Case summary:

Person X is graduated from large university. He desired to become an entrepreneur. After death of his grandfather he got a business worth of $1million. Then he decided to buy minimum one franchise in the area of fast foods.an issue behind is that he will sell off investment after 3 years and go on to something else.

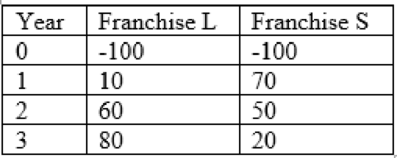

Person X has two alternatives franchise L and franchise S. Franchise L providing breakfast and lunch while franchise S is providing only dinner. Person X made evaluation of each franchise and find out that both have characteristics of risk and needs

Here are the net cash flows (in thousand $)

To determine: The MIRR of each franchises and the definition of MIRR.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

- What is the future value of $500 invested for 3 years at an annual compound interest rate of 4%?arrow_forwardA loan of $10,000 is taken at an annual interest rate of 6% for 5 years. What is the total interest payable under simple interest? Expalarrow_forwardA loan of $10,000 is taken at an annual interest rate of 6% for 5 years. What is the total interest payable under simple interest?arrow_forward

- You borrow $8,000 at an annual interest rate of 7%, and it compounds yearly for 2 years. What is the total amount payable? Helparrow_forwardYou borrow $8,000 at an annual interest rate of 7%, and it compounds yearly for 2 years. What is the total amount payable?arrow_forwardIf a bond pays $50 annually and is priced at $1,000, what is its annual yield? Explarrow_forward

- If a bond pays $50 annually and is priced at $1,000, what is its annual yield?arrow_forwardA car loan of $15,000 is taken for 3 years at an annual interest rate of 8%. What is the simple interest payable?arrow_forwardYou gave me unhelpful so i am also gave you unhelpful.if you will not give unhelpful then also i will not give unhelpful. what is finance?arrow_forward

- You want to save $15,000 in 5 years. If your bank offers 3% annual interest, how much should you invest today? (Use compound interest.) Explarrow_forwardIf you invest $2,000 at an annual interest rate of 6%, compounded annually, for 3 years, what is the future value?arrow_forwardYou want to save $15,000 in 5 years. If your bank offers 3% annual interest, how much should you invest today? (Use compound interest.)arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning