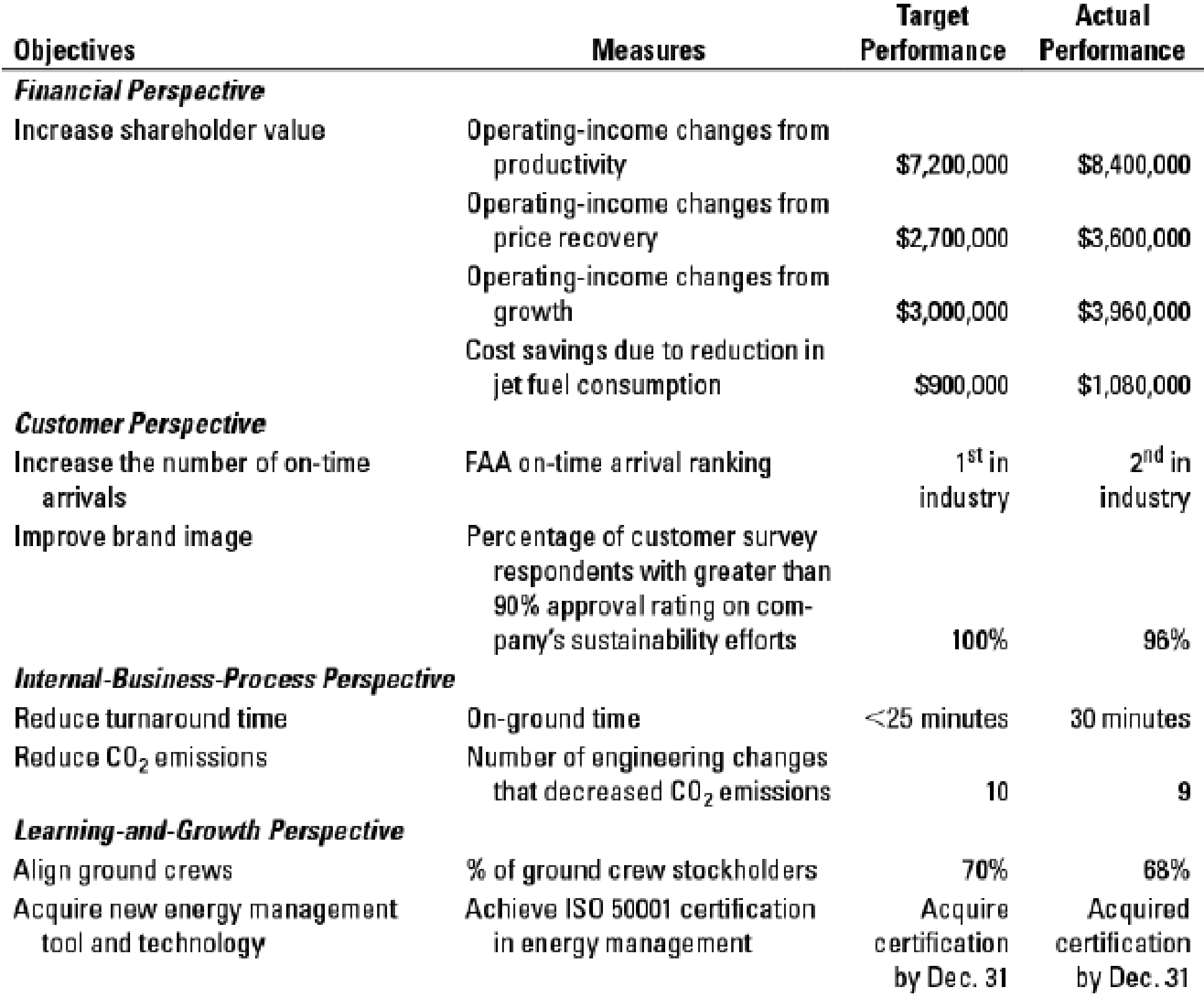

Balanced scorecard, environmental, and social performance. WrightAir is a no-frills airline that services the Midwest. Its mission is to be the only short-haul, low-fare, high-frequency point-to-point carrier in the Midwest. However, there are several large commercial carriers offering air transportation, and WrightAir knows that it cannot compete with them based on the services those carriers provide. WrightAir has chosen to reduce costs by not offering many inflight services, such as food and entertainment options. Instead, the company is dedicated to providing the highest quality transportation at the lowest fare. WrightAir’s balanced scorecard measures (and actual results) for 2017 follow:

- 1. What is WrightAir’s strategy? Was WrightAir successful in implementing its strategy in 2017? Explain your answer.

Required

- 2. Draw a strategy map as in Figure 12-2 for WrightAir describing the cause-and-effect relationships among the strategic objectives described in the balanced scorecard. Identify what you believe are any (a) strong ties, (b) focal points, (c) trigger points, and (d) distinctive objectives. Comment on your structural analysis of the strategy map.

- 3. Based on the strategy identified in requirement 1 above, what role does the price-recovery component play in explaining the success of WrightAir?

- 4. Would you have included customer-service measures in the customer perspective? Why or why not? Explain briefly.

- 5. Would you have included some measure of employee satisfaction and employee training in the learning-and-growth perspective? Would you consider this objective critical to WrightAir for implementing its strategy? Why or why not? Explain briefly.

- 6. Why do you think Wright Air has introduced environmental measures in its balanced scorecard? Is the company meeting its performance objectives in this area?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- What Is the correct answer A B ?? General Accounting questionarrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forward

- Determine the cost of the patent.arrow_forwardAccounting questionarrow_forwardMs. Sharon Washton was born 26 years ago in Bahn, Germany. She is the daughter of a Canadian High Commissioner serving in that country. However, Ms. Washton is now working in Prague, Czech Republic. The only income that she earns in the year is from her Prague marketing job, $55,000 annually, and is subject to income tax in Czech Republic. She has never visited Canada. Determine the residency status of Sharon Washtonarrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,