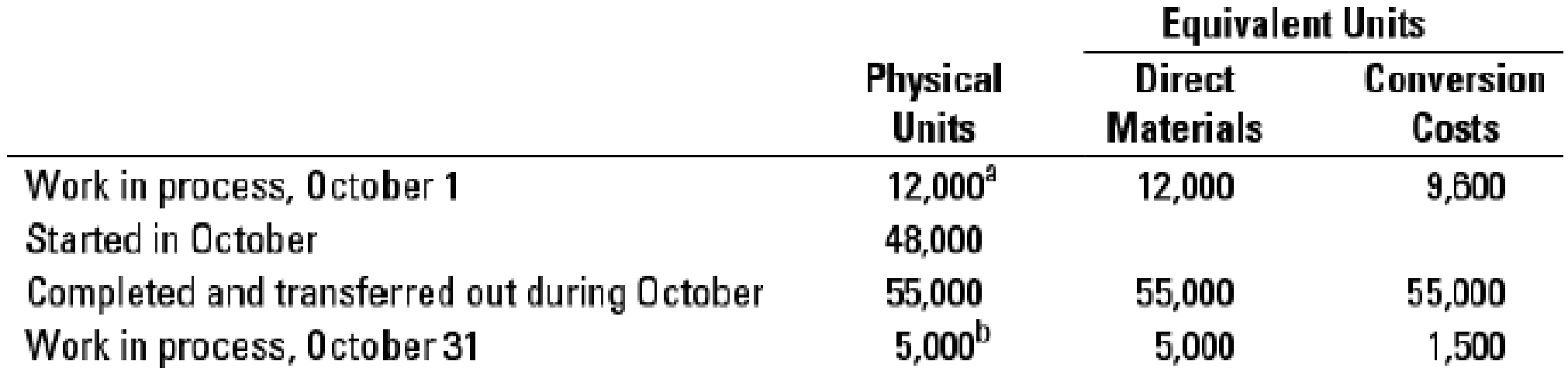

Weighted-average method, assigning costs. ZanyBrainy Corporation makes interlocking children’s blocks in a single processing department. Direct materials are added at the start of production. Conversion costs are added evenly throughout production. ZanyBrainy uses the weighted-average method of

a Degree of completion: direct materials, 100%; conversion costs, 80%.

b Degree of completion: direct materials, 100%; conversion costs, 30%.

Total Costs for October 2017

| Work in process, beginning | ||

| Direct materials | $ 5,760 | |

| Conversion costs | 14,825 | $ 20,585 |

| Direct materials added during October | 25,440 | |

| Conversion costs added during October | 58,625 | |

| Total costs to account for | $104,650 |

- 1. Calculate the cost per equivalent unit for direct materials and conversion costs.

Required

- 2. Summarize the total costs to account for and assign them to units completed (and transferred out) and to units in ending work in process.

Learn your wayIncludes step-by-step video

Chapter 17 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Operations Management

Financial Accounting: Tools for Business Decision Making, 8th Edition

Management (14th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

- prepare an income statement for delray manufacturing (a manufacturer)assume that its cost of goods manufactured is $1,247,000arrow_forwardOn 10/6/2024, company A sells goods to Customer C for €20,000 with an agreed credit of two months. On 31/12/2024, in the context of investigating the collectability of its receivables, the company estimates that it will only collect €10,000 from customer C and forms a provision for doubtful debts for the remaining amount. Finally, on 30/3/2025, company A receives from customer C the amount of: a. €9,000 b. €11,000. You are requested to comment on the impact of the above collection cases a. 9000 b. 11,000 on the income statement for fiscal year 2025, justifying your position.arrow_forwardNeed helparrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning