Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 49P

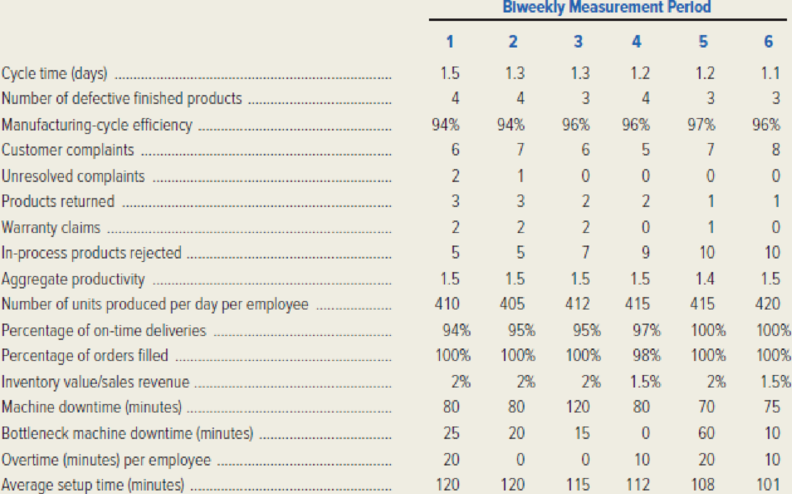

MedTech, Inc. manufactures diagnostic testing equipment used in hospitals. The company practices JIT production management and has a state-of-the-art manufacturing system, including an FMS and an AMHS. The following nonfinancial data were collected biweekly in the Harrisburg plant during the first quarter of the current year.

Required:

- 1. For each nonfinancial performance measure, indicate which of the following areas of manufacturing performance is involved: (a) production processing, (b) product quality, (c) customer acceptance, (d) in-process quality control, (e) productivity, (f) delivery performance, (g) raw material and scrap, (h) inventory, (i) machine maintenance. Some measures may relate to more than one area.

- 2. Write a memo to management commenting on the performance data collected for the Harrisburg plant. Be sure to note any trends or other important results you see in the data. Evaluate the Harrisburg plant in each of the areas listed in requirement (1).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please try to give correct answer this financial accounting question

Don't use ai given answer accounting questions

Right Answer

Chapter 12 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 12 - Why is goal congruence important to an...Ch. 12 - Define and give examples of the following terms:...Ch. 12 - Prob. 3RQCh. 12 - Explain the relationship between performance...Ch. 12 - What is the key feature of activity-based...Ch. 12 - What is the key feature of activity-based...Ch. 12 - Prob. 7RQCh. 12 - Define and give examples of the following terms:...Ch. 12 - Give an example of a common resource in an...Ch. 12 - Explain how and why cost allocation might be used...

Ch. 12 - Define the term cost allocation base. What would...Ch. 12 - Referring to Exhibit 125, why are marketing costs...Ch. 12 - Prob. 13RQCh. 12 - Why do some managers and accountants choose not to...Ch. 12 - Why is it important in responsibility accounting...Ch. 12 - Prob. 16RQCh. 12 - Prob. 17RQCh. 12 - What is meant by customer profitability analysis?...Ch. 12 - List seven areas in which nonfinancial,...Ch. 12 - Define the term manufacturing cycle efficiency.Ch. 12 - Prob. 21RQCh. 12 - What is meant by aggregate productivity, and what...Ch. 12 - Prob. 23RQCh. 12 - Using the Internet, identity the organizational...Ch. 12 - Prob. 25RQCh. 12 - Explain how an improvement in employee retention...Ch. 12 - For each of the following organizational subunits,...Ch. 12 - Prob. 28ECh. 12 - Prob. 29ECh. 12 - Xerox Corporation has been an innovator in its...Ch. 12 - The following data pertain to the Waikiki Sands...Ch. 12 - Lackawanna Community College has three divisions:...Ch. 12 - Countywide Cable Services, Inc. is organized with...Ch. 12 - Prob. 35ECh. 12 - Prob. 36ECh. 12 - Prob. 37ECh. 12 - Prob. 39PCh. 12 - Prob. 40PCh. 12 - Prob. 41PCh. 12 - Rocky Mountain General Hospital serves three...Ch. 12 - Refer to the organization chart for Rocky Mountain...Ch. 12 - Prob. 44PCh. 12 - Buckeye Department Stores, Inc. operates a chain...Ch. 12 - Building Services, Co. (BSC) was started a number...Ch. 12 - Warriner Equipment Company, which is located in...Ch. 12 - Prob. 48PCh. 12 - MedTech, Inc. manufactures diagnostic testing...Ch. 12 - Prob. 50PCh. 12 - Cathys Classic Clothes is a retailer that sells to...Ch. 12 - Pacific Rim Industries is a diversified company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oakridge Manufacturing had the following balances on December 30, 2024: Finished Goods Inventory: $480,000 Cost of Goods Manufactured for December: $1,400,000 Total Manufacturing Costs for December: $1,550,000 Cost of Goods Sold in December: $1,500,000 Calculate the beginning balance of Finished Goods Inventory on December 1, 2024.arrow_forwardNeed answerarrow_forwardThe materials quantity variance for April is?arrow_forward

- What are the required sales?arrow_forwardMartinez Enterprises began the year with owner's equity of $18,000. During the year, Martinez received additional owner investments of $25,000, recorded expenses of $72,000, and had owner drawings of $5,000. If Martinez's ending owner's equity was $52,000, what was the company's revenue for the year?arrow_forwardAccounting 55arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License