Concept explainers

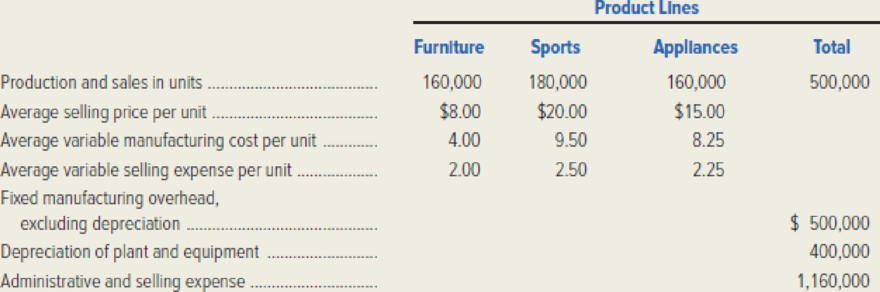

Pacific Rim Industries is a diversified company whose products are marketed both domestically and internationally. The company’s major product lines are furniture, sports equipment, and household appliances. At a recent meeting of Pacific Rim’s board of directors, there was a lengthy discussion on ways to improve overall corporate profitability. The members of the board decided that they required additional financial information about individual corporate operations in order to target areas for improvement.

Danielle Murphy, the controller, has been asked to provide additional data that would assist the board in its investigation. Murphy believes that income statements, prepared along both product lines and geographic areas, would provide the directors with the required insight into corporate operations. Murphy had several discussions with the division managers for each product line and compiled the following information from these meetings.

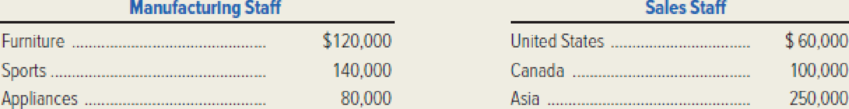

- 1. The division managers concluded that Murphy should allocate fixed manufacturing

overhead to both product lines and geographic areas on the basis of the ratio of the variable costs expended to total variable costs. - 2. Each of the division managers agreed that a reasonable basis for the allocation of

depreciation on plant and equipment would be the ratio of units produced per product line (or per geographical area) to the total number of units produced. - 3. There was little agreement on the allocation of administrative and selling expenses, so Murphy decided to allocate only those expenses that were traceable directly to a segment. For example, manufacturing staff salaries would be allocated to product lines, and sales staff salaries would be allocated to geographic areas. Murphy used the following data for this allocation.

- 4. The division managers were able to provide reliable sales percentages for their product lines by geographical area.

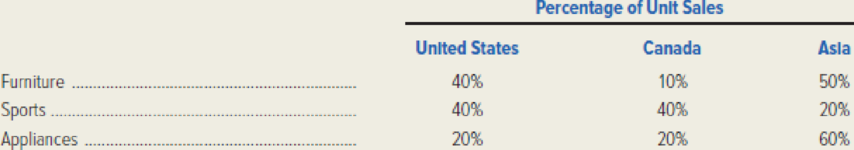

Murphy prepared the following product-line income statement based on the data presented above.

Required:

- 1. Prepare a segmented income statement for Pacific Rim Industries based on the company’s geographical areas. The statement should show the operating income for each segment.

- 2. As a result of the information disclosed by both segmented income statements (by product line and by geographic area), recommend areas where Pacific Rim Industries should focus its attention in order to improve corporate profitability.

1.

Prepare a segmented income statement for Industry P based on the geographical areas of the company.

Explanation of Solution

Segment reporting: Segment reporting refers to the process of preparing accounting report by segment and for the entire organization. Several organizations prepare segmented income statements to show the income for major segments and for the enterprise as a whole.

