You have just graduated from the MBA program of a large university, and one of your favorite courses was Today’s Entrepreneurs. In fact, you enjoyed it so much you have decided you want to “be your own boss.” While you were in the master’s program, your grandfather died and left you $1 million to do with as you please. You are not an inventor, and you do not have a trade skill that you can market; however, you have decided that you would like to purchase at least one established franchise in the fast-foods area, maybe two (if profitable). The problem is that you have never been one to stay with any project for too long, so you figure that your time frame is 3 years. After 3 years you will go on to something else.

You have narrowed your selection down to two choices: (1) Franchise L. Lisa’s Soups, Salads & Stuff, and (2) Franchise S, Sam’s Fabulous Fried Chicken.

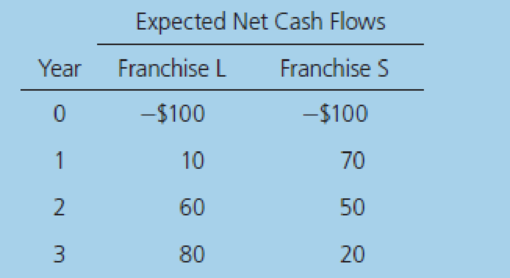

The net cash flows that follow include the price you would receive for selling the franchise in Year 3 and the

Here are the net cash flows (in thousands of dollars):

You also have made subjective risk assessments of each franchise and concluded that both franchises have risk characteristics that require a return of 10%. You must now determine whether one or both of the franchises should be accepted.

- a. What is capital budgeting?

Trending nowThis is a popular solution!

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

- You have just graduated from the MBA program of a large university, and one of your favorite courses was “Today’s Entrepreneurs.” In fact, you enjoyed it so much you have decided you want to “be your own boss.” While you were in the master’s program, your grandfather died and left you $1 million to do with as you please. You are not an inventor, and you do not have a trade skill that you can market; however, you have decided that you would like to purchase at least one established franchise in the fast-food area, maybe two(if profitable). The problem is that you have never been one to stay with any project for too long, so you figure that your time frame is 3 years. After 3 years you will go on tosomething else. You have narrowed your selection down to two choices: (1) Franchise L, Lisa’s Soups, Salads, & Stuff, and (2) Franchise S, Sam’s Fabulous Fried Chicken. The net cash flows shown below include the price you would receive for selling the franchise in Year 3 and the forecast…arrow_forwardYou have just graduated from the MBA program of a large university, and one of your favorite courses was “Today’s Entrepreneurs.” In fact, you enjoyed it so much you have decided you want to “be your own boss.” While you were in the master’s program, your grandfather died and left you $1 million to do with as you please. You are not an inventor, and you do not have a trade skill that you can market; however, you have decided that you would like to purchase at least one established franchise in the fast-food area, maybe two(if profitable). The problem is that you have never been one to stay with any project for too long, so you figure that your time frame is 3 years. After 3 years you will go on tosomething else. You have narrowed your selection down to two choices: (1) Franchise L, Lisa’s Soups, Salads, & Stuff, and (2) Franchise S, Sam’s Fabulous Fried Chicken. The net cash flows shown below include the price you would receive for selling the franchise in Year 3 and the forecast…arrow_forwardYou have just graduated from the MBA program of a large university, and one of your favorite courses was “Today’s Entrepreneurs.” In fact, you enjoyed it so much you have decided you want to “be your own boss.” While you were in the master’s program, your grandfather died and left you $1 million to do with as you please. You are not an inventor, and you do not have a trade skill that you can market; however, you have decided that you would like to purchase at least one established franchise in the fast-food area, maybe two(if profitable). The problem is that you have never been one to stay with any project for too long, so you figure that your time frame is 3 years. After 3 years you will go on tosomething else. You have narrowed your selection down to two choices: (1) Franchise L, Lisa’s Soups, Salads, & Stuff, and (2) Franchise S, Sam’s Fabulous Fried Chicken. The net cash flows shown below include the price you would receive for selling the franchise in Year 3 and the forecast…arrow_forward

