Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 7P

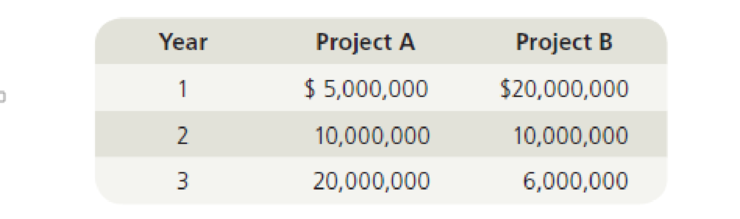

Your division is considering two investment projects, each of which requires an up-front expenditure of $15 million. You estimate that the investments will produce the following net cash flows:

- a. What are the two projects’

net present values , assuming the cost of capital is 5%? 10%? 15%? - b. What are the two projects’ IRRs at these same costs of capital?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Solve plz

Answer correctly otherwise unhelpful

You've collected the following information from your favorite financial website.

52-Week Price

Dividend

Hi

77.40

Lo

Stock (Dividend)

Yield % PE Ratio Close Price Net Change

10.43

Acevedo .36

2.6

6

13.90

-.24

55.81

33.42

Georgette, Incorporated 1.54

3.8

10

40.43

-.01

131.04

70.05

YBM 2.55

2.9

10

89.08

3.07

50.24

35.00

13.95

Manta Energy .80

5.2

6

20.74

Winter Sports .32

1.5

28

15.43

??

-.26

.18

According to analysts, the growth rate in dividends for YBM for the next five years is expected to be 21 percent. Suppose YBM meets

this growth rate in dividends for the next five years and then the dividend growth rate falls to 5.75 percent, indefinitely. Assume

investors require a return of 14 percent on YBM stock. According to the dividend growth model, what should the stock price be today?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 12 - What types of projects require the least detailed...Ch. 12 - Prob. 3QCh. 12 - Prob. 4QCh. 12 - Prob. 5QCh. 12 - A project has an initial cost of 40,000, expected...Ch. 12 - IRR Refer to Problem 12-1. What is the projects...Ch. 12 - Prob. 3PCh. 12 - Prob. 4PCh. 12 - Prob. 5PCh. 12 - Prob. 6P

Ch. 12 - Your division is considering two investment...Ch. 12 - Edelman Engineering is considering including two...Ch. 12 - Prob. 9PCh. 12 - Project S has a cost of $10,000 and is expected to...Ch. 12 - Prob. 11PCh. 12 - After discovering a new gold vein in the Colorado...Ch. 12 - Prob. 13PCh. 12 - Prob. 14PCh. 12 - The Pinkerton Publishing Company is considering...Ch. 12 - Shao Airlines is considering the purchase of two...Ch. 12 - The Perez Company has the opportunity to invest in...Ch. 12 - Filkins Fabric Company is considering the...Ch. 12 - The Ulmer Uranium Company is deciding whether or...Ch. 12 - The Aubey Coffee Company is evaluating the...Ch. 12 - Your division is considering two investment...Ch. 12 - The Scampini Supplies Company recently purchased a...Ch. 12 - You have just graduated from the MBA program of a...Ch. 12 - Prob. 2MCCh. 12 - Define the term “net present value (NPV).” What is...Ch. 12 - Prob. 4MCCh. 12 - Prob. 5MCCh. 12 - What is the underlying cause of ranking conflicts...Ch. 12 - Prob. 7MCCh. 12 - Prob. 8MCCh. 12 - Prob. 9MCCh. 12 - Prob. 10MCCh. 12 - In an unrelated analysis, you have the opportunity...Ch. 12 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1. Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow?arrow_forwardQuestion 3Footfall Manufacturing Ltd. reports the following financialinformation at the end of the current year:Net Sales $100,000Debtor’s turnover ratio (based onnet sales)2Inventory turnover ratio 1.25Fixed assets turnover ratio 0.8Debt to assets ratio 0.6Net profit margin 5%Gross profit margin 25%Return on investment 2%Use the given information to fill out the templates for incomestatement and balance sheet given below:Income Statement of Footfall Manufacturing Ltd. for the year endingDecember 31, 20XX(in $)Sales 100,000Cost of goodssoldGross profitOther expensesEarnings beforetaxTax @50%Earnings aftertaxBalance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX(in $)Liabilities Amount Assets AmountEquity Net fixed assetsLong termdebt50,000 InventoryShort termdebtDebtorsCashTOTAL TOTALarrow_forwardSolve correctly and no aiarrow_forward

- You are considering an option to purchase or rent a single residential property. You can rent it for $5,000 per month and the owner would be responsible for maintenance, property insurance, and property taxes. Alternatively, you can purchase this property for $204,500 and finance it with an 80 percent mortgage loan at 4 percent interest that will fully amortize over a 30-year period. The loan can be prepaid at any time with no penalty. You have done research in the market area and found that (1) properties have historically appreciated at an annual rate of 2 percent per year, and rents on similar properties have also increased at 2 percent annually; (2) maintenance and insurance are currently $1,545.00 each per year and they have been increasing at a rate of 3 percent per year; (3) you are in a 24 percent marginal tax rate and plan to occupy the property as your principal residence for at least four years; (4) the capital gains exclusion would apply when you sell the property; (5)…arrow_forwardIf data is unclear or blurr then comment i will write it.arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License