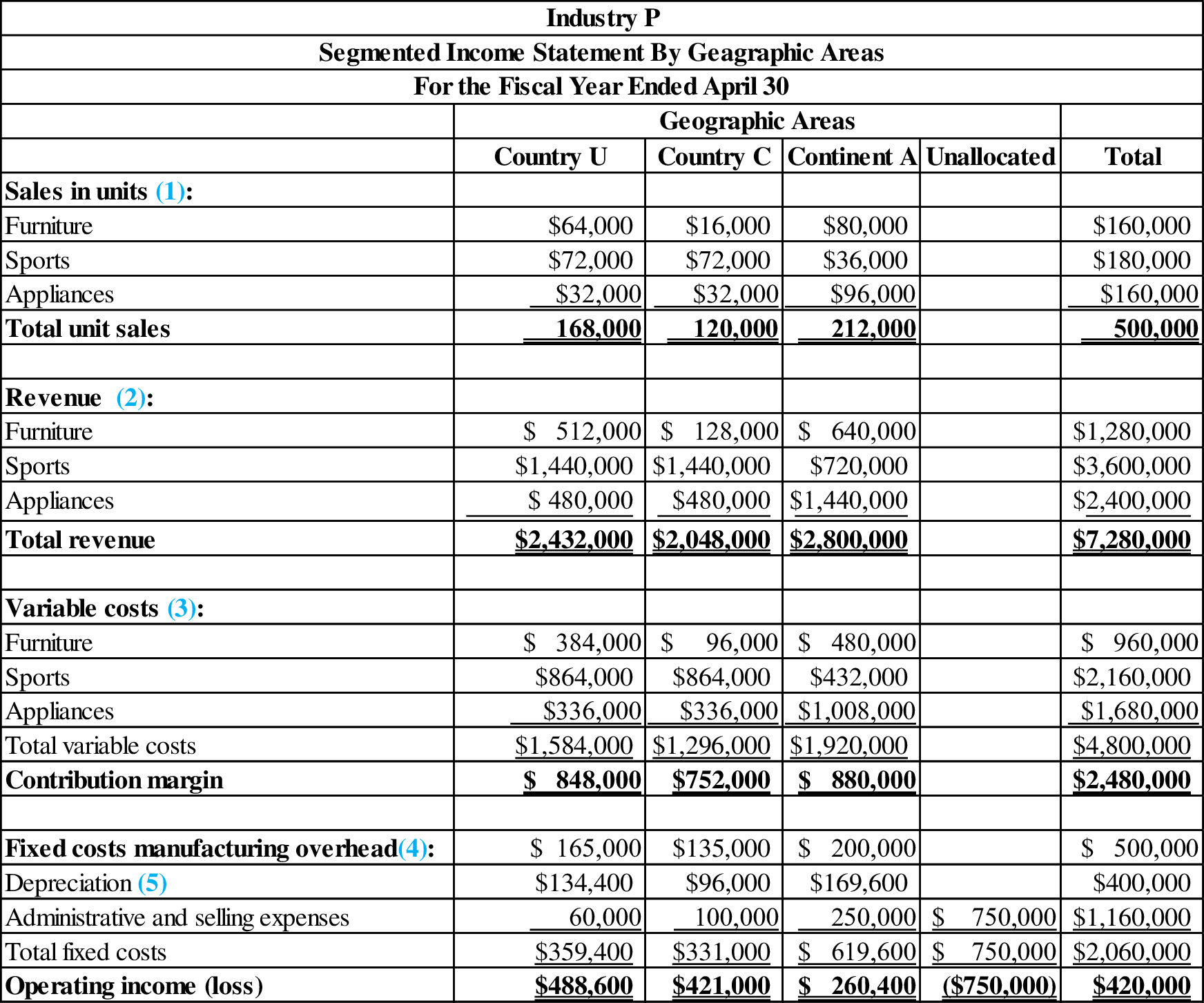

Prepare a segmented income statement:

Figure (1)

Working notes:

(1)Calculate sales in units:

| Total Units | × | % of Sales | = | Units Sold | |

| Country U | |||||

| Furniture | 160,000 | × | 0.4 | = | 64,000 |

| Sports | 180,000 | × | 0.4 | = | 72,000 |

| Appliances | 160,000 | × | 0.2 | = | 32,000 |

| Country C | |||||

| Furniture | 160,000 | × | 0.1 | = | 16,000 |

| Sports | 180,000 | × | 0.4 | = | 72,000 |

| Appliances | 160,000 | × | 0.2 | = | 32,000 |

| Continent A | |||||

| Furniture | 160,000 | × | 0.5 | = | 80,000 |

| Sports | 180,000 | × | 0.2 | = | 36,000 |

| Appliances | 160,000 | × | 0.6 | = | 96,000 |

Table (1)

(2)Calculate revenue:

|

Units Sold (a) |

Unit Price (b) |

Revenue | |

| Country U | |||

| Furniture | 64,000 | $8.00 | $ 512,000 |

| Sports | 72,000 | $20 | $1,440,000 |

| Appliances | 32,000 | $15 | $480,000 |

| Country C | |||

| Furniture | 16,000 | $8 | $128,000 |

| Sports | 72,000 | $20 | $1,440,000 |

| Appliances | 32,000 | $15 | $480,000 |

| Continent A | |||

| Furniture | 80,000 | $8 | $640,000 |

| Sports | 36,000 | $20 | $720,000 |

| Appliances | 96,000 | $15 | $1,440,000 |

Table (2)

(3)Calculate variable costs:

|

Units Sold (a) |

Variable manufacturing Cost per unit (b) |

Variable selling Cost per unit (c) |

Total variable cost | |

| Country U | ||||

| Furniture | 64,000 | $4 | $2 | $384,000 |

| Sports | 72,000 | $10 | $3 | $864,000 |

| Appliances | 32,000 | $8 | $2 | $336,000 |

| Country C | ||||

| Furniture | 16,000 | $4 | $2 | $96,000 |

| Sports | 72,000 | $10 | $3 | $864,000 |

| Appliances | 32,000 | $8 | $2 | $336,000 |

| Continent A | ||||

| Furniture | 80,000 | $4 | $2 | $480,000 |

| Sports | 36,000 | $10 | $3 | $432,000 |

| Appliances | 96,000 | $8 | $2 | $1,008,000 |

Table (3)

(4)Calculate manufacturing overhead:

|

Total Manufacturing Overhead (a) | Area Variable costs |

Proportion of Total (b) |

Allocated Manufacturing Cost | |

| Country U | $500,000 | $1,584,000 | 33% | $165,000 |

| Country C | $500,000 | $1,296,000 | 27% | $135,000 |

| Continent A | $500,000 | $1,920,000 | 40% | $200,000 |

| Total | $4,800,000 | $500,000 |

Table (4)

(5)Calculate depreciation expense:

|

Total Manufacturing Overhead (a) | Area Variable costs |

Proportion of Total (b) |

Allocated Manufacturing Cost | |

| Country U | $400,000 | $168,000 | 33.60% | $134,400 |

| Country C | $400,000 | $120,000 | 24.00% | $96,000 |

| Continent A | $400,000 | $212,000 | 42.40% | $ 169,600 |

| Total | $500,000 | $400,000 |

Table (5)

2.

Recommend areas in which Industry P must focus its attention in order to improve corporate profitability.

Explanation of Solution

Areas where the management of the company must focus its attention in order to enhance corporate profitability include the following:

The income statement by product line provides that the furniture product might not be profitable. The product line of furniture does not have a “positive contribution”. Conversely, the “fixed costs allocated” to the product line will result in a loss. The management must investigate the following factors:

- Discontinuing the manufacture of furniture and focusing on the other product lines that are profitable more.

- Cutting variable costs linked with product line of furniture.

- The probability of maximizing volume by cutting prices or increasing advertising will result in a larger total contribution margin.

- The probability of maximizing the selling price of these products.

- Calculate the amount of fixed costs assigned to furniture is separable if the product line is dropped.

Want to see more full solutions like this?

Chapter 12 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Gale Corporation owns 15% of the common stock of Troy Enterprises and uses the fair-value method to account for this investment. Troy reported net income of $140,000 for 2022 and paid dividends of $80,000 on November 1, 2022. How much income should Gale recognize on this investment in 2022? a. $21,000 b. $12,000 c. $33,000 d. $9,500 e. $60,000arrow_forwardHow much income should Mason investments recognize on this investment in 2024 on these financial accounting question?arrow_forwardPresented below is the trial balance of Sandhill Corporation at December 31, 2020. Debit Credit Cash $289,100 Sales Revenue $11,907,000 Debt Investments (trading) (at cost, $218,000) 225,400 Cost of Goods Sold 7,056,000 Debt Investments (long-term) 439,040 Equity Investments (long-term) 407,680 Notes Payable (short-term) 132,300 Accounts Payable 668,360 Selling Expenses 2,940,000 Investment Revenue 93,100 Land 382,200 Buildings 1,528,800 Dividends Payable 199,920 Accrued Liabilities 141,120 Accounts Receivable 638,960 Accumulated Depreciation–Buildings 223,440 Allowance for Doubtful Accounts 37,240 Administrative Expenses 1,323,000 Interest Expense 310,660 Inventory 877,100 Gain 117,600 Notes Payable (long-term) 1,323,000 Equipment 882,000 Bonds Payable 1,470,000 Accumulated Depreciation–Equipment 88,200 Franchises 235,200 Common Stock ($5 par) 1,470,000 Treasury Stock 281,260 Patents 287,140 Retained Earnings 114,660 Paid-in Capital in Excess of Par 117,600 Totals $18,103,540 Debit…arrow_forward

- Aram's taxable income before considering capital gains and losses is $85,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer). Aram sold a capital asset that he owned for more than one year for a $3,750 gain, a capital asset that he owned for more than one year for a $550 loss, a capital asset that he owned for six months for a $450 gain, and a capital asset he owned for two months for a $2,400 loss. What is taxable income and incomed taxed at ordinary rates?arrow_forwardMarc and Mikkel are married and file a joint tax return. Marc and Mikkel earned salaries this year of $64,200 and $13,200, respectively. In addition to their salaries, they received interest of $354 from municipal bonds and $600 from corporate bonds. Marc contributed $2,600 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,600 (under a divorce decree effective June 1, 2017). Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,200 of expenditures that qualify as itemized deductions, and they had a total of $2,596 in federal income taxes withheld from their paychecks during the year.What is the total amount of Marc and Mikkel's deductions from AGI?arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

- Can you please give me correct solution this general accounting question?arrow_forwardMichael McDowell Co. establishes a $108 million liability at the end of 2025 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2026. Also, at the end of 2025, the company has $54 million of temporary differences due to excess depreciation for tax purposes, $7.56 million of which will reverse in 2026. The enacted tax rate for all years is 20%, and the company pays taxes of $34.56 million on $172.80 million of taxable income in 2025. McDowell expects to have taxable income in 2026. Assuming that the only deferred tax account at the beginning of 2025 was a deferred tax liability of $5,400,000, draft the income tax expense portion of the income statement for 2025, beginning with the line "Income before income taxes." (Hint: You must first compute (1) the amount of temporary difference underlying the beginning $5,400,000 deferred tax liability, then (2) the amount of temporary differences…arrow_forwardHi experts please answer the financial accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L