- You have just graduated from the MBA program of a large university, and one of your favorite courses was Today’s Entrepreneurs. In fact, you enjoyed it so much you have decided you want to “be your own boss.” While you were in the master’s program, your grandfather died and left you $1 million to do with as you please. You are not an inventor, and you do not have a trade skill that you can market; however, you have decidedthat you would like to purchase at least one established franchise in the fast-foods area, maybe two (if profitable). The problem is that you have never been one to stay with any project for too long, so you figure that your time frame is 3 years. After 3 years you will go on to something else.You have narrowed your selection down to two choices: (1) Franchise L, Lisa’s Soups, Salads & Stuff, and (2) Franchise S, Sam’s Fabulous Fried Chicken. The net cash flows that follow include the price you would receive for selling the franchise in Year 3 and the forecast of…arrow_forward1. You have just graduated from the BTEC program of UTAS and one of your favorite courses was "Entrepreneurship." In fact, you enjoyed it so much you have decided you want to "be your own boss." Your grandfather has given you OMR 130000 to do whatever you wish. He also gives you 10000 in the second year. You have decided that you would like to purchase an old paper factory using all the money and launch a new tissue paper product. The problem is that you have never been one to stay with any project for too long, so you figure that your time frame is 5 years. After 5 years you will go on to something else. The salvage value at the end of the 5th year is OMR 7000. Cash Outflow Cash Inflow Year (OMR) (OMR) 130000 1 10000 20000 2 30000 3 60000 4 80000 20000 It is funded by both debt and equity and currently has a weighted cost of capital (Discount rate) of 8%. Answer the following questions: - A. Calculate the Internal rate of return and net present value for the above project. Critically…arrow_forward1. You have just graduated from the BTEC program of UTAS and one of your favorite courses was “Entrepreneurship.” In fact, you enjoyed it so much you have decided you want to “be your own boss.” Your grandfather has given you OMR 130000 to do whatever you wish. He also gives you 10000 in the second year. You have decided that you would like to purchase an old paper factory using all the money and launch a new tissue paper product. The problem is that you have never been one to stay with any project for too long, so you figure that your time frame is 5 years. After 5 years you will go on to something else. The salvage value at the end of the 5th year is OMR 7000. Year Cash Outflow (OMR) Cash Inflow (OMR) 0 130000 - 1 10000 20000 2 - 30000 3 - 60000 4 - 80000 5 - 20000 It is funded by both debt and equity and currently has a weighted cost of capital (Discount rate) of 8%. Answer the following questions: - A. Calculate the Internal rate of return and net…arrow_forward

- Mr. Ahmed has been working in a small company for many years and earns a living. Due to theincrease in the size of his family (dependent members), the income earned now proves to beinsufficient. Mr. Ahmed approaches his friend Mr. Azad, who has plans of starting a new venture.Mr. Azad is skilled, passionate and has new ideas that would enable him to start a newmanufacturing venture, but lacks capital. Mr. Ahmed, who knows little about doing business, hassaved money over the years and plans to invest the same in a partnership concern with Mr. Azad.Mr. Ahmed wishes to continue his job as well as participate in the partnership concernonly by investing his saved money.Using the above caseA) You are required to advise and explain in detail, the nature of partnership that the above people must enter into ,B) List down the various clauses that need to be incorporated in the partnership deed.arrow_forwardYou have been doing a good business at your auto service & repair shop. Business is brisk! You have decided that, rather than just blowing your profits on a big party, to invest in a way to grow your business and - you hope -- bring in even more profits later. You have been working 50 hours per week at the shop but haven't taken any pay yet. You have money left to divide between your wage, and money to invest in growing your business. The more wages you pay yourself the less you will have to invest in your shop. > Weekly, you have been selling 30 brake replacements ($300 each), and 100 oil changes ($80 each). > Labor costs, have been about $4,400 per week: Technicians: $1,200 each Porter: $620 Service Writer: $800 Cashier: $580 > Supplies & parts cost you $3,400 per week > Rent & utilities for your shop is $5,000 per week > Insurance is $1,200 per week Show your work & circle your answer: 6. Calculate your total weekly revenue. 7. Calculate your weekly profit. 8. Determine your own…arrow_forwardYou recently joined ABC Limited, a small company holding a leading position in an embryonic market. You notice that your boss is very optimistic about the company and argues that ABC Limited's future is ensured. Your boss validates his argument by providing the following reasons. • ABC Limited has sixty percent share of the market due to the lowest cost structure, and • The company has the most reliable and highest-valued products. Required: You are required to write a memo to your boss outlining why the assumptions posed might be incorrect.arrow_forward

- Smart owns multiple Burger restaurants. After months of struggling, one of the restaurants just must be closed, Smart knows that this loss will already cause a decrease in his reported net earnings, he decides to go ahead and charge a majority of the company's expenses to this business unit shut down. This is an example of ………. in earning Managementarrow_forwardKryptonite is a telecommunications provider located in Iowa with hundreds of thousands of employees. Their CEO, Clark Klein, is considering the replacement of their expensive Defined Benefit (DB) Pension Plan which requires large contributions every year with a 401(K) where the employees will bear the investment risk. The majority of the workforce is young, and the top executives are all in their 50s and 60s. 1. Who would benefit the most from the change away from the DB plan to a 401(k)?arrow_forwardImagine that you are a 25-year old finance professional. You wanted to buy the latest model of your favorite laptop brand. You intend for it to used for your passion project which is video-editing. In the past, you have been engaged by your friends to be their videographer and you received some compensation for it. Thinking that this might be a beginning of a new income source, you wanted to invest in a laptop to begin your project. You can either use your credit card to buy it now or you can wait for 18 months to save for it and purchase in cash. Will you buy the laptop now using your credit card or will you wait for the next 18 months to purchase it in cash? Why would you choose such decision? Answer this thoroughly.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College