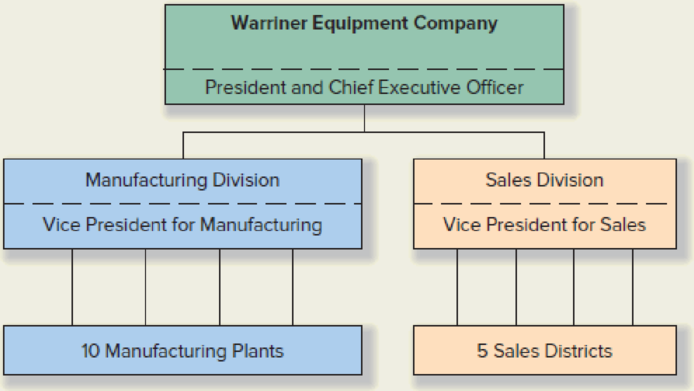

Warriner Equipment Company, which is located in Ontario, Canada, manufactures heavy construction equipment. The company’s primary product, an especially powerful bulldozer, is among the best produced in North America. The company operates in a very price-competitive industry, so it has little control over the price of its products. It must meet the market price. To do so, the firm has to keep production costs in check by operating as efficiently as possible. Mathew Basler, the company’s president, has stated that, to be successful, the company must provide a very high-quality product and meet its delivery commitments to customers on time. Warriner Equipment Company is organized as shown below.

There is currently a disagreement between the company’s two vice presidents regarding the responsibility-accounting system. The vice president for manufacturing claims that the 10 plants should be cost centers. He recently expressed the following sentiment: “The plants should be cost centers because the plant managers do not control the sales of our products. Designating the plants as profit centers would result in holding the plant managers responsible for something they can’t control.” A contrary view is held by the vice president for marketing. He recently made the following remarks: “The plants should be profit centers. The plant managers are in the best position to affect the company’s overall profit.”

Required: As the company’s new controller, you have been asked to make a recommendation to Mathew Basler, the company president, regarding the responsibility center issue. Write a memo to the president making a recommendation and explaining the reasoning behind it. In your memo, address the following points.

- 1. Assuming that Warriner Equipment Company’s overall goal is profitability, what are the company’s critical success factors? A critical success factor is a variable that meets these two criteria: It is largely under the company’s control and the company must succeed in this area in order to reach its overall goal of profitability.

- 2. Which responsibility-accounting arrangement is most consistent with achieving success on the company’s critical success factors?

- 3. What responsibility-center designation is most appropriate for the company’s sales districts?

- 4. As a specific example, consider the rush-order problem illustrated in the chapter. Suppose that Warriner Equipment Company often experiences rush orders from its customers. Which of the two proposed responsibility-accounting arrangements is best suited to making good decisions about accepting or rejecting rush orders? Specifically, should the plants be cost centers or profit centers?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Asbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have a smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model. Since the introduction of the new product, profits have been steadily declining, although sales have been increasing. The management at ACE believes that the problem might be in how the accounting system allocates costs to products. The current system at ACE allocates manufacturing overhead to products based on direct labor costs. For the most recent year, which is representative, manufacturing overhead totaled $2,023,500 based on production of 30,000 Personal grinders and 10,000 Commercial grinders. Direct costs were as follows: Personal Commercial Total Direct materials $ 1,444,200 $ 609,750 $ 2,053,950 Direct labor 1,029,000 657,250 1,686,250 Management has determined that overhead costs are caused by three cost…arrow_forwardAsbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have a smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model. Since the introduction of the new product, profits have been steadily declining, although sales have been increasing. The management at ACE believes that the problem might be in how the accounting system allocates costs to products. The current system at ACE allocates manufacturing overhead to products based on direct labor costs. For the most recent year, which is representative, manufacturing overhead totaled $2,145,000 based on production of 30,000 Personal grinders and 10,000 Commercial grinders. Direct costs were as follows: Direct materials Direct labor Personal $ 1,451,400 1,038,000 Commercial $ 702,000 749,500 Total $ 2,153,400 1,787,500 Management has determined that overhead costs are caused by three cost drivers. These…arrow_forwardAsbury Coffee Enterprises (ACE) manufactures two models of coffee grinders. Personal and Commercial. The Personal grinders have a smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model. Since the introduction of the new product, profits have been steadily declining, although sales have been increasing. The management at ACE believes that the problem might be in how the accounting system allocates costs to products. The current system at ACE allocates manufacturing overhead to products based on direct labor costs. For the most recent year, which is representative, manufacturing overhead totaled $1,929,000 based on production of 30,000 Personal grinders and 10,000 Commercial grinders. Direct costs were as follows: Direct materials Direct labor Cost Driver Number of production runs Quality tests performed Shipping orders processed Total overhead Management has determined that overhead costs are caused by three cost…arrow_forward

- Zodiac Sound Company manufactures audio systems, both made-to-order and mass-produced systems that are typically sold to large- scale manufacturers of electronics equipment. For competitive reasons, the company is trying to increase its manufacturing cycle efficiency (MCE) measure. As a strategy for improving its MCE performance, the company is considering a switch to JIT manufacturing. While the company managers have a fairly good feel for the costs of implementing JIT, they are unsure about the benefits of such a move, both in financial and nonfinancial terms. To help inform the ultimate decision regarding a move to a JIT system, you've been asked to provide some input. Fortunately, you've recently attended a continuing professional education (CPE) workshop on the costs and benefits of moving to JIT and therefore feel comfortable responding to management's request. Required: 3. Given the estimated data below, calculate the MCE for both the current manufacturing process and the…arrow_forwardZodiac Sound Company manufactures audio systems, both made-to-order and mass-produced systems that are typically sold to large- scale manufacturers of electronics equipment. For competitive reasons, the company is trying to increase its manufacturing cycle efficiency (MCE) measure. As a strategy for improving its MCE performance, the company is considering a switch to JIT manufacturing. While the company managers have a fairly good feel for the costs of implementing JIT, they are unsure about the benefits of such a move, both in financial and nonfinancial terms. To help inform the ultimate decision regarding a move to a JIT system, you've been asked to provide some input. Fortunately, you've recently attended a continuing professional education (CPE) workshop on the costs and benefits of moving to JIT and therefore feel comfortable responding to management's request. Required: 3. Given the estimated data below, calculate the MCE for both the current manufacturing process and the…arrow_forwardAn Australian company has two manufacturing plants, one in Australia and the other in a Southeast Asian country. Both produce the same product, each for sale in their respective countries. However, their labour productivity and capital productivity figures are quite different. The analyst thinks this is because the Australian plant uses more automated equipment for processing while the other plant uses a higher percentage of labour. In your own words, explain how the aforementioned factors can cause productivity figures to be misleading. Is there another way to compare the two plants that would be more meaningful?arrow_forward

- It's Your Turn. Show Us What You Know Shannon's Brewery in Keller, Texas is considering using a sales team to help it penetrate market areas not served by its current distributors. However, Shannon Carter, the CEO, wants to know whether it would be cheaper to hire an independent outside sales force rather than hire and train his own sales personnel. Estimates are that the costs of hiring, training, and maintaining his own sales force would entail fixed costs of salaries and administrative overhead of $300,000 per year. These sales people would also receive a 2.9% commission on all sales. If going with the independent sales force option, all costs would be variable in that these reps would be paid a commission of 10.8% on all sales. At what level of sales will the costs of each sales force be equal? Round your answer to the nearest dollar value. Round your answer to the nearest one dollar.arrow_forwardHyundai Heavy Industries Co. is one of Korea’s largest industrial producers.According to an article in BusinessWeek Online, the company is not only the world’s largest shipbuilder but also manufactures other industrial goods ranging from construction equipment and marine engines to building power plants and oil refineries worldwide. Despite being a major industrial force in Korea, several of the company’s divisions are unprofitable, or “bleeding red ink” in the words of the article. Indeed, last year the power plant and oil refineries building division recorded a $105 million loss, or 19 percent of its sales. Hyundai Heavy Industries recently hired a new CEO who is charged with the mission of bringing the un-profitable divisions back to profitability. According to BusinessWeek,Hyundai’s profit-driven CEO has provided division heads with the followingultimatum: “... hive off money-losing businesses and deliver profits within ayear—or else resign.” Suppose you are the head of the marine…arrow_forwardMercury, Incorporated, produces cell phones at its plant in Texas. In recent years, the company's market share has been eroded by stiff competition from overseas. Price and product quality are the two key areas in which companies compete in this market. A year ago, the company's cell phones had been ranked low in product quality in a consumer survey. Shocked by this result, Jorge Gomez, Mercury's president, initiated an intense effort to improve product quality. Gomez set up a task force to implement a formal quality improvement program. Included on this task force were representatives from the Engineering, Marketing, Customer Service, Production, and Accounting departments. The broad representation was needed because Gomez believed that this was a companywide program and that all employees should share the responsibility for its success. After the first meeting of the task force, Holly Elsoe, manager of the Marketing Department, asked John Tran, production manager, what he thought of…arrow_forward

- Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are smaller and less expensive than the home consoles. The company only recently began producing the home model. Since the introduction of the new product, profits have been steadily declining. Management believes that the accounting system is not accurately allocating costs to products, particularly because sales of the new product have been increasing. Management has asked you to investigate the cost allocation problem. You find that manufacturing overhead is currently assigned to products based on their direct labor costs. For your investigation, you have data form last year. Manufacturing overhead was $1,432,000 based on production of 290,000 handheld consoles and 108,000 home consoles. Direct labor and direct materials costs were as follows. Handheld Home Total Direct labor…arrow_forwardMaglie Company manufactures two video game consoles: handheld and home. The handheld consoles are smaller and less expensive than the home consoles. The company only recently began producing the home model. Since the introduction of the new product, profits have been steadily declining. Management believes that the accounting system is not accurately allocating costs to products, particularly because sales of the new product have been increasing. Management has asked you to investigate the cost allocation problem. You find that manufacturing overhead is currently assigned to products based on their direct labor costs. For your investigation, you have data from last year. Manufacturing overhead was $1,334,000 based on production of 320,000 handheld consoles and 113,000 home consoles. Direct labor and direct materials costs were as follows. Handheld Home Total Direct labor $ 1,285,500 $ 382,000 $ 1,667,500 Materials 800,000…arrow_forwardMaglie Company manufactures two video game consoles: handheld and home. The handheld consoles are smaller and less expensive than the home consoles. The company only recently began producing the home model. Since the introduction of the new product, profits have been steadily declining. Management believes that the accounting system is not accurately allocating costs to products, particularly because sales of the new product have been increasing. Management has asked you to investigate the cost allocation problem. You find that manufacturing overhead is currently assigned to products based on their direct labor costs. For your investigation, you have data from last year. Manufacturing overhead was $1,237,000 based on production of 290,000 handheld consoles and 100,000 home consoles. Direct labor and direct materials costs were as follows. Handheld Home Total Direct labor $ 1,135,250 $ 411,000 $ 1,546,250 Materials 700,000 671,000 1,371,000…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning