Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 33E

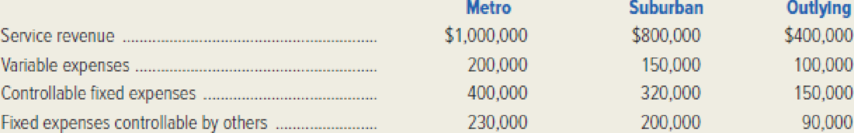

Countywide Cable Services, Inc. is organized with three segments: Metro, Suburban, and Outlying. Data for these segments for the year just ended follow.

In addition to the expenses listed above, the company has $95,000 of common fixed expenses. Income-tax expense for the year is $145,000.

Required:

- 1. Prepare a segmented income statement for Countywide Cable Services, Inc. Use the contribution format.

- 2. Build a spreadsheet: Construct an Excel spreadsheet to solve the preceding requirement. Show how the solution will change if the following information changes: the sales revenues were $950,000 and $815,000 for Metro and Suburban, respectively.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Beginning inventory, purchases, and sales for an inventory item are as follows:

Date

Line Item Description

Units and Cost

Sep. 1

Beginning Inventory

23 units @ $15

5

Sale

13 units

17

Purchase

25 units @ $17

30

Sale

17 units

Assuming a perpetual inventory system and the last-in, first-out method:

Determine the cost of goods sold for the September 30 sale.$

Determine the inventory on September 30.

$

Line Item Description

Units and Cost

Beginning inventory

12 units at $48

First purchase

15 units at $53

Second purchase

55 units at $56

Third purchase

13 units at $61

The firm uses the periodic inventory system, and there are 25 units of the commodity on hand at the end of the year.

What is the ending inventory balance of Commodity Z using LIFO?

a. $1,465

b. $1,265

c. $5,244

d. $1,200

Company sells blankets for $40 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Company uses a perpetual inventory system.

Date

Blankets

Units

Cost

May 3

Purchase

11

$20

10

Sale

4

17

Purchase

10

$17

20

Sale

6

23

Sale

3

30

Purchase

8

$24

Determine the May 31 inventory balance using the FIFO inventory costing method.

a. $328

b. $272

c. $320

d. $384

Chapter 12 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 12 - Why is goal congruence important to an...Ch. 12 - Define and give examples of the following terms:...Ch. 12 - Prob. 3RQCh. 12 - Explain the relationship between performance...Ch. 12 - What is the key feature of activity-based...Ch. 12 - What is the key feature of activity-based...Ch. 12 - Prob. 7RQCh. 12 - Define and give examples of the following terms:...Ch. 12 - Give an example of a common resource in an...Ch. 12 - Explain how and why cost allocation might be used...

Ch. 12 - Define the term cost allocation base. What would...Ch. 12 - Referring to Exhibit 125, why are marketing costs...Ch. 12 - Prob. 13RQCh. 12 - Why do some managers and accountants choose not to...Ch. 12 - Why is it important in responsibility accounting...Ch. 12 - Prob. 16RQCh. 12 - Prob. 17RQCh. 12 - What is meant by customer profitability analysis?...Ch. 12 - List seven areas in which nonfinancial,...Ch. 12 - Define the term manufacturing cycle efficiency.Ch. 12 - Prob. 21RQCh. 12 - What is meant by aggregate productivity, and what...Ch. 12 - Prob. 23RQCh. 12 - Using the Internet, identity the organizational...Ch. 12 - Prob. 25RQCh. 12 - Explain how an improvement in employee retention...Ch. 12 - For each of the following organizational subunits,...Ch. 12 - Prob. 28ECh. 12 - Prob. 29ECh. 12 - Xerox Corporation has been an innovator in its...Ch. 12 - The following data pertain to the Waikiki Sands...Ch. 12 - Lackawanna Community College has three divisions:...Ch. 12 - Countywide Cable Services, Inc. is organized with...Ch. 12 - Prob. 35ECh. 12 - Prob. 36ECh. 12 - Prob. 37ECh. 12 - Prob. 39PCh. 12 - Prob. 40PCh. 12 - Prob. 41PCh. 12 - Rocky Mountain General Hospital serves three...Ch. 12 - Refer to the organization chart for Rocky Mountain...Ch. 12 - Prob. 44PCh. 12 - Buckeye Department Stores, Inc. operates a chain...Ch. 12 - Building Services, Co. (BSC) was started a number...Ch. 12 - Warriner Equipment Company, which is located in...Ch. 12 - Prob. 48PCh. 12 - MedTech, Inc. manufactures diagnostic testing...Ch. 12 - Prob. 50PCh. 12 - Cathys Classic Clothes is a retailer that sells to...Ch. 12 - Pacific Rim Industries is a diversified company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On the basis of the following data, what is the estimated cost of the inventory on May 31 using the retail method? Date Line Item Description Cost Retail May 1 Inventory $23,800 $39,670 May 1-31 Purchases 42,600 67,540 May 1-31 Sales 91,090 a. $24,690 b. $19,580 c. $29,564 d. $9,984arrow_forward00000000 The following lots of Commodity Z were available for sale during the year. Line Item Description Units and Cost Beginning inventory 12 units at $48 First purchase 15 units at $53 Second purchase 55 units at $56 Third purchase 13 units at $61 The firm uses the periodic inventory system, and there are 25 units of the commodity on hand at the end of the year. What is the ending inventory balance of Commodity Z using LIFO? a. $1,465 b. $1,265 c. $5,244 d. $1,200arrow_forwardBeginning inventory 8 units at $51 First purchase 17 units at $55 Second purchase 26 units at $58 Third purchase 15 units at $63 The firm uses the periodic inventory system, and there are 23 units of the commodity on hand at the end of the year. What is the ending inventory balance of Commodity Z using FIFO? a. $1,173 b. $1,409 c. $3,773 d. $3,796arrow_forward

- 00000arrow_forwardThe inventory data for an item for November are: Nov. 1 Inventory 4 Sold 19 units at $23 8 units 10 Purchased 32 units at $21 25 units 17 Sold 30 Purchased 21 units at $23 Using a perpetual system, what is the cost of goods sold for November if the company uses LIFO? a. $731 b. $861 c. $962 Od. $709arrow_forwardI got the 3rd incorrect. can you help me go step by step. Date Line Item Description Units and Cost Amount Mar. 1 Inventory 21 units @ $31 $651 June 16 Purchase 29 units @ $33 957 Nov. 28 Purchase 39 units @ $39 1,521 Total 89 units $3,129 There are 13 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the inventory cost using the weighted average cost methods. $arrow_forward

- 3arrow_forwardBoxwood Company sells blankets for $31 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system. Date Blankets Units Cost May 3 Purchase 8 $15 10 Sale 5 17 Purchase 10 $18 20 Sale 7 23 Sale 2 30 Purchase 12 $19 Determine the cost of goods sold for the sale of May 20 using the FIFO inventory costing method. a. $201 b. $114 c. $117 O d. $171arrow_forwardIn the month of March, Horizon Textiles Ltd. had 7,500 units in beginning work in process that were 65% complete. During March, 29,500 units were transferred into production from another department. At the end of March, there were 3,800 units in ending work in process that were 40% complete. Compute the equivalent units of production for materials and conversion costs using the weighted-average method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License