Concept explainers

1)

Case summary:

Person X is graduated from large university. He desired to become an entrepreneur. After death of his grandfather he got a business worth of $1million. Then he decided to buy minimum one franchise in the area of fast foods.an issue behind is that he will sell off investment after 3 years and go on to something else.

Person X has two alternatives franchise L and franchise S. Franchise L providing breakfast and lunch while franchise S is providing only dinner. Person X made evaluation of each franchise and find out that both have characteristics of risk and needs

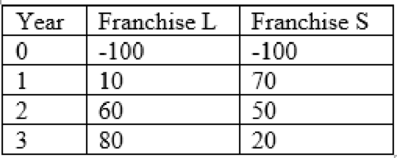

Here are the net cash flows (in thousand $)

To determine: The payback period and its meaning.

2)

To determine: The rationale for the payback period technique and the franchise or franchises must be accepted if the company’s supreme acceptable payback is 2 years and is both franchises are independent or mutually exclusive.

3)

To determine: The variance among the regular and discounted payback periods.

4)

To determine: The main demerit of discounted payback and the payback method of real usefulness in capital budgeting decisions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

- What is the 50/30/20 budgeting rule in finance , and how is it applied?dont use chatarrow_forwardI need help in this question What is the weighted average cost of capital (WACC) and why is it important?arrow_forwardPlease help in this question. What is a stock’s beta, and what does it indicate about the stock?arrow_forward

- What is the 50/30/20 budgeting rule in fin, and how is it applied?arrow_forwardI need help in this question!! What is the difference between a Roth IRA and a Traditional IRA in finance?arrow_forwardDo not use chatgpt What is the difference between a Roth IRA and a Traditional IRA in finance?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT