Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 13E

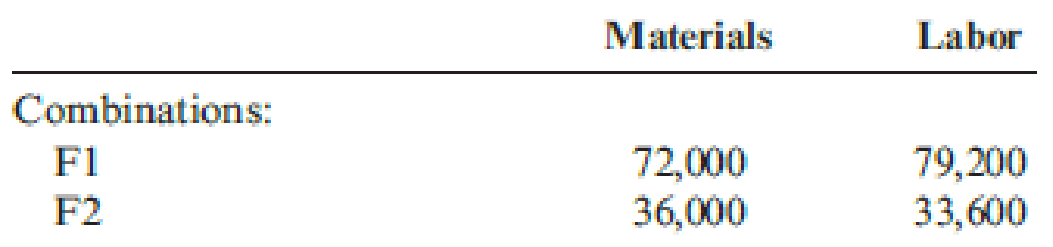

Carsen Company produces handcrafted pottery that uses two inputs: materials and labor. During the past quarter, 24,000 units were produced, requiring 96,000 pounds of materials and 48,000 hours of labor. An engineering efficiency study commissioned by the local university revealed that Carsen can produce the same 24,000 units of output using either of the following two combinations of inputs:

The cost of materials is $8 per pound; the cost of labor is $12 per hour.

Required:

- 1. Compute the output-input ratio for each input of Combination F1. Does this represent a productivity improvement over the current use of inputs? What is the total dollar value of the improvement? Classify this as a technical or an

allocative efficiency improvement. - 2. Compute the output-input ratio for each input of Combination F2. Does this represent a productivity improvement over the current use of inputs? Now, compare these ratios to those of Combination F1. What has happened?

- 3. Compute the cost of producing 24,000 units of output using Combination F1. Compare this cost to the cost using Combination F2. Does moving from Combination F1 to Combination F2 represent a productivity improvement? Explain.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Hi expert please help me this question

Calculate the book equipment of taxable income

Can you please solve this questions

Chapter 15 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 15 - Prob. 1DQCh. 15 - What are the five principles of lean thinking?Ch. 15 - Prob. 3DQCh. 15 - Prob. 4DQCh. 15 - Explain how lean manufacturing is able to produce...Ch. 15 - What role does a demand-pull system have on lean...Ch. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - What is the purpose of assigning facility costs to...Ch. 15 - Why are units shipped used to calculate the...

Ch. 15 - When will the average unit cost be useful for...Ch. 15 - Explain why changes in value-stream profitability...Ch. 15 - Prob. 13DQCh. 15 - Prob. 14DQCh. 15 - What is productivity measurement?Ch. 15 - Prob. 16DQCh. 15 - Prob. 17DQCh. 15 - Discuss the advantages and disadvantages of...Ch. 15 - Prob. 19DQCh. 15 - Prob. 20DQCh. 15 - What is profit-linked productivity measurement and...Ch. 15 - Prob. 22DQCh. 15 - What is the price-recovery component?Ch. 15 - Anderson Company has the following departmental...Ch. 15 - During the week of June 12, Harrison Manufacturing...Ch. 15 - In 20x2, Choctaw Company implements a new process...Ch. 15 - Refer to Cornerstone Exercise 15.3. Choctaw...Ch. 15 - Prob. 5ECh. 15 - Bienestar Inc., has the following departmental...Ch. 15 - Bienestar, Inc., implemented cellular...Ch. 15 - Henderson, Inc., has just created five order...Ch. 15 - Prob. 9ECh. 15 - Shorts Manufacturing, Inc., has implemented lean...Ch. 15 - The following Box Scorecard was prepared for a...Ch. 15 - Prob. 12ECh. 15 - Carsen Company produces handcrafted pottery that...Ch. 15 - Helena Company needs to increase its profits and...Ch. 15 - Helena Company needs to increase its profits and...Ch. 15 - Prob. 16ECh. 15 - Lean manufacturing is characterized by all but one...Ch. 15 - Lean manufacturing uses value streams to produce a...Ch. 15 - A manufacturing cell within a value stream is...Ch. 15 - Total productive efficiency is achieved when both...Ch. 15 - The following information is given for a...Ch. 15 - Sixty employees (all CPAs) of a local public...Ch. 15 - Sixty employees (all CPAs) of a local public...Ch. 15 - Bradford Company, a manufacturer of small tools,...Ch. 15 - Continuous improvement is the governing principle...Ch. 15 - Prob. 26PCh. 15 - Jadlow Company produces handcrafted leather...Ch. 15 - Prob. 28P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- hello teacher please solve questionsarrow_forwardhello teacher please answerarrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What journal entry would Abercrombie & Fitch have made to write down its merchandise inventory during the year ended…